Trace Elements Market Analysis

I,Analysis of non-ferrous metals

Week-on-week: Month-on-month:

| Units | Week 4 of January | Week 5 of January | Week-on-week changes | December average price | January average price | Month-on-month change | Current price as of February 3 | |

| Shanghai Metals Market # Zinc ingots | Yuan/ton |

24310 |

25082 |

↑772 |

23070 |

24516 |

↑1446 |

25050 |

| Shanghai Metals Network # Electrolytic copper | Yuan/ton |

100525 |

102812 |

↑2287 |

93236 |

102039 |

↑8803 |

101320 |

| Shanghai Metals Network Australia

Mn46% manganese ore |

Yuan/ton |

42.15 |

42.15 |

↑0.3 |

41.58 |

42.18 |

↑0.6 |

42.45 |

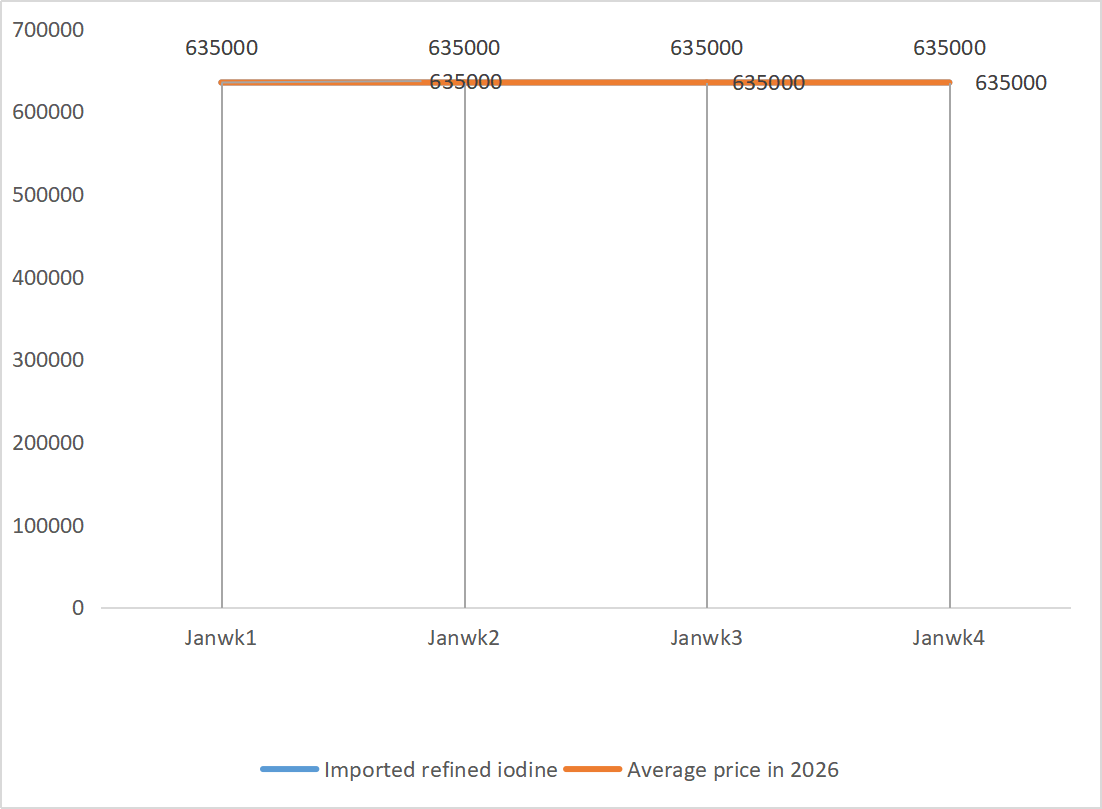

| The price of imported refined iodine by Business Society | Yuan/ton |

635000 |

635000 |

- |

635000 |

635000 |

- |

635000 |

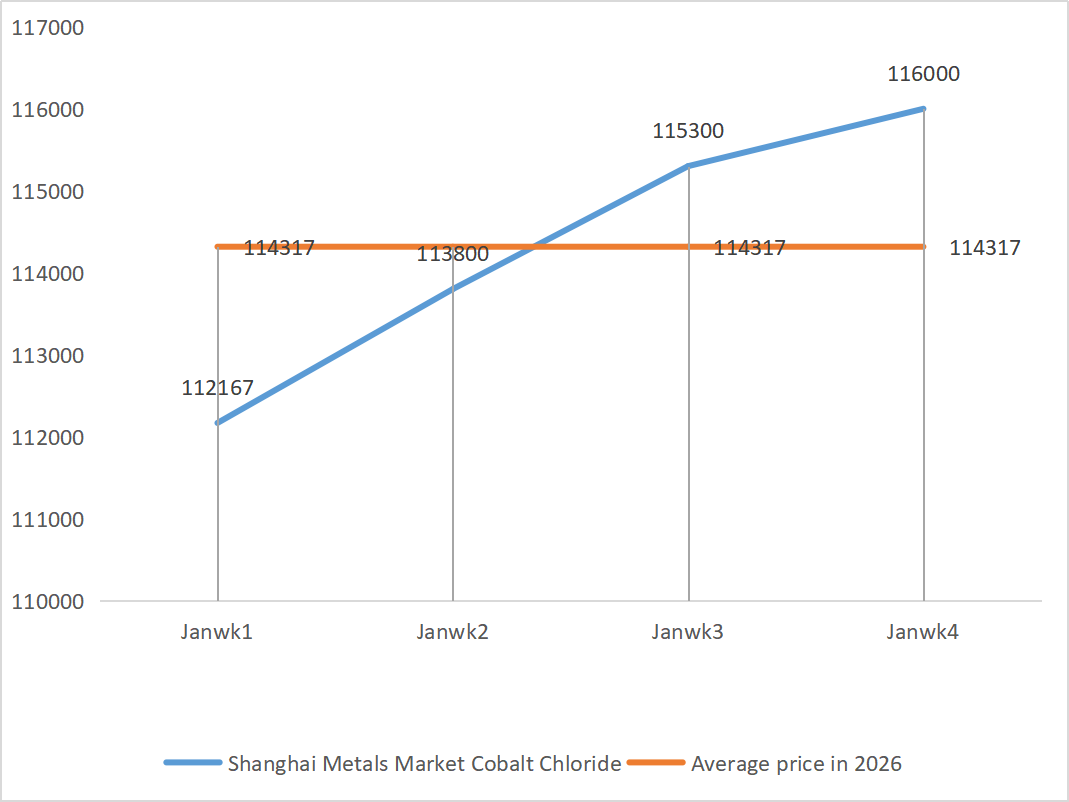

| Shanghai Metals Market Cobalt Chloride

(co≥24.2%) |

Yuan/ton |

116000 |

116000 |

- |

109135 |

115275 |

↑6140 |

116000 |

| Shanghai Metals Market Selenium Dioxide | Yuan/kilogram |

136.5 |

145.5 |

↑9 |

112.9 |

132.50 |

↑19.6 |

152.5 |

| Capacity utilization rate of titanium dioxide manufacturers | % |

72.86 |

73 |

↑0.14 |

74.69 |

75.2 |

↑0.51 |

1)Zinc sulfate

① Raw materials: Zinc hypooxide: Supply tightness persists and manufacturers’ quotations remain firm.

Zinc network price background: Macro sentiment is expected to gradually cool down, metal prices as a whole may face correction pressure. Zinc prices are expected to be relatively firm, despite the rapid increase in prices before the Spring Festival and the gradual entry of downstream markets into the holiday rhythm. Social inventories have not accumulated significantly, and the low inventory pattern provides bottom support for zinc prices. In addition, LME zinc inventories are currently at a low level of around 110,000 tons, providing some support for prices. Zinc prices are expected to gradually return to fundamentals next week, fluctuating around 24,900 yuan per ton.

② Sulfuric acid: Market prices are stable this week.

The operating rate of producers this week was 68% (unchanged from the previous week), and the capacity utilization rate was 58% (up 7% from the previous week), but orders from major producers have been scheduled until mid to late February, and spot delivery remains tight. High prices of zinc oxide, the main raw material, have provided strong support for product prices. It is expected that the price of zinc sulfate will remain stable at a high level in the short term.

2)Manganese sulfate

Raw materials: ① Strong cost support: The prices of raw materials manganese ore and sulfuric acid remain firm, continuing to support costs.

② Sulfuric acid prices remain high and stable.

This week, producers’ operating rate was 67%, capacity utilization rate was 51%, unchanged from the previous week, and major producers’ orders were scheduled until late February. Prices of raw materials such as manganese ore and sulfuric acid remained firm, continuing to support costs.

Manganese sulfate prices are expected to remain high and firm. Based on the analysis of enterprise order volume and raw material factors, manganese sulfate is expected to remain firm in the short term. Customers are advised to purchase as needed.

3)Ferrous sulfate

In terms of raw materials: The current ferrous sulfate market is in a tight balance of “supply constraints”. Production cuts in the upstream titanium dioxide industry have led to a contraction in the supply of its by-product ferrous sulfate, which has been diverted by the lithium iron phosphate industry. The operating rate is 80% (up 20% from the previous month), but the capacity utilization rate remains at 25% (up 6% from the previous month), with limited production recovery.

At present, the overall operating rate of domestic ferrous sulfate is not good, and enterprises have very little spot inventory, which is a favorable factor for the price increase of ferrous sulfate. Considering the recent inventory levels of enterprises and the upstream operating rates, ferrous sulfate is expected to rise in the short term. It is recommended that customers increase their inventories appropriately

4)Copper sulfate/basic copper chloride

On a macro level, Trump’s nomination of “hawkish” representative Kevin Walsh to replace Powell as chair of the Federal Reserve was like a “policy nuclear bomb” that blew up the market. The temporary easing of political uncertainty in the United States has become the main trigger, and market concerns over the Fed’s independence have cooled, weakening the core logic that previously supported the rapid rise in gold prices. With the sharp decline in precious metals, market tensions spread to the metal sector, and the fundamentals are in the seasonal off-season for consumption during the Spring Festival, the Shanghai copper futures price is expected to adjust at a high level in the short term. However, the medium – to long-term support logic for copper futures has not vanished, the tight mine situation remains unchanged, concerns over US tariffs persist, geopolitical risks remain high, and tensions between the US and Iran continue to escalate and could trigger regional conflicts. Amid the interweaving of multiple uncertainties, the Shanghai copper market has seen greater divergence and more volatility.

Supply side: Global copper mine production growth is only 0.9%, with frequent accidents such as the Mantovede strike in Chile and the Grasberg mudslide in Indonesia, ICSG predicts a gap of 800,000 to 1 million tons in 2025. China’s dependence on imported copper concentrate exceeds 90%, long-term contract TC drops to $0 per ton, policy promotes “overseas cooperation + recycling” double insurance, with the target of recycled copper accounting for 28% by 2028. Smelters are under pressure to cut production due to low processing fees. Domestic refined copper output in December was 1.326 million tons (up 9.1% year-on-year), but social inventories accumulated to 225,900 tons. COMEX inventories of more than 550,000 short tons show the US siphon effect. Copper prices are expected to fluctuate in the range of 100,000-102,000 yuan per ton next week. To sum up, copper prices show resilience in the macro bull/bear game. Beware of a high pullback in the short term. In the medium and long term, new energy demand, low interest rates and geopolitical risk premiums support the upward movement of the copper price center. It is expected that copper prices will mainly fluctuate in a wide range in February.

In the short term, copper sulfate is expected to fluctuate at a high level. Customers are advised to maintain normal inventories.

5)Magnesium sulfate/magnesium oxide

In terms of raw materials: Currently, sulfuric acid in the north is stable at a high level.

Magnesium oxide and magnesium sulfate prices have risen. The impact of magnesite resource control, quota restrictions and environmental rectification has led to many enterprises producing based on sales. Light-burned magnesium oxide enterprises shut down on Friday due to capacity replacement policies and the increase in sulfuric acid prices, and the prices of magnesium sulfate and magnesium oxide rose in the short term. It is recommended to stock up appropriately.

6)Calcium iodate

The price of refined iodine rose slightly, the supply of calcium iodate was tight, some iodide manufacturers were shut down or limited production, and the supply of iodide was tight. It is expected that the tone of a long-term steady and small increase in iodide will remain unchanged. It is recommended to stock up appropriately.

7)Sodium selenite

In terms of raw materials: The prices of non-ferrous metals continue to rise. The overall market for crude selenium and selenium dioxide is shrinking in volume but stable in price. Pre-holiday stockpiling is cautious. The support from high-end demand is stronger than that in traditional fields. Capital speculation leads to a shortage of raw materials due to the upstream non-shipment of crude selenium and selenium dioxide. The inventory of manufacturers is low and the price is raised. Buy on demand.

8)Cobalt chloride

The cobalt chloride market remained thin last week, with no significant change in trading atmosphere compared to the previous week. The mainstream quotations of smelters and recycling enterprises remained above 115,000 yuan per ton, while some enterprises quoted slightly below this level in order to recover funds before the Spring Festival. Terminal cell factories have a rush demand due to changes in export policies, but given that most enterprises have sufficient raw material stock in the early stage and the current high price of cobalt chloride, the actual purchasing willingness in the market is generally not strong. As the Spring Festival approaches and logistics are about to be suspended, it is expected that the market will remain generally sluggish with prices but no demand before the festival.

9)Cobalt salts/potassium chloride/potassium carbonate/calcium formate/iodide

1. Cobalt: The trading atmosphere in the cobalt market has weakened, and spot prices have remained stable. On the supply side, supported by rising raw material costs, smelters’ quotations remained firm. Towards the end of the year, the purchasing intentions of downstream enterprises have generally weakened. Coupled with the gradual recovery of Congolese exports and the decline in electrolytic cobalt prices and other news factors suppressing market trading sentiment, enterprise purchasing has returned to rigid demand. With strong support from upstream raw material costs, it is expected that cobalt sulfate prices will still show a pattern of “more likely to rise than fall” in the short term.

2. Potassium chloride: The price should remain stable even before the Spring Festival. After the supply guarantee meeting on January 27th, there will be limited changes in potash prices in the market, and many traders will temporarily suspend sales and wait and see. If the policy is not implemented or the enforcement is limited, potash prices may rise again, or at least remain firm. It is recommended to keep an eye on the stock in Hong Kong and the international environment, and to appropriately stock up and purchase as needed in the near future.

3. Domestic formic acid market prices will still face some downward pressure, and major manufacturers have plans to limit production of formic acid. The current stalemate in supply and demand in the market remains unchanged, and the pressure of inventory digestion still exists. It is necessary to pay attention to the changes in supply and demand in the market. Calcium formate prices may be slightly adjusted this week, and it is recommended to stock up according to demand.

4. Iodide prices are stable this week compared to last week.

Post time: Feb-04-2026