Trace Elements Market Analysis

I,Analysis of non-ferrous metals

Week-on-week: Month-on-month:

| Units | Week 2 of September | Week 3 of September | Week-on-week changes | August average price | As of September 20Average price | Month-on-month change | Current price as of September 23 | |

| Shanghai Metals Market # Zinc ingots | Yuan/ton |

22096 |

22054 |

↓42 |

22250 |

22059 |

↓191 |

21880 |

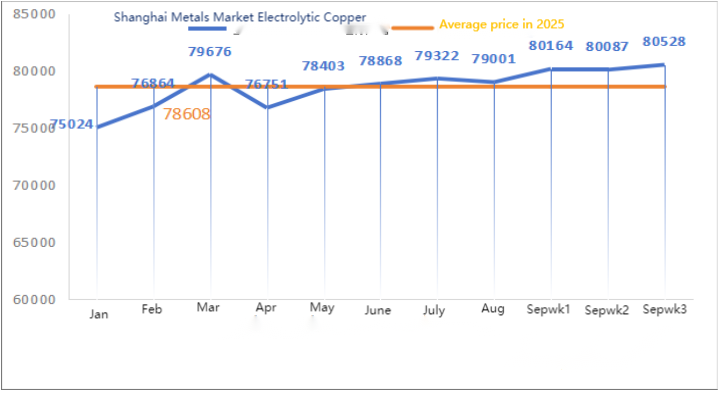

| Shanghai Metals Market # Electrolytic Copper | Yuan/ton |

80087 |

80528 |

↑441 |

79001 |

80260 |

↑1259 |

80010 |

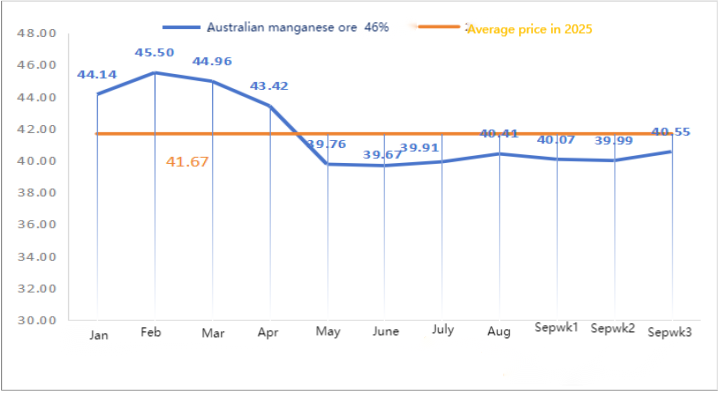

| Shanghai Metals AustraliaMn46% manganese ore | Yuan/ton |

39.99 |

40.55 |

↑0.56 |

40.41 |

40.20 |

↓0.21 |

40.65 |

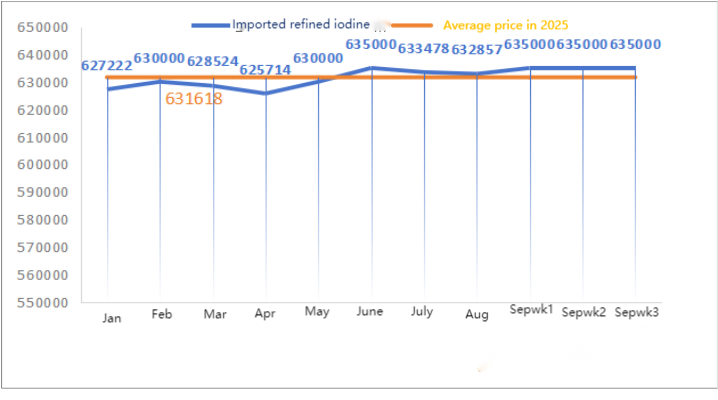

| Business Society imported refined iodine prices | Yuan/ton |

635000 |

635000 |

632857 |

635000 |

↑2143 |

635000 |

|

| Shanghai Metals Market Cobalt Chloride(co≥24.2%) | Yuan/ton |

66400 |

69000 |

↑2600 |

63771 |

66900 |

↑3029 |

70800 |

| Shanghai Metals Market Selenium Dioxide | Yuan/kilogram |

104 |

105 |

↑1 |

97.14 |

103 |

↑5.86 |

105 |

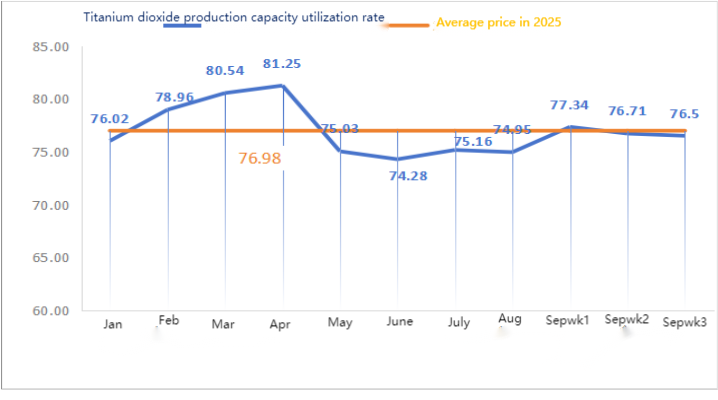

| Capacity utilization rate of titanium dioxide manufacturers | % |

76.08 |

76.5 |

↑0.42 |

74.95 |

76.64 |

↑1.69 |

1)Zinc sulfate

① Raw materials: Zinc hypooxide: High transaction coefficient. The Fed is expected to cut interest rates, but the fundamentals remain weak reality. There are no obvious signs of improvement in consumption. Short-term monetary easing and the peak consumption season are expected to bring some increase to support zinc prices, but before the inventory inflection point appears, the upward driving force for zinc prices is limited. Zinc prices are expected to remain low and volatile in the short term.

② Sulfuric acid prices were stable at high levels across the country this week. Soda ash: Prices were stable this week. ③ The demand side is relatively stable. There is a tendency for zinc supply and demand balance to be in excess, and there is little possibility of a significant decline in zinc in the short – to medium term. It is expected that zinc prices will operate within the range of 21,000-22,000 yuan per ton.

On Monday, the operating rate of water zinc sulfate producers was 83%, down 6% from the previous week, and the capacity utilization rate was 68%, down 1% from the previous week.

The upstream operating rate of zinc sulfate enterprises is normal, but the order intake is significantly insufficient. The spot market has experienced different levels of pullback. Feed enterprises have not been very active in purchasing recently. Under the dual pressure of the operating rate of upstream enterprises and the insufficient existing order volume, zinc sulfate will continue to operate weakly and stably in the short term. It is recommended that customers prepare in advance appropriately based on their own inventory.

2)Manganese sulfate

In terms of raw materials: ① The price of imported manganese ore in China remained stable and firm, with a slight increase in the price of certain types of ore. With the increase in the price of manganese alloys downstream, the expectation of the release of the surplus demand for replenishment before the festival, and the official implementation of the Fed’s interest rate cut, the atmosphere of port miners holding back sales and maintaining prices was obvious, and the transaction price center moved slowly and slightly upward.

② Sulfuric acid prices remained largely stable at high levels.

This week, the operating rate of manganese sulfate manufacturers was 95%, up 19% compared with the previous week. Capacity utilization was 56%, up 7% from the previous week.

Demand in the feed industry is gradually picking up, while the fertilizer industry has seasonal stockpiling. Based on the analysis of enterprise orders and raw material factors, manganese sulfate is expected to remain firm in the short term. It is recommended that customers increase their inventory appropriately. It is recommended that customers shipping by sea fully consider the shipping time and prepare goods in advance.

3)Ferrous sulfate

In terms of raw materials: Although the demand for titanium dioxide has improved compared to the previous period, the overall sluggish demand situation still exists. The backlog of titanium dioxide inventories at manufacturers persists. The overall operating rate remains at a relative position. The tight supply of ferrous sulfate heptahydrate persists. Coupled with the relatively stable demand for lithium iron phosphate, the tight raw material situation has not been fundamentally alleviated.

This week, the operating rate of ferrous sulfate producers was 75%, and the capacity utilization rate was 24%, remaining flat compared to the previous week. Producers are scheduled until November – December. Major manufacturers are expected to cut production, and quotations this week are stable compared to last week. In addition, the supply of by-product ferrous sulfate is tight, the cost of raw materials is strongly supported, the overall operating rate of ferrous sulfate is not good, and there is very little spot inventory of enterprises, which brings favorable factors for the price increase of ferrous sulfate. Considering the recent inventory of enterprises and the operating rate of upstream, ferrous sulfate is expected to rise in the short term.

4)Copper sulfate/basic cuprous chloride

Raw materials: Copper prices fell this week as the Fed failed to cut interest rates more than expected in September, capital market risk appetite declined, the rebound of the US dollar index weighed on the metals market, and copper prices dropped. Reference range for the main operating range of Shanghai copper: 79,000-80,100 yuan/ton.

Macroeconomics: Copper prices are weighed down by rising inventories and a weak global economy, but Chinese consumers’ restocking and a weakening dollar have limited the decline to some extent. Coupled with the continued shutdown of copper mines in Indonesia, one of the world’s largest, copper prices are expected to be cautious in the later period, with a focus on expectations in the global economic market.

In terms of etching solution: Some upstream raw material manufacturers have accelerated capital flow by deep processing etching solution into sponge copper or copper hydroxide, and the proportion of sales to the copper sulfate industry has decreased, with the transaction coefficient reaching a new high.

Copper sulfate/caustic copper producers were operating at 100% this week, with a capacity utilization rate of 45%, remaining flat compared to the previous week. Copper prices were under pressure to fall, and copper sulfate prices followed suit. This week, prices dropped compared to last week. Customers are advised to stock up based on their own inventories.

5)Magnesium oxide

Raw materials: The raw material magnesite is stable.

Magnesium oxide prices were stable this week after last week, factories were operating normally and production was normal. The delivery time is generally around 3 to 7 days. The government has shut down backward production capacity. Kilns cannot be used to produce magnesium oxide, and the cost of using fuel coal increases in winter. Customers are advised to purchase according to their needs.

6)Magnesium sulfate

Raw materials: The price of sulfuric acid in the north is currently rising in the short term.

At present, magnesium sulfate plants are operating at 100%, production and delivery are normal, sulfuric acid prices are stable at a high level, and with the increase in magnesium oxide prices, the possibility of further increases cannot be ruled out. Customers are advised to purchase according to their production plans and inventory requirements.

7)Calcium iodate

Raw materials: The domestic iodine market is stable at present, the supply of imported refined iodine from Chile is stable, and the production of iodide manufacturers is stable.

Calcium iodate producers were operating at 100% this week, unchanged from the previous week; Capacity utilization was 34%, down 2% from the previous week; Quotations from major manufacturers remained stable. Supply and demand are balanced and prices are stable. Customers are advised to purchase on demand based on production planning and inventory requirements.

8)Sodium selenite

In terms of raw materials: The current market price of crude selenium has stabilized, indicating that the competition for supply in the crude selenium market has become increasingly fierce recently, and market confidence is strong. It has also contributed to the further increase in the price of selenium dioxide. Currently, the entire supply chain is optimistic about the medium and long-term market price.

This week, sample manufacturers of sodium selenite were operating at 100%, with capacity utilization at 36%, remaining flat compared to the previous week. Manufacturers’ quotations remained stable this week. Prices remained stable. But a small increase is not ruled out.

It is recommended that clients purchase on demand based on their own inventory.

9)Cobalt chloride

In terms of raw materials: Cobalt prices continued to rise this week, and tight supply of raw materials remains the core contradiction in the market. Due to the ongoing ban on the export of cobalt intermediates in the Democratic Republic of the Congo, domestic smelting enterprises are under greater pressure to purchase raw materials. They only maintain essential purchases, and some enterprises have turned to using cobalt salts as substitutes, pushing the spot resources of cobalt salts to tighten and prices to strengthen. China’s imports of cobalt hydroprocess intermediates declined further in September, and smelters continued to deplete raw material inventories, providing solid support on the cost side.

This week, cobalt chloride producers’ operating rate was 100% and capacity utilization rate was 44%, remaining flat compared with the previous week. Manufacturers’ quotations remained stable this week. Prices were raised this week due to rising raw material prices. The cost support for cobalt chloride feedstock has strengthened, and prices are expected to rise further in the future

It is recommended that demand-side purchase and stockpiling plans be made seven days in advance in light of inventory.

10)Cobalt salts/potassium chloride/potassium carbonate/calcium formate/iodide

1. Cobalt salts: Raw material costs: The Congolese (DRC) export ban continues, cobalt intermediate prices continue to rise, and cost pressures are passed downstream.

The cobalt salt market was positive this week, with quotations maintaining an upward trend and supply being tight, mainly driven by supply and demand. In the short term, cobalt salt prices will fluctuate greatly due to policy and inventory, and it is recommended to pay attention to the details of quota allocation in the Democratic Republic of the Congo and domestic inventory consumption. In the long term, cobalt salt demand is closely related to the development of the new energy industry. If new energy vehicles and battery technology continue to advance, cobalt salt demand is expected to grow steadily, but vigilance is needed for supply-side policy changes and the risks of alternative technology development.

2. The overall price of potassium chloride has not changed significantly. The market shows a trend of both supply and demand being weak. The supply of market sources remains tight, but the demand side support from downstream factories is limited. There are small fluctuations in some high-end prices, but the extent is not large. Prices remain stable at a high level. The price of potassium carbonate remained stable in line with the price of potassium chloride.

3. Calcium formate prices were stable this week. Raw formic acid plants resume production and now increase factory production of formic acid, leading to an increase in formic acid capacity, oversupply, and long-term

Expect the price of calcium formate to fall.

4. Iodide prices were stable this week compared to last week.

Post time: Sep-26-2025