Trace Elements Market Analysis

I,Analysis of non-ferrous metals

Week-on-week: Month-on-month:

| Units | Week 3 of August | Week 4 of August | Week-on-week changes | Average price in July | As of August 29

Average price |

Month-on-month change | Current price as of September 2 | |

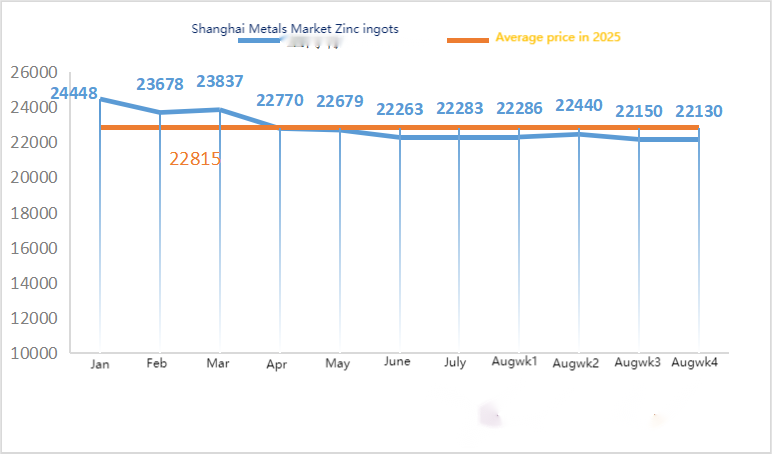

| Shanghai Metals Market # Zinc ingots | Yuan/ton |

22150 |

22130 |

↓20 |

22356 |

22250 |

↓108 |

22150 |

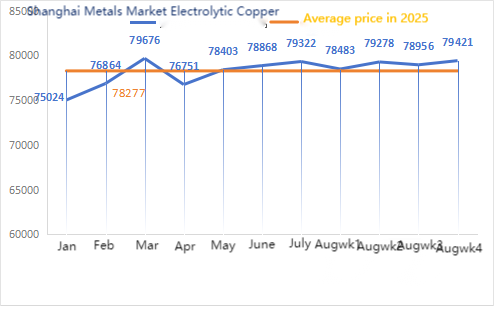

| Shanghai Metals Market # Electrolytic Copper | Yuan/ton |

78956 |

79421 |

↑465 |

79322 |

79001 |

↓321 |

80160 |

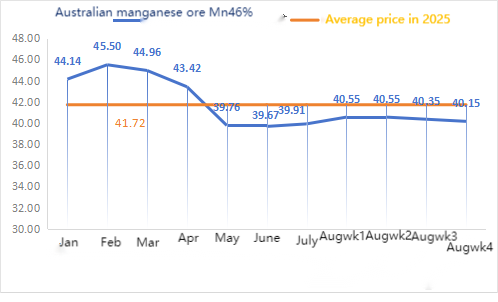

| Shanghai Metals Network Australia

Mn46% manganese ore |

Yuan/ton |

40.35 |

40.15 |

↓0.2 |

39.91 |

40.41 |

↑0.50 |

40.15 |

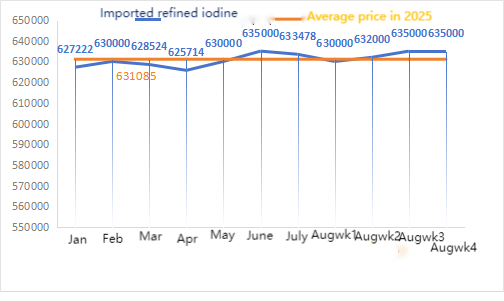

| The price of imported refined iodine by Business Society | Yuan/ton |

635000 |

635000 |

633478 |

632857 |

↓621 |

632857 |

|

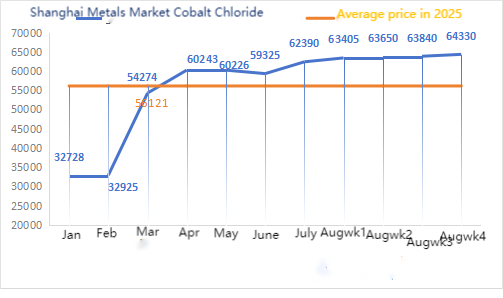

| Shanghai Metals Market Cobalt Chloride

(co≥24.2%) |

Yuan/ton |

63840 |

64330 |

↑490 |

62390 |

63771 |

↑1381 |

65250 |

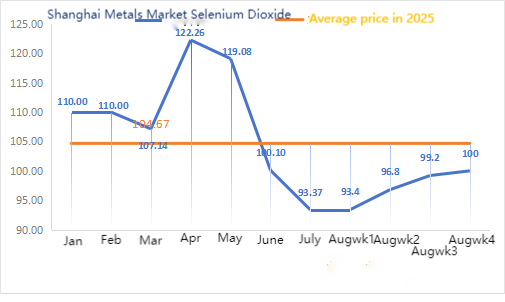

| Shanghai Metals Market Selenium Dioxide | Yuan/kilogram |

99.2 |

100 |

↑0.8 |

93.37 |

97.14 |

↑3.77 |

100 |

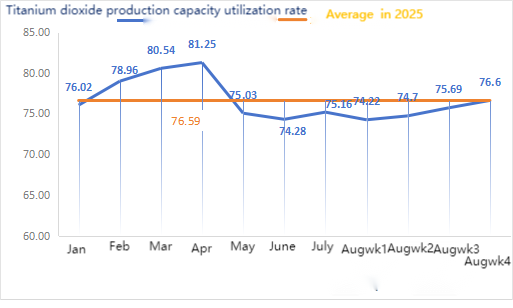

| Capacity utilization rate of titanium dioxide manufacturers | % |

75.69 |

76.6 |

↑0.91 |

75.16 |

74.95 |

↓0.21 |

In terms of raw materials: zinc hypooxide: With high raw material costs and undiminished purchasing enthusiasm from downstream industries, manufacturers have a strong willingness to raise prices, and the transaction coefficient remains at a high level within the month.

② Sulfuric acid prices remained stable in various regions this week. Soda ash: Prices were stable this week. ③ Macroscopically, a weaker dollar combined with expectations of a rate cut in September supported metal prices to strengthen.

Overall, affected by the military parade, some galvanizing enterprises in the north reduced production, consumption was suppressed, downstream replenishment at low prices was insufficient, and social inventories continued to increase slightly, suppressing zinc prices. With the transition of consumption between peak and off-peak seasons, there is support for zinc prices below. Short-term macro guidance is weak, fundamentals are mixed with bulls and bears, zinc prices remain in a narrow range of fluctuations.

Zinc prices are expected to operate in the range of 22,000 to 22,500 yuan per ton next week.

The operating rate of the water sulfate zinc sample factory on Monday was 83%, unchanged from the previous week; Capacity utilization was 68%, down 3% from the previous week, driven by equipment failures at some factories. This week’s quotations are the same as last week’s. The demand for the feed industry is relatively stable as large group manufacturers in the export feed industry mainly conduct quarterly tenders, and some small customers and traders purchase according to orders. The mainstream manufacturers’ orders are scheduled until the end of September, and some until the first ten days of October. Coupled with firm raw material costs and the recovery of demand in various industries, it is expected that the price of monohydrate zinc will rise slightly before mid-September. It is recommended that the demand side purchase and stock up based on their own inventory.

In terms of raw materials: ① At the beginning of the week, the manganese ore market was in a wait-and-see consolidation operation. Due to traffic control at Tianjin Port, it was difficult to inquire about pick-up vehicles. Last week, statistics showed a significant decrease in port clearance volume. Port traders’ reports were mainly stable, and downstream sporadic inquiries intensified the price reduction. As the “anti-internal competition” sentiment fades, the black series futures market is generally falling, and the pace of demand recovery in the “golden September and Silver October” needs to be closely watched.

The transaction price of manganese ore slightly declined this week.

② Sulfuric acid prices remained largely stable.

This week, the operating rate of manganese sulfate sample factories was 81%, up 10% from the previous week; The capacity utilization rate was 42%, down 2% from the previous week. Although the resumption of operations by some factories led to an increase in the capacity utilization rate, the shutdown of major factories caused the capacity utilization rate to decline. Quotations rose this week amid tight deliveries from manufacturers. As the weather turns cooler and livestock feed increases, along with the arrival of the back-to-school season and the boost in terminal demand for meat, eggs and milk, the breeding sentiment warms up and the feed industry is expected to develop well. The capacity utilization rate of manganese sulfate manufacturers is at its lowest level in nearly three months. Some manufacturers have placed orders until November, and the tight delivery situation remains unchanged. Coupled with the high operation of raw materials and strong cost support, the price of manganese sulfate keeps rising. It is recommended that customers who ship by sea fully consider the shipping time and stock up in advance.

In terms of raw materials: Downstream demand for titanium dioxide remains sluggish. Some manufacturers have accumulated titanium dioxide inventories, resulting in low operating rates. The tight supply situation of ferrous sulfate in Qishui continues.

This week, the operating rate of sample manufacturers of ferrous sulfate was 75%, and the capacity utilization rate was 24%, remaining flat compared with the previous week. This week, mainstream manufacturers suspended quotations.

Producers have scheduled orders until late October. The supply of raw material heptahydrate is tight and the price is high and firm. With cost support and relatively abundant orders, along with the suspension of quotations by mainstream manufacturers and tight delivery, there is a possibility that the price of monohydrate ferrous has risen. It is recommended that demand-side purchase and stock up in combination with inventory.

4)Copper sulfate/basic cuprous chloride

In terms of raw materials: Macroscopically, U.S. economic data did not exceed expectations, the probability of the Fed cutting interest rates remains high, the offshore renminbi has been strong recently, and domestic risk appetite is acceptable. In terms of industry, the supply of copper raw materials remains tight. The current tight supply of scrap and the expectation of smelting maintenance have alleviated the pressure of domestic oversupply. Coupled with the approaching peak season, price support is strong. In the short term, copper prices are expected to maintain a volatile but strong trend. Reference range for the main operating range of Shanghai copper: 79,000-80,200 yuan/ton

In terms of etching solution: Some upstream raw material manufacturers have accelerated capital turnover by deep processing etching solution into sponge copper or copper hydroxide, the proportion of sales to the copper sulfate industry has narrowed, the raw material shortage has further intensified, and the transaction coefficient has reached a new high.

In terms of price, Shanghai copper’s main operating range reference: 79,000-80,200 yuan/ton with a narrow fluctuation.

This week, the operating rate of copper sulfate/caustic copper producers was 100% and the capacity utilization rate was 45%, remaining flat compared with the previous week.

Based on the recent raw material trends and inventory analysis, copper sulfate is expected to remain at a high level with fluctuations in the short term. Customers are advised to maintain normal inventory.

Raw materials: The raw material magnesite is stable.

The factory is operating normally and production is normal. The delivery time is generally around 3 to 7 days. Prices have been stable from August to September. As winter approaches, there are policies in major factory areas that prohibit the use of kilns for magnesium oxide production, and the cost of using fuel coal increases in winter. Combined with the above, it is expected that the price of magnesium oxide will rise from October to December. Customers are advised to purchase based on demand.

6)Magnesium sulfate

Raw materials: The price of sulfuric acid in the north is currently rising in the short term.

At present, magnesium sulfate plants are operating at 100% and production and delivery are normal. As September approaches, the price of sulfuric acid is temporarily stable and further increases cannot be ruled out. Customers are advised to purchase according to their production plans and inventory requirements.

Raw materials: The domestic iodine market is stable at present, the supply of imported refined iodine from Chile is stable, and the production of iodide manufacturers is stable.

This week, the production rate of calcium iodate sample manufacturers was 100%, the capacity utilization rate was 36%, the same as the previous week, and the quotations of mainstream manufacturers remained stable.

Calcium iodate prices are expected to remain stable in the short term. Customers are advised to purchase according to their production plans and inventory requirements.

In terms of raw materials: With crude selenium raw materials constantly rising in price, the cost of diselenium has remained high, the possibility of selling at a low price no longer exists, and confidence in the market price in the later period is also growing.

This week, the sodium selenite sample manufacturers’ operating rate was 100% and the capacity utilization rate was 36%, remaining flat compared to the previous week. The manufacturers’ quotations remained stable this week. In the short term, the price of sodium selenite will remain stable. It is recommended that clients purchase according to their own inventory as needed.

Raw materials: Imports of cobalt intermediates in July released on July 20 exceeded market expectations, further weakening the sentiment of price hikes. At present, many downstream customers are adopting a cautious wait-and-see attitude, and overall prices are in a stalemate with limited fluctuations.

This week, the cobalt chloride sample factory’s operating rate was 100%, and the capacity utilization rate was 44%, remaining flat compared to the previous week. Manufacturers’ quotations remained stable this week. The price of cobalt chloride is expected to remain stable in the short term. Customers are advised to purchase according to their inventory.

10)Cobalt salts/potassium chloride/potassium carbonate/calcium formate/iodide

1. On the supply side, due to the continuous intensification of raw material shortages and cost inversion, smelting enterprises’ output continued to decline, maintaining long-term supply and actively holding prices. After domestic prices stabilized, traders postponed selling at a lower price and raised their quotations slightly. As the summer break drew to a close, some downstream manufacturers began to make purchases in the market, but due to the relatively high cobalt price squeezing their production profits, demand was relatively weak. Coupled with the still high social inventory in the market, downstream purchases were temporarily unable to accept high prices, and actual transactions remained weak. Under the influence of the continuous rise in raw material costs, cobalt prices are expected to remain strong in the short term, but the extent of the increase will still depend on the actual purchasing situation of downstream. If downstream can purchase in large quantities, the increase in cobalt will be more smooth.

2. There has been no significant change in the overall price of potassium chloride. The market shows a trend of both supply and demand being weak. The supply of market sources remains tight, but the demand support from downstream factories is limited. There are small fluctuations in some high-end prices, but the extent is not large. Prices remain stable at a high level. The price of potassium carbonate fluctuates with that of potassium chloride.

3. The price of calcium formate remained stable at a high level this week. The price of raw formic acid rose as factories shut down for maintenance. Some calcium formate plants have stopped taking orders.

4. Iodide prices remained stable this week compared to last week.

Post time: Sep-03-2025