Trace Elements Market Analysis

I,Analysis of non-ferrous metals

Week-on-week: Month-on-month:

| Units | Week 4 of October | Week 5 of October | Week-on-week changes | September average price | As of October 31

Average price |

Month-on-month change | Current price as of November 5 | |

| Shanghai Metals Market # Zinc ingots | Yuan/ton |

21930 |

22190 |

↑260 |

21969 |

22044 |

↑75 |

22500 |

| Shanghai Metals Market # Electrolytic Copper | Yuan/ton |

85645 |

87904 |

↑2259 |

80664 |

86258 |

↑5594 |

85335 |

| Shanghai Metals Network Australia

Mn46% manganese ore |

Yuan/ton |

40.55 |

40.45 |

↓0.1 |

40.32 |

40.49 |

↑0.17 |

40.45 |

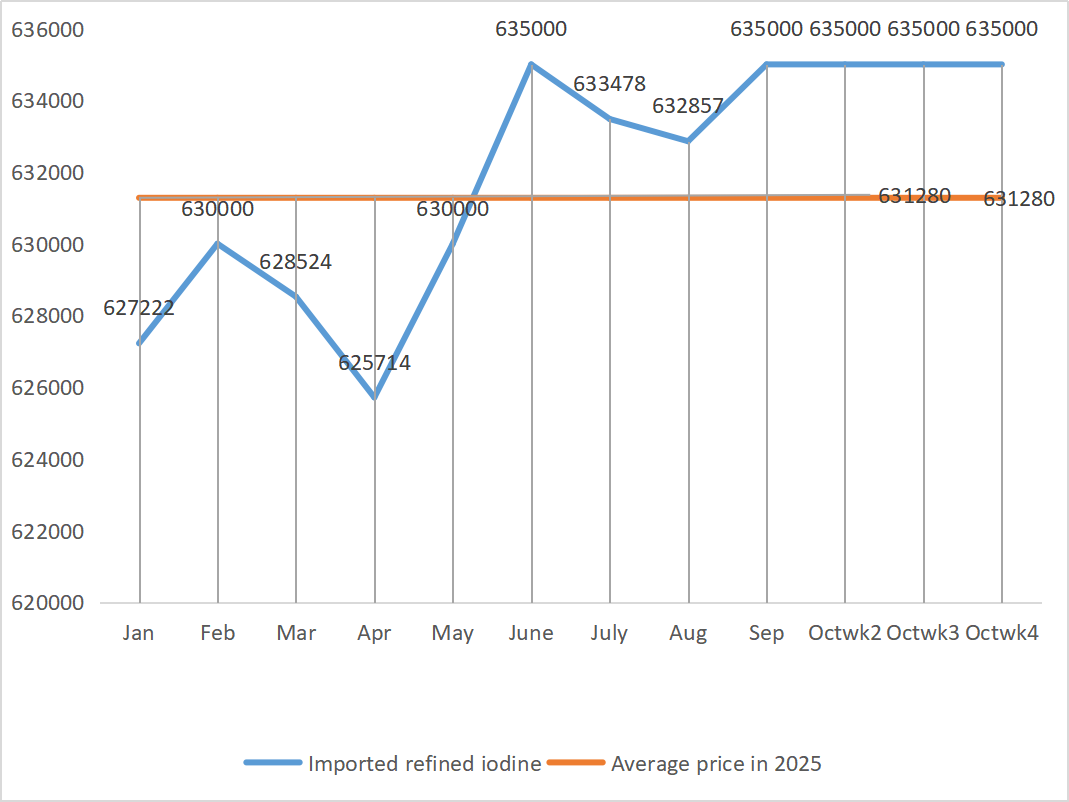

| The price of imported refined iodine by Business Society | Yuan/ton |

635000 |

635000 |

635000 |

635000 |

|

635000 |

|

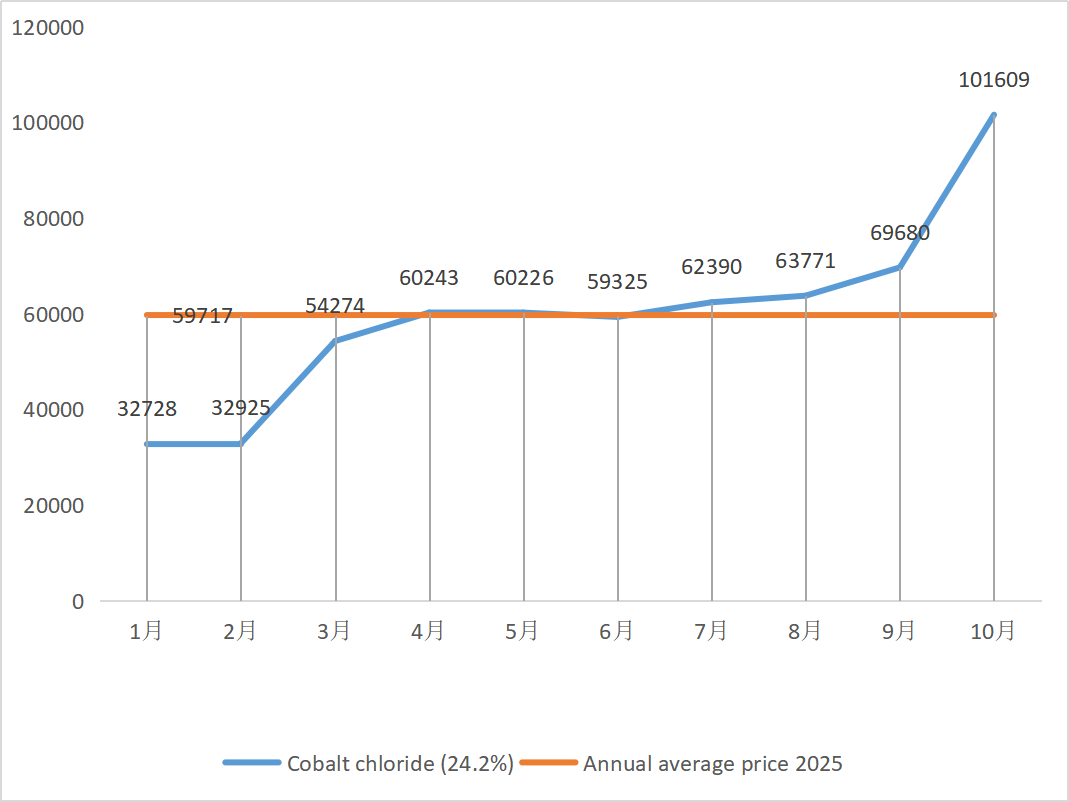

| Shanghai Metals Market Cobalt Chloride

(co≥24.2%) |

Yuan/ton |

104250 |

105000 |

↑750 |

69680 |

101609 |

↑31929 |

105000 |

| Shanghai Metals Market Selenium Dioxide | Yuan/kilogram |

107.5 |

109 |

↑1.5 |

103.64 |

106.91 |

↑3.27 |

110 |

| Capacity utilization rate of titanium dioxide manufacturers | % |

77.44 |

77.13 |

↓0.31 |

76.82 |

77.68 |

↑0.86 |

1)Zinc sulfate

① Raw materials: Zinc hypooxide: The transaction coefficient keeps hitting new highs for the year.

Pricing basis zinc online price: On the macro side, the Federal Reserve cut interest rates by another 25 basis points as expected to boost metal prices, but the fundamentals of strong supply and weak demand remain unchanged, downstream consumption performance is weak, and upward pressure on Shanghai zinc still exists. Zinc prices are expected to remain stable in the short term, with a range of 22,000-22,600 yuan per ton.

② Sulfuric acid prices remain stable at high levels across the country. Soda ash: Prices were stable this week.

On Monday, the operating rate of water zinc sulfate producers was 79%, down 10% from the previous week, and the capacity utilization rate was 67%, down 7% from the previous week. Major manufacturers’ orders are scheduled until mid to late November. Due to the impact of macro policies in the first half of the year, customers made concentrated purchases, and the demand was advanced, resulting in poor demand at present and a slower delivery pace for manufacturers.

The spot market has experienced various levels of pullbacks. Feed enterprises have not been very active in purchasing recently. Under the dual pressure of the operating rate of upstream enterprises and the insufficient existing order volume, zinc sulfate will continue to operate weakly and stably in the short term. It is suggested that customers reduce the inventory cycle.

2)Manganese sulfate

In terms of raw materials: ① The price of imported manganese ore fluctuated slightly and rebounded

② Sulfuric acid remained stable at a high level this week.

This week, the operating rate of manganese sulfate manufacturers was 85%, up 9% compared with the previous week. Capacity utilization was 58%, up 5% from the previous week. Major manufacturers’ orders are scheduled until late November.

Manufacturers hover around the production cost line and expect prices to remain stable. Due to the recent continuous increase in the price of raw material sulfuric acid, costs have risen slightly, and the enthusiasm of domestic terminal customers to replenish inventories has increased significantly. Based on the analysis of enterprise order volume and raw material factors, manganese sulfate is expected to remain firm in the short term. It is recommended that customers increase their inventories appropriately.

3)Ferrous sulfate

In terms of raw materials: Demand for titanium dioxide remains sluggish, and the operating rate of titanium dioxide manufacturers is low. Ferrous sulfate heptahydrate is a product in the titanium dioxide production process. The current situation of manufacturers directly affects the market supply of ferrous sulfate heptahydrate. Lithium iron phosphate has a stable demand for ferrous sulfate heptahydrate, further reducing the supply of ferrous sulfate heptahydrate to the ferrous industry.

Ferrous sulfate was firm this week, mainly due to the relative progress of raw material supply affected by the operating rate of the titanium dioxide industry. Recently, the shipment of heptahydrate ferrous sulfate has been good, which has led to an increase in costs for monohydrate ferrous sulfate producers. Currently, the overall operating rate of ferrous sulfate in China is not good, and enterprises have very little spot inventory, which brings favorable factors for the price increase of ferrous sulfate. Taking into account the recent inventory levels of enterprises and the upstream operating rates, ferrous sulfate is expected to rise in the short term. It is suggested that the demand side make purchase plans in advance in light of inventory.

4)Copper sulfate/basic copper chloride

Raw materials: Codelco, the world’s largest copper producer, cut its production forecast for 2025 on Tuesday, but the revised target remains higher than that for 2024. Production also rose year-on-year in the first nine months of 2025. The revised forecast helped ease concerns over the recent supply shortage that has been supporting copper prices since September, but at the same time, the dollar remained strong, putting pressure on copper prices.

Macroscopically, last week’s collective voice from the Fed’s hawkish camp directly cooled expectations of a December rate cut, and the dollar index soared to a three-month high, casting a shadow over the outlook for metal demand. Coupled with China’s manufacturing PMI contracting for the seventh consecutive month in October, a continuous decline in new export orders, and the risk of the longest shutdown in history in the US government and the volatile international geopolitical situation, the upward momentum of copper prices has been completely suppressed. Weak fundamental demand, Shanghai copper social inventory soared 11,348 tons to 116,000 tons in a single month, hitting a nearly one-month high, and the premium of Yangshan copper plunged 28 percent to $36 per ton in a single month, showing the contraction in import demand. As the traditional peak season draws to a close and expectations of weakened downstream consumption intensify, short-term copper prices are expected to be under pressure and run weakly at high levels. Copper price range this week: 85,190-85,480 yuan/ton.

Etching solution: Some upstream raw material manufacturers have accelerated capital turnover by deep processing etching solution into sponge copper or copper hydroxide. The proportion of sales to the copper sulfate industry has decreased, and the transaction coefficient has reached a new high.

Copper prices remained stable at a high level this week. Against the backdrop of high copper network prices, downstream customers purchased as needed.

5)Magnesium sulfate/magnesium oxide

Raw materials: The price of sulfuric acid is rising in the north at present.

The magnesia market is mainly stable. Recent reports on the rectification of magnesia enterprises in production areas have supported the market price. The price of light-burned magnesia powder is stable. There may be changes in subsequent kiln upgrades. The price of magnesia sulfate may rise slightly in the short term. It is recommended to stock up appropriately.

6)Calcium iodate

Raw materials: The domestic iodine market is stable at present, the supply of imported refined iodine from Chile is stable, and the production of iodide manufacturers is stable.

The price of refined iodine rose slightly in the fourth quarter, the supply of calcium iodate was tight, and some iodide manufacturers halted or limited production. It is expected that the general tone of a steady and slight increase in iodide prices will remain unchanged. It is recommended to stock up appropriately.

7)Sodium selenite

In terms of raw materials: Due to the recent good transaction situation of crude selenium bidding prices in the market, the cost of diselenium is already high, and the possibility of selling at a low price is low.

The price of selenium rose and then stabilized. Market insiders said that the selenium market price was stable with an upward trend, the trading activity was average, and the price was expected to remain strong in the later period. Sodium selenite producers say demand is weak, costs are rising, orders are increasing, and quotations are stable this week. Prices are expected to strengthen in the short term.

8)Cobalt chloride

The cobalt market declined slightly last week, with ternary battery production, installation volume and sales growing slowly, and demand growing slowly; The Congolese government has introduced an export quota system, and there is expected to be a severe shortage of supply sources. Indonesia’s cobalt product exports have increased to make up for some of the shortage of cobalt raw materials, and overall supply shortage; The supply of cobalt salts has decreased and prices have stabilized. The price of lithium cobalt oxide has fluctuated and stabilized, and there are still positive factors for the cobalt market. International cobalt prices have been fluctuating and rising, but positive factors remain and negative factors weaken; Overall, the upward momentum of the cobalt market remains and the downward pressure weakens. Stock up as needed.

9)Cobalt salt/potassium chloride/potassium carbonate/calcium formate/iodide

1. Cobalt: Raw material costs: The cobalt market has been stable recently, with manufacturers showing obvious reluctance to sell. Most enterprises’ intended prices are relatively high, and the downstream willingness to take over is limited. There has been no significant improvement in the demand side, and the market transaction atmosphere needs to be improved. In the short term, the cobalt market is likely to rise steadily.

2. Potassium chloride: At present, the inventory of potassium chloride at northern ports is still acceptable, with both new and old sources coexisting, increasing merchants’ awareness of selling and liquidating. However, supported by the guidance prices of large traders, the market as a whole is stabilizing and consolidating.

3 The price of calcium formate continued to decline this week. Raw formic acid plants resume production and now increase factory production of formic acid, leading to an increase in formic acid capacity and an oversupply. In the long term, calcium formate prices are falling.

4 Iodide prices were stable this week compared to last week.

Post time: Nov-07-2025