Trace Elements Market Analysis

I,Analysis of non-ferrous metals

Week-on-week: Month-on-month:

| Units | Week 2 of December | Week 3 of December | Week-on-week changes | November average price | The average price as of December 19 | Month-on-month changes | Current price as of December 23 | |

| Shanghai Metals Market # Zinc ingots | Yuan/ton |

23170 |

23122 |

↑398 |

22407 |

23021 |

↑564 |

23090 |

| Shanghai Metals Network # Electrolytic copper | Yuan/ton |

90495 |

92140 |

↑2546 |

86502 |

91528 |

↑4720 |

93470 |

| Shanghai Metals Network Australia

Mn46% manganese ore |

Yuan/ton |

41.65 |

41.85 |

↑0.84 |

40.55 |

41.44 |

↑0.68 |

41.85 |

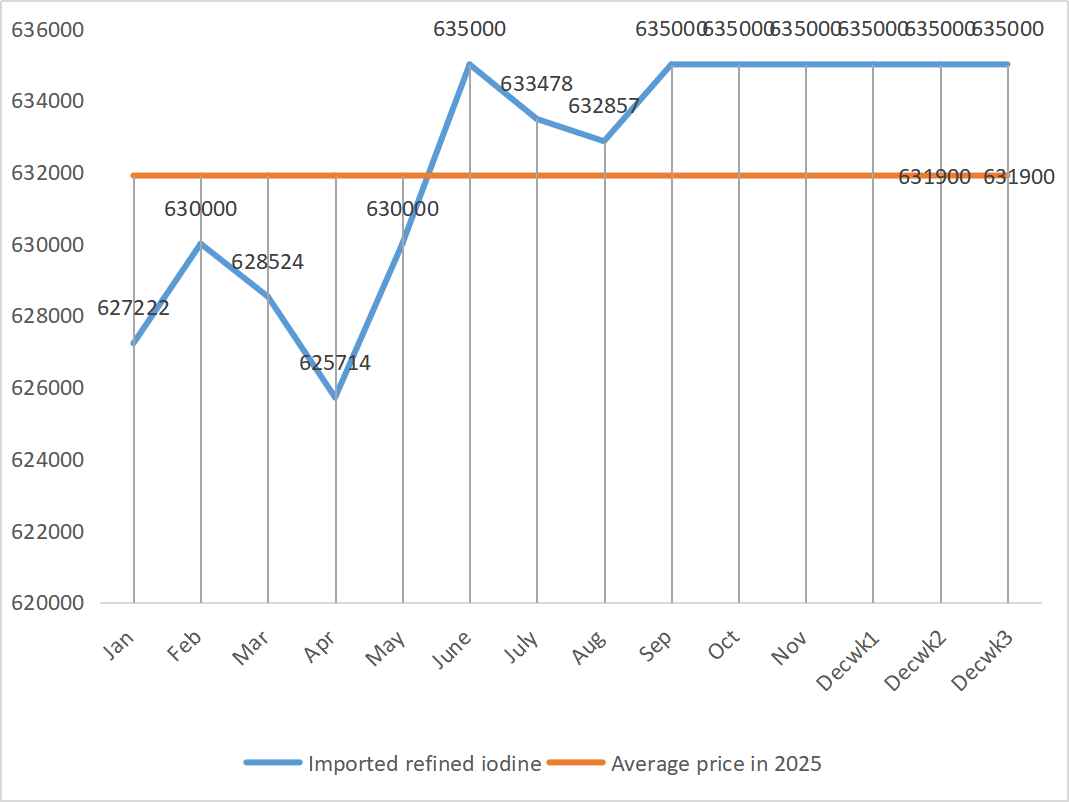

| The price of imported refined iodine by Business Society | Yuan/ton |

635000 |

635000 |

- |

635000 |

635000 |

|

635000 |

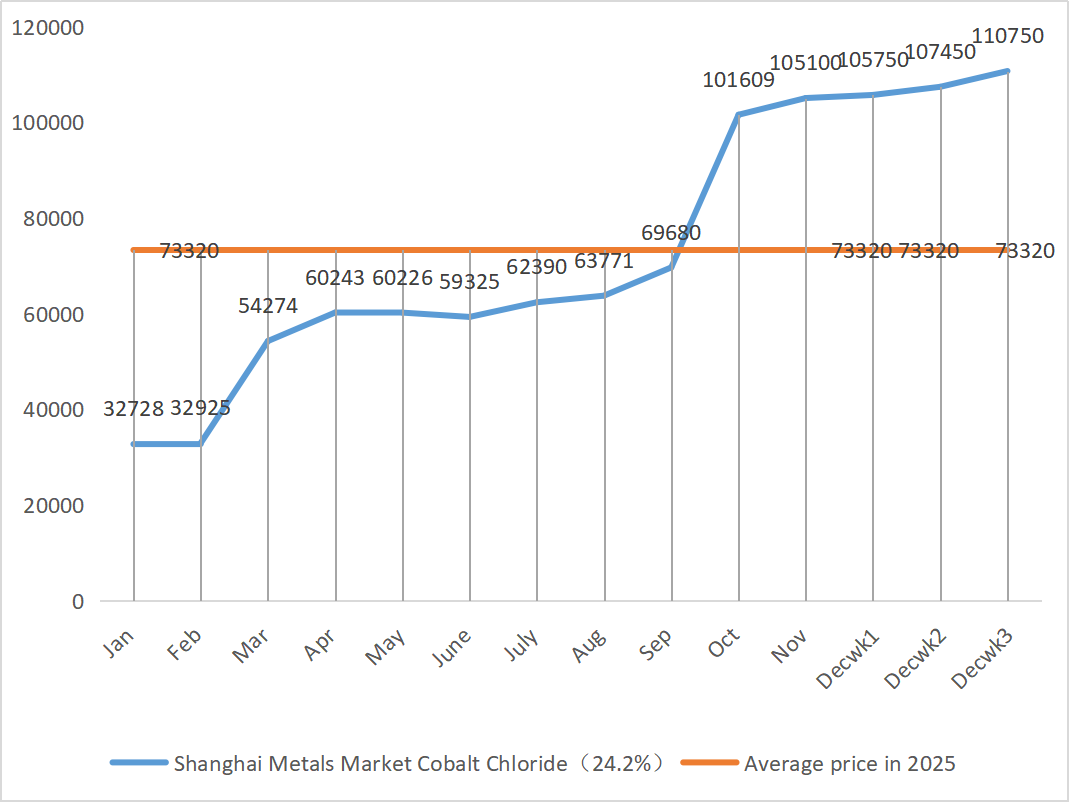

| Shanghai Metals Market Cobalt Chloride

(co≥24.2%) |

Yuan/ton |

107450 |

110750 |

↑1700 |

105100 |

107983 |

↑1500 |

110750 |

| Shanghai Metals Market Selenium Dioxide | Yuan per kilogram |

108 |

112 |

↓6 |

113.5 |

111.33 |

↓2.5 |

115 |

| Capacity utilization rate of titanium dioxide manufacturers | % |

74.26 |

75.09 |

↓0.2 |

75.97 |

74.60 |

↓1.61 |

1)Zinc sulfate

① Raw materials: zinc hypooxide: Macroscopically, the market remains concerned about U.S. employment data, and the dollar index has declined, driving up the prices of non-ferrous metals in general. In terms of fundamentals, the consumer side has been somewhat dragged down by environmental warnings issued in many places across the country; On the supply side, processing fees for zinc concentrate remain low, profits of smelters are compressed, and some manufacturers have implemented production cuts and shutdowns, resulting in a reduction in supply. Domestic zinc ingot supply support is quite obvious. Overall, zinc prices are mainly supported by the supply side, and it is expected that zinc network prices will remain at around 23,200 yuan per ton next week.

② Sulfuric acid: On December 18, representatives from the National Development and Reform Commission, the China Sulfuric Acid Industry Association, the China Phosphate and Compound Fertilizer Industry Association, and key enterprises attended the meeting. The meeting called on the sulfuric acid and phosphate compound fertilizer industries to fully ensure the supply and stable prices of fertilizers at present, and required smelting acid enterprises to keep the sales price of sulfuric acid no higher than the level of December 11, 2025, to ensure the stable operation of the market. More attention will be paid to market feedback on the price trend of sulfuric acid in the future. Earlier tightened export policies for phosphate fertilizers led to a decline in sulfur prices, but sulfuric acid market prices have not followed suit for the time being. The current high prices are stable, and some markets are expected to strengthen further due to regional supply and demand. This week, market prices showed regional divergence.

On Monday, the operating rate of water zinc sulfate producers was 68%, down 15% from the previous week; Capacity utilization was 68%, up 5% from the previous week. Major manufacturers’ orders are scheduled until mid to early January. High raw material costs provide a rigid support for zinc sulfate prices, and the current market remains stable at a high level. At the same time, accelerated export shipments and the resumption of inquiries have provided further impetus for price increases. Customers are advised to lock in orders in advance as appropriate based on their inventory and delivery cycle.

2)Manganese sulfate

In terms of raw materials: ① Manganese ore market manganese ore prices remain high and firm

② Sulfuric acid prices remain high and stable.

This week, the operating rate of manganese sulfate producers was 90% and the capacity utilization rate was 62%, remaining flat compared with the previous week. Major manufacturers’ orders are scheduled until the first ten days of January, and some until mid to late January. Manufacturers have sufficient orders in the early stage and are scheduled to ship. Cost-driven, based on the analysis of enterprise order volume and raw material factors, manganese sulfate will remain firm in the short term. Customers are advised to purchase as needed.

3)Ferrous sulfate

Raw materials: As a by-product of titanium dioxide, its supply is constrained by the main industry. The current high inventory and sluggish sales in the titanium dioxide industry, along with the shutdown of some manufacturers, have directly led to a reduction in the output of ferrous sulfate. Meanwhile, the demand for lithium iron phosphate is stable and continues to divert some raw materials, exacerbating the tight supply of feed-grade products.

This week, major manufacturers have suspended quotations. Against the backdrop of the market’s major manufacturers having no possibility of resuming work before New Year’s Day, the downstream market generally holds a “bullish” expectation for ferrous sulfate prices. The price of ferrous sulfate is more likely to rise than fall. With strong support from raw material costs and the suspension of quotations in some regions, it is expected that the price of ferrous sulfate will show an upward trend in the medium and short term.

It is suggested that the demand side purchase according to its own production situation.

4)Copper sulfate/basic copper chloride

On a macro level, Fed surveys suggest tariffs could heighten inflation next year, while Governor Waller advocates for further rate cuts based on the job market, indicating a balance between his policy of controlling inflation and stabilizing the economy, which is overall positive for metal prices.

In terms of fundamentals, spot supplies are abundant and holders are actively selling off, but transactions are mediocre; Weak demand as the end of the year approaches. Overall, macro support for copper prices is obvious, but the suppression of demand by high prices is also gradually emerging. In addition, domestic demand remains resilient amid expectations of off-season consumption, and the slow resumption of global disrupted mines and low domestic social inventories continue the tight supply situation. It is expected that copper prices will operate in the range of 91,500-92,500 yuan per ton next week, and the cost support of copper sulfate remains solid.

Customers are advised to take advantage of their own inventories to stock up when copper prices fall back to a relatively low level, so as to ensure supply while controlling costs.

5)Magnesium sulfate/magnesium oxide

In terms of raw materials: Currently, sulfuric acid in the north is stable at a high level.

Magnesium oxide and magnesium sulfate prices have risen. The impact of magnesite resource control, quota restrictions and environmental rectification has led to many enterprises producing based on sales. Light-burned magnesium oxide enterprises shut down on Friday due to capacity replacement policies and the increase in sulfuric acid prices, and the prices of magnesium sulfate and magnesium oxide rose in the short term. It is recommended to stock up appropriately.

6)Calcium iodate

Raw materials: The price of refined iodine rose slightly in the fourth quarter. The supply of calcium iodate is tight. Some iodide manufacturers have suspended production or limited production. The supply of iodide is expected to remain stable and slightly upward in the long term. It is recommended to stock up appropriately.

7)Sodium selenite

In terms of raw materials: The selenium market was weak at the end of the year, with light transactions. The price center of crude selenium and disselenium shifted downward, while the prices of selenium powder and selenium tablets remained unchanged. Terminal restocking is coming to an end, speculative funds are on the sidelines, and prices are under short-term pressure. Buy on demand.

8)Cobalt chloride

Domestic cobalt metal quotations have stabilized strongly. The Congolese quota system has led to a shortage of supply, and costs are expected to rise. Cobalt miners can retain the Congolese cobalt export quota for 2025, and export cobalt products from Indonesia and Russia to make up for some of the shortage of cobalt raw materials. The price of cobalt salts has risen and the price of lithium cobalt oxide has stabilized. Good news remains. International cobalt prices are rising, but positive and negative factors are weakening for the domestic cobalt market. Stock up appropriately and adequately.

9)Cobalt salts/potassium chloride/potassium carbonate/calcium formate/iodide

1. Cobalt salts: Supply side: The quota system in the Democratic Republic of the Congo has led to a structural shortage. Congolese export quotas have tightened significantly. The Democratic Republic of the Congo, the world’s largest producer of cobalt, will produce 220,000 tons in 2024, accounting for 76% of the global total. The country imposed a cobalt export ban in February 2025 and switched to a quota system in October: an export cap of only 18,125 tons for the remainder of 2025 and a quota of 96,600 tons per year for 2026-2027, a 56% reduction from actual exports in 2024. The policy has led to a reduction of about 200,000 tons in global cobalt supply, or 40% of annual demand. Coupled with the dual drivers of new energy and AI demand, they form the underlying logic for the medium – to long-term upward trend of cobalt prices. In the short term, cobalt salt prices are expected to remain volatile or stable at high levels. Subsequently, if there is a substantial increase in cobalt intermediate exports from the Democratic Republic of the Congo or a significant rebound in downstream demand, prices are expected to rise further.

2. Potassium chloride: The price of potassium is firm, but the demand is not strong and there are not many transactions. The import volume is large and the stock at the port has not increased significantly recently. The recent price firmness is related to the inspection of state reserves. The goods may be released after New Year’s Day. Purchase according to demand in the near future.

3. The stalemate in supply and demand in the formic acid market remains unchanged, and there is significant pressure to digest inventory. Downstream demand is unlikely to show substantial improvement in the short term. In the short term, prices will still be mainly fluctuating and weak, and the demand for calcium formate is average. It is recommended to pay attention to the formic acid market and purchase as needed

4. Iodide prices remained stable this week compared to last week.

Post time: Dec-24-2025