Trace Elements Market Analysis

I,Analysis of non-ferrous metals

| Units | Week 2 of November | Week 3 of November | Week-on-week changes | October average price | As of November 21

Average price |

Month-on-month change | Current price as of November 25 | |

| Shanghai Metals Market # Zinc ingots | Yuan/ton |

22522 |

22332 |

↓190 |

22044 |

22433 |

↑389 |

22400 |

| Shanghai Metals Market # Electrolytic Copper | Yuan/ton |

86880 |

86176 |

↓704 |

86258 |

86404 |

↑146 |

86610 |

| Shanghai Metals Network Australia

Mn46% manganese ore |

Yuan/ton |

40.55 |

40.55 |

- |

40.49 |

40.52 |

↑0.03 |

40.65 |

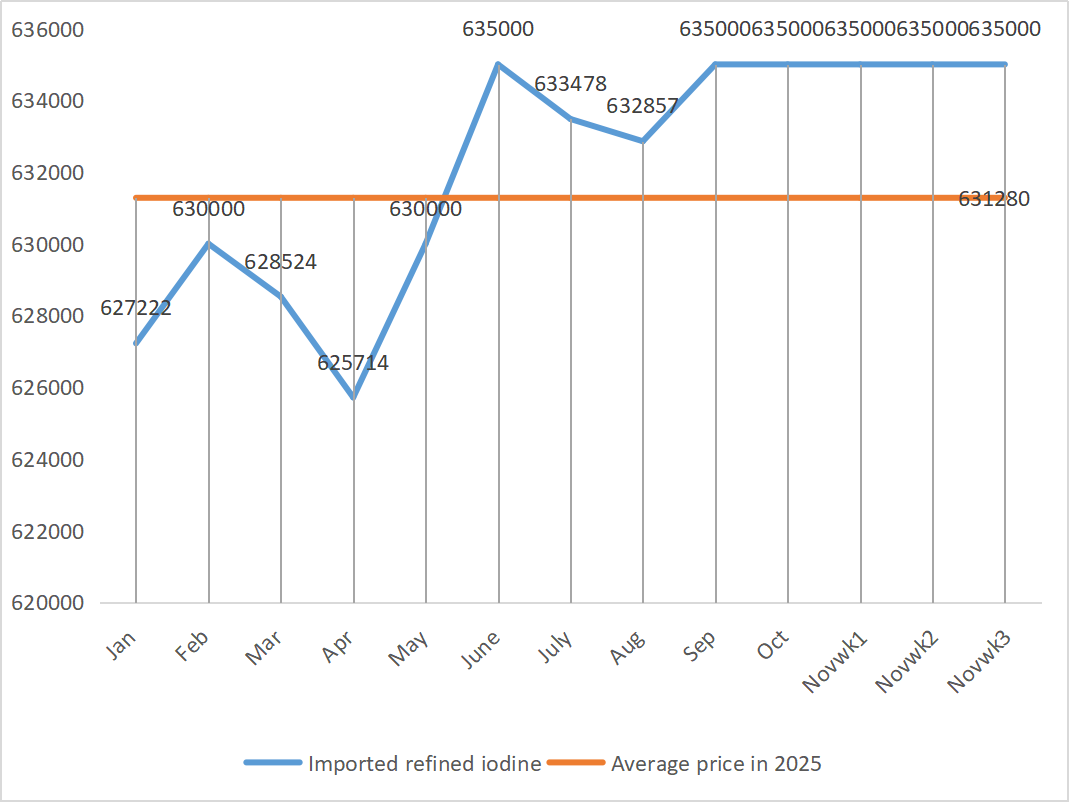

| The price of imported refined iodine by Business Society | Yuan/ton |

635000 |

635000 |

- |

635000 |

635000 |

|

635000 |

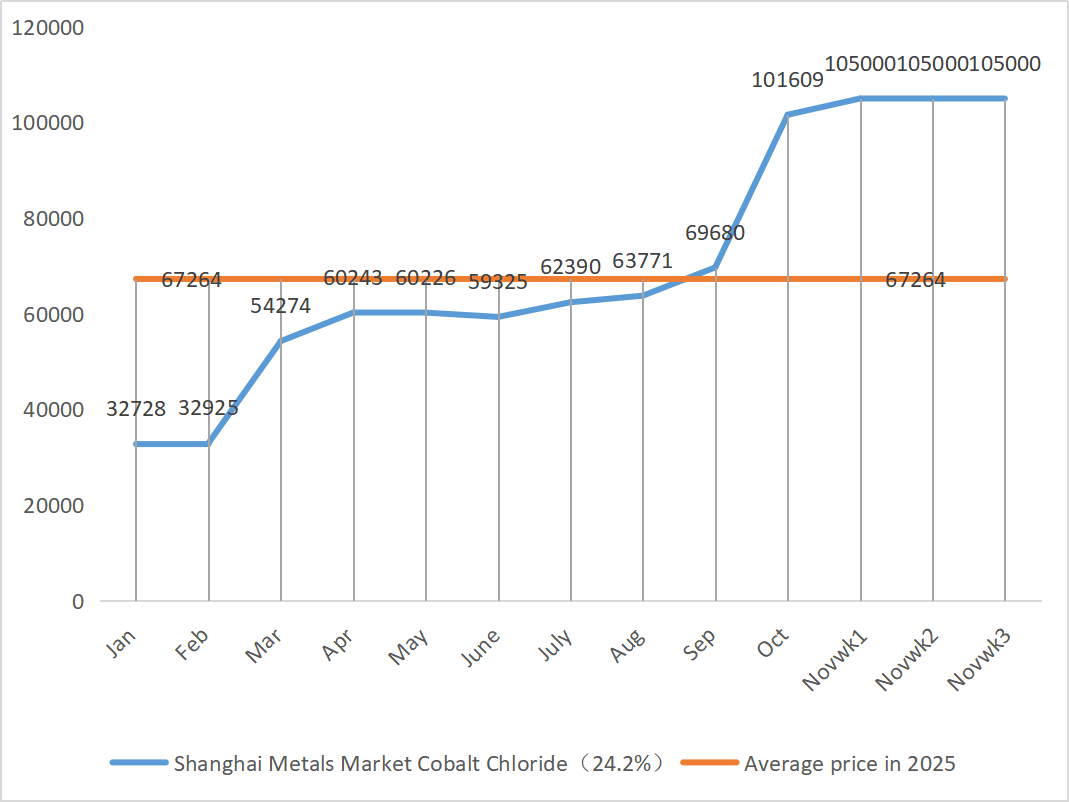

| Shanghai Metals Market Cobalt Chloride

(co≥24.2%) |

Yuan/ton |

105000 |

105000 |

- |

101609 |

105000 |

↑3391 |

105000 |

| Shanghai Metals Market Selenium Dioxide | Yuan/kilogram |

114 |

115 |

↑1 |

106.91 |

113 |

↑6.09 |

115 |

| Capacity utilization rate of titanium dioxide manufacturers | % |

76.04 |

76.02 |

↓0.02 |

77.68 |

76.36 |

↓1.32 |

Week-on-week: Month-on-month:

1)Zinc sulfate

① Raw materials: Zinc hypooxide: The transaction coefficient keeps hitting new highs for the year.

At the macro level, there are no clear signs of recovery in expectations of Fed rate cuts, which will still put pressure on zinc prices in the short term; The fundamentals show structural support highlights: The window for domestic zinc ingot exports continues to open, and the volume of refined zinc exports in October increased significantly. Coupled with the release of domestic restocking demand against the backdrop of falling zinc prices, domestic social inventories of zinc ingot have shown signs of falling, providing effective support for the bottom of zinc prices. The average price of zinc is expected to be 22,400 yuan per ton next week. ② Due to the continuous increase in sulfur prices, the prices of sulfuric acid are mainly rising in various regions. Soda ash: Prices remained stable this week.

On Monday, the operating rate of water zinc sulfate producers was 74%, up 4% from the previous week, and the capacity utilization rate was 64%, down 3% from the previous week. Major manufacturers are fully booked until mid-December. On the supply side: The current zinc sulfate market is driven by both “cost-push” and “demand-pull”. Until raw material prices do not fall significantly or demand weakens more than expected, prices remain at a high level. In the short term, high raw material costs form a rigid support, and prices still have support. In the long term, due to accelerated export shipments and the resumption of inquiries, it is expected that prices will rise slightly in the later period. It is recommended to purchase on demand.

2)Manganese sulfate

Raw materials: ① Prices were stable at the beginning of the week. Foreign futures quotations rose slightly and the volume of arrivals at ports decreased, boosting market confidence. But downstream alloy prices fluctuated little, steel mills’ tender prices rose and fell, and market sentiment was divided.

② Sulfuric acid remained stable at a high level this week.

This week, the operating rate of manganese sulfate producers was 85%, unchanged from the previous week, and the capacity utilization rate was 58%, slightly up 1% from the previous week. Major manufacturers’ orders are scheduled until mid-December, and short-term prices are expected to be stronger. The core logic of the current market is cost-driven. If the price of sulfuric acid continues to rise, the price of manganese sulfate is bound to follow suit. Customers are advised to buy on demand.

3)Ferrous sulfate

Raw materials: As a by-product of titanium dioxide, its supply is constrained by the low operating rate of titanium dioxide in the main industry. Meanwhile, the stable demand from the lithium iron phosphate industry has squeezed the share flowing to the feed industry, resulting in a long-term tight supply of feed-grade ferrous sulfate.

This week, the operating rate of ferrous sulfate producers was 80%, up 5% from the previous week, and the capacity utilization rate was 26%, up 6% from the previous week. Despite the long-term tightness of raw materials due to the low operating rate of titanium dioxide and the shrinking supply of ferrous sulfate heptahydrate in some regions, the logic of high costs remains unchanged. It is expected that prices will likely rise after inventory pressure eases, supported by strong raw material costs. It is suggested that the demand side purchase according to its own production situation and avoid purchasing at high prices.

4)Copper sulfate/basic copper chloride

In terms of raw materials: In the short term, the suppression of demand by high prices and the loose supply pattern have put pressure on prices, and there is a possibility of a pullback. But in the medium to long term, the bottom support for copper sulfate prices is solid. The market is in a fierce battle between “high cost support” and “high prices suppressing demand”, and it is expected to remain in a high volatility pattern in the short term.

On the macro front, Fed Governor Waller, who is also a strong contender for the next Fed president, said he advocated for a continuation in December but would adopt more successive meetings from January. Since the government resumed operations, most private sector data and information have shown no substantial change in economic fundamentals, and the labor market has continued to weaken. Inflation is expected to continue to fall. Bearish for metal prices. Copper grid prices are expected to be in the range of 86,500 to 87,500 yuan per ton next week.

Etching solution: Upstream manufacturers, in an effort to speed up capital turnover, have further processed etching solution into sponge copper, etc., resulting in a narrower proportion of raw materials directly flowing into the copper sulfate industry. This structural change has prolonged the tight supply of raw materials, and the purchase transaction coefficient has continued to rise, creating an unshakable cost bottom for copper sulfate prices.

Customers are advised to stock up at the right time when copper prices fall back to a relatively low level based on their own inventories, so as to ensure supply while controlling costs.

5)Magnesium sulfate/magnesium oxide

In terms of raw materials: Currently, sulfuric acid in the north is stable at a high level.

Due to the control of magnesite resources, quota restrictions and environmental rectification, many enterprises are producing based on sales. In September and October, many enterprises with an annual output of less than 100,000 tons were forced to suspend production for transformation due to the capacity replacement policy. There are no concentrated resumption actions in early November, and short-term productivity is unlikely to increase significantly. The price of sulfuric acid has risen, and the prices of magnesium sulfate and magnesium oxide are likely to increase slightly in the short term. It is recommended to stock up appropriately.

6)Calcium iodate

Raw materials: The domestic iodine market is stable at present, the supply of imported refined iodine from Chile is stable, and the production of iodide manufacturers is stable.

In the context of a moderate recovery in demand but limited production capacity, it is not ruled out that there will be a slight increase in the price of pure calcium iodate powder. It is recommended to stock up appropriately.

7)Sodium selenite

In terms of raw materials: The price of diselenium rose and then stabilized. Market insiders said that the selenium market price was stable with an upward trend, the trading activity was average, and the price was expected to remain strong in the later period. Sodium selenite producers say demand is weak, costs are rising, orders are increasing, and quotations are slightly lowered this week. Buy on demand.

8)Cobalt chloride

The cobalt market stabilized as a whole last week. On the supply side, supported by raw material production costs, smelters have a strong willingness to hold prices. On the demand side, purchasing intentions have strengthened. Some companies have chosen to accept the low-priced old inventory from traders, while others have begun to try to take over the high-priced new goods from smelters. This diversion of purchasing behavior has jointly pushed up the transaction price center slightly. The market is still in a critical game between supply and demand, and the price divergence between upstream and downstream remains. It is expected that in the short term, cobalt salt prices will mainly show a stable and slightly strong trend. Once downstream customers gradually digest the current price level and start a new round of centralized purchasing, cobalt salt prices are expected to gain stronger momentum and resume the upward channel. Stock up appropriately based on demand.

9)Cobalt salt/potassium chloride/potassium carbonate/calcium formate/iodide

1. Cobalt salt: Raw material cost: The cobalt salt market as a whole shows a pattern of supply and demand competition. The raw material cost support on the supply side is relatively strong, while the demand side has marginally improved but has not yet been fully released. In the short term, cobalt salt prices are expected to be stable with a slight increase. Attention should be paid to the rhythm of downstream centralized purchasing and changes in cobalt raw material supply policies in the Democratic Republic of the Congo. It is recommended to keep a close eye on market dynamics and make reasonable plans for purchasing and production.

2. Potassium chloride: Recently, the potassium chloride market still shows a “stable with a slight strength” pattern. Traders’ mentality is somewhat divided. Some traders lock in profits by selling at high prices. Others are cautiously watching and waiting for the market to become clear. On the demand side, the overall downstream demand is still affected by the previous high inventory pressure and the market’s wait-and-see sentiment. The purchasing pace has not significantly accelerated, mainly replenishing inventories for essential needs, and the willingness to stockpile on a large scale is relatively low. To sum up, in the short term, the potassium chloride market is supported by costs and prices are likely to remain high and volatile. However, the inhibitory effect of high prices on demand may limit the space for further price increases.

3. Calcium formate prices continued to decline this week. Raw formic acid plants resume production and now increase factory production of formic acid, leading to an increase in formic acid capacity and an oversupply. In the long term, calcium formate prices are falling.

4 Iodide prices were stable this week compared to last week.

Post time: Nov-27-2025