I,Analysis of non-ferrous metals

Week-on-week: Month-on-month:

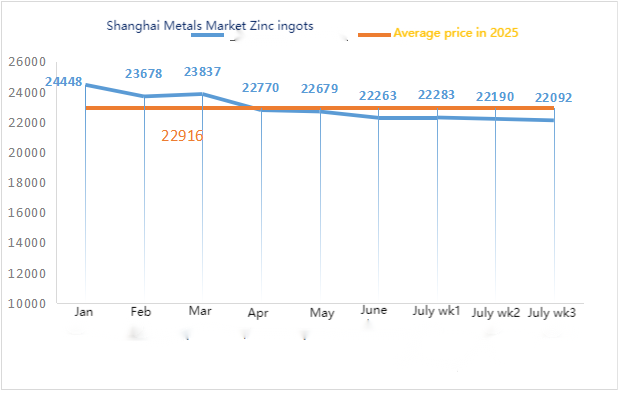

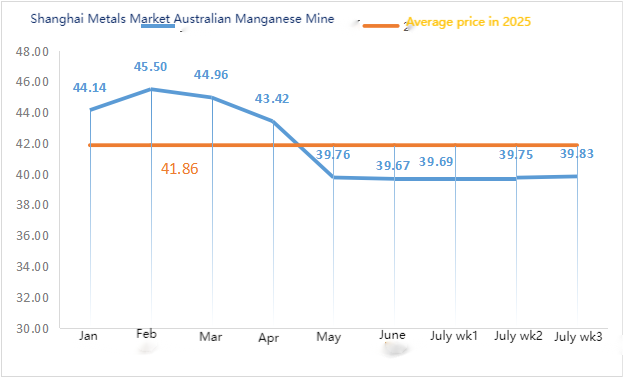

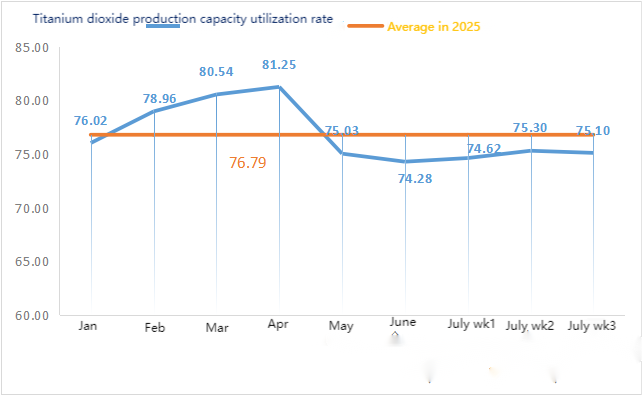

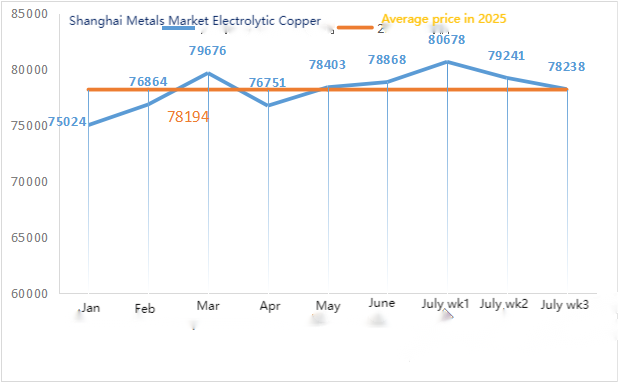

| Units | Week 2 of July | Week 3 of July | Week-on-week changes | Average price in June | As of July 18Average price | Month-on-month change | Current price as of July 22 | |

| Shanghai Metals Market # Zinc Ingots | Yuan/ton |

22190 |

22092 |

↓98 |

22263 |

22181 |

↓82 |

22780 |

| Shanghai Metals Market # Electrolytic Copper | Yuan/ton |

79241 |

78238 |

↓1003 |

78868 |

79293 |

↑425 |

79755 |

| Shanghai Metals Network AustraliaMn46% manganese ore | Yuan/ton |

39.75 |

39.83 |

↑0.08 |

39.67 |

39.76 |

↓0.09 |

39.95 |

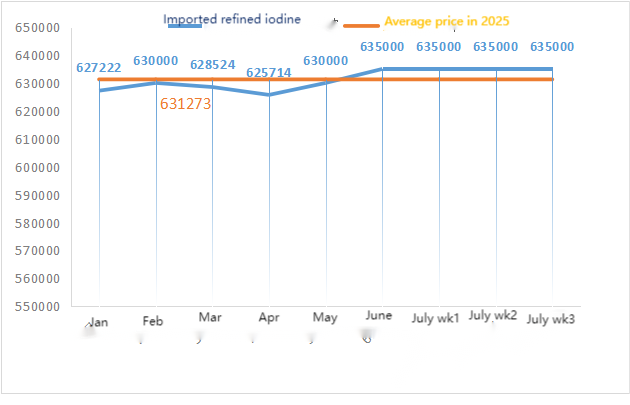

| The price of imported refined iodine by Business Society | Yuan/ton |

635000 |

635000 |

635000 |

635000 |

635000 |

||

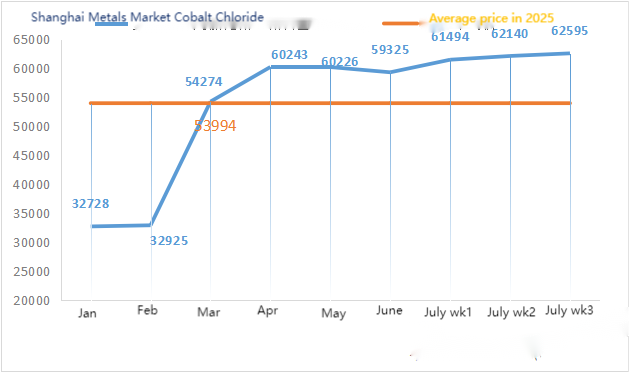

| Shanghai Metals Market Cobalt Chloride(co≥24.2%) | Yuan/ton |

62140 |

62595 |

↑455 |

59325 |

62118 |

↑2793 |

62750 |

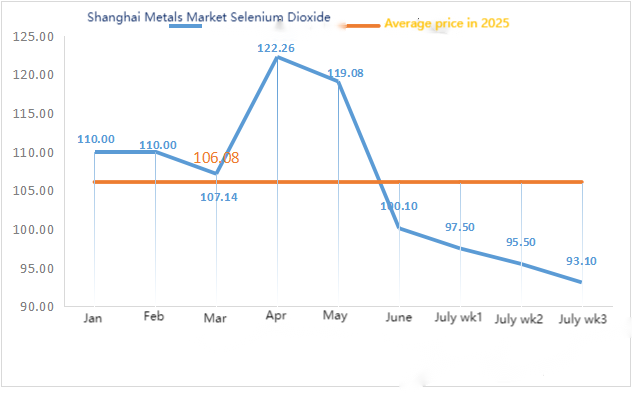

| Shanghai Metals Market Selenium Dioxide | Yuan/kilogram |

95.5 |

93.1 |

↓2.4 |

100.10 |

95.21 |

↓4.89 |

90 |

| Capacity utilization rate of titanium dioxide manufacturers | % |

75.3 |

75.1 |

↓0.2 |

74.28 |

75.01 |

↑0.73 |

Raw materials:

① Zinc hypooxide: High raw material costs and strong purchasing intentions from downstream industries keep the transaction coefficient at a nearly three-month high. ② Sulfuric acid prices remained stable across the country this week. Soda ash prices remained stable this week. ③ Shanghai zinc opened and closed higher on Monday, with strong prices, and the main contract has risen by more than 2%. The U.S. economy remains resilient and there have been growing calls for the Fed to cut interest rates recently, easing sentiment overseas. China is about to release plans to stabilize growth in key industries such as steel and nonferrous metals, and market sentiment is positive. Coupled with the recent strengthening of the black series, Shanghai zinc continues to be strong. However, the zinc market is still in the off-season for consumption at present. The supply side is stable with an increase, and the pace of inventory accumulation still needs to be watched in the future.

On Monday this week, the operating rate of water sulfate manufacturers was 89%, unchanged from the previous week. The capacity utilization rate was 72%, up 2% from the previous week. Some manufacturers completed maintenance, driving data changes. Market quotations this week remained stable compared to last week. Major manufacturers’ orders are scheduled until mid-August, but overall zinc sulfate demand is not out of the off-season level. Given that zinc ingot prices have risen this week and demand is not high, zinc sulfate prices are expected to remain stable until around the end of July. Attention should be paid to whether zinc ingot prices remain high in the later period and whether excessive monthly demand increases during the feed peak season in August. It is recommended that customers keep a close eye on the dynamics of manufacturers and their own inventories, and determine their purchasing plans 1-2 weeks in advance according to the planning.

In terms of raw materials: ① The manganese ore market is stable with a slow upward trend. Both supply and demand sides are operating cautiously amid the interwoven sentiment of bulls and bears, and it is expected that there will be limited volatility in the short term.

In terms of domestic manganese ore, some manganese oxide mines in Guangxi have been shut down recently. Coupled with reduced production in some southern regions during the rainy season, the supply of domestic manganese ore in circulation has tightened, and quotations have partially increased.

② The price of sulfuric acid remained stable.

This week, the operating rate of manganese sulfate producers was 73%, unchanged from the previous week, and the capacity utilization rate was 62%, down 4% from the previous week. The summer heat suppressed the feed intake of livestock and poultry, and the peak season of aquaculture in the south provided some support for manganese sulfate demand, but could not offset the overall weakness of livestock and poultry feed. Overall, orders from manufacturers were low, quotations remained near the cost line, and manufacturers showed a strong willingness to hold prices. The increase in manganese ore prices has supported the cost price. Major factories have raised prices this week. Customers are advised to purchase and stock up at the right time based on production conditions.

In terms of raw materials: Downstream demand for titanium dioxide remains sluggish. Some manufacturers have accumulated titanium dioxide inventories, resulting in low operating rates. The tight supply situation of ferrous sulfate in Qishui continues.

This week, samples of ferrous sulfate were operating at 75% and capacity utilization at 24%, remaining flat compared to the previous week. Quotations remained at their highest level this week. With manufacturers scheduling orders until late August, the tight supply situation of raw material Qishui ferrous has not improved, and the price of Qishui ferrous has risen further recently. With cost support and relatively abundant orders, it is expected that the price of Qishui ferrous will remain firm at a high level in the later period. It is recommended that the demand side purchase and stock up at the right time in combination with inventory.

4)Copper sulfate/basic cuprous chloride

Raw materials: Macroscopically, the risk of stagflation in the United States will weigh on the dollar. In addition, as Trump’s sanctions against Russia are accompanied by a 50-day buffer period, easing market concerns about any immediate supply disruptions, it is bullish for copper prices.

In terms of fundamentals, there is some pressure on the supply side, and the overall supply rhythm fluctuates due to the change of futures months. From the demand side, downstream consumer sentiment has been poor recently, and even if holders adjust their premium quotes, it has failed to effectively boost transactions.

Etching solution: Some upstream raw material suppliers are deep processing etching solution, further intensifying the raw material shortage, and the transaction coefficient remains high.

Copper sulfate futures rose slightly, closing at around 79,000 yuan today

Copper sulfate producers’ operating rate this week was 86%, down 14% from the previous week, and capacity utilization was 38%, flat from the previous week. Copper prices rose this week, and copper sulfate/basic copper chloride quotations rose this week compared with last week. Based on the recent trend of raw materials and the operation of manufacturers, copper sulfate is expected to remain at a high level with fluctuations in the short term.

Copper net prices fluctuate greatly, and manufacturers’ quotations are mostly based on changes in copper net prices. It is recommended that customers make purchases at the right time.

Raw materials: Currently, the price of sulfuric acid in the north has broken through 1,000 yuan per ton, and the price is expected to rise in the short term.

Magnesium sulfate plants are operating at 100%, production and delivery are normal, and orders are scheduled until mid-August. 1) The military parade is approaching. According to past experience, all hazardous chemicals, precursor chemicals and explosive chemicals involved in the north will increase in price at that time. 2) As summer approaches, most sulfuric acid plants will shut down for maintenance, which will drive up the price of sulfuric acid. It is predicted that the price of magnesium sulfate will not fall before September. The price of magnesium sulfate is expected to remain stable for a short period of time. Also, in August, pay attention to logistics in the north (Hebei/Tianjin, etc.). Logistics are subject to control due to the military parade. Vehicles need to be found in advance for shipment.

Raw materials: The domestic iodine market is stable at present, the supply of imported refined iodine from Chile is stable, and the production of iodide manufacturers is stable.

This week, the production rate of calcium iodate sample factories was 100%, the capacity utilization rate was 36%, the same as the previous week, and the price of imported iodine remained stable. High summer temperatures have led to a decline in livestock feed intake and a lack of willingness to replenish stocks voluntarily. Aquatic feed enterprises are in the peak demand season, driving the demand for calcium iodate to remain stable. Demand this week is slightly lower than the normal week of the month. Market quotations have reached the manufacturers’ cost line, and mainstream manufacturers have a strong willingness to hold prices, leaving no room for negotiation.

In terms of raw materials: The recent surge in selenium tenders at copper smelters has driven up market confidence to keep selenium prices firm.

This week, sample manufacturers of sodium selenite were operating at 100%, with capacity utilization at 36%, remaining flat compared to the previous week. The manufacturer’s orders are relatively abundant, but the support from raw material costs is average. It is expected that there will be no possibility of price increase in the future. Customers are advised to purchase at an appropriate time based on their own inventory.

Raw materials: On the supply side, reluctance to sell has emerged, driving quotations to continue to rise. On the demand side, purchases are still dominated by essential needs, with small single transaction volumes. Based on the changes in the supply and demand pattern, cobalt chloride futures have risen this week. The futures price today is 62,750 yuan per ton. It is expected that cobalt chloride prices will maintain an upward trend in the future.

This week, cobalt chloride sample manufacturers’ operating rate was 100% and capacity utilization rate was 44%, remaining flat compared with the previous week. Quotations from major manufacturers remained stable this week.

It is not ruled out that cobalt chloride prices will rise later. Customers are advised to stock up at the right time based on their inventory.

9)Cobalt salt/potassium chloride/potassium carbonate/calcium formate/iodide

1. Despite still being affected by Congo’s ban on gold and cobalt exports, there is little willingness to purchase and few bulk transactions. The trading atmosphere in the market is average, and the cobalt salt market is likely to be stable in the short term.

2. The domestic potassium chloride market shows a weak downward trend. Under the advocacy of the policy of ensuring supply and stabilizing prices, the prices of both imported potassium and domestic potassium chloride are gradually recovering. The supply and shipment volume in the market have also increased significantly compared with the previous period. Downstream compound fertilizer factories are cautious and mainly purchase according to demand. The current market trading is light and there is a strong wait-and-see sentiment. If there is no significant boost from the demand side in the short term, the price of potassium chloride is likely to remain weak. The price of potassium carbonate remained stable compared with last week.

3. The price quote for calcium formate remained stable this week.

4. Iodide prices this week were stronger than last week.

Media Contact:

Media Contact:

Elaine Xu

SUSTAR Group

Email: elaine@sustarfeed.com

Mobile/WhatsApp: +86 18880477902

Post time: Jul-24-2025