Trace Elements Market Analysis

I,Analysis of non-ferrous metals

Week-on-week: Month-on-month:

| Units | Week 4 of November | Week 1 of December | Week-on-week changes | November average price | 5-day average price up to December | Month-on-month changes | Current price as of December 2 | |

| Shanghai Metals Market # Zinc ingots | Yuan/ton |

22330 |

22772 |

↑442 |

22407 |

22772 |

↑365 |

23190 |

| Shanghai Metals Network # Electrolytic copper | Yuan/ton |

86797 |

89949 |

↑3152 |

86502 |

89949 |

↑3447 |

92215 |

| Shanghai Metals Network AustraliaMn46% manganese ore | Yuan/ton |

40.63 |

40.81 |

↑0.18 |

40.55 |

40.81 |

↑0.26 |

41.35 |

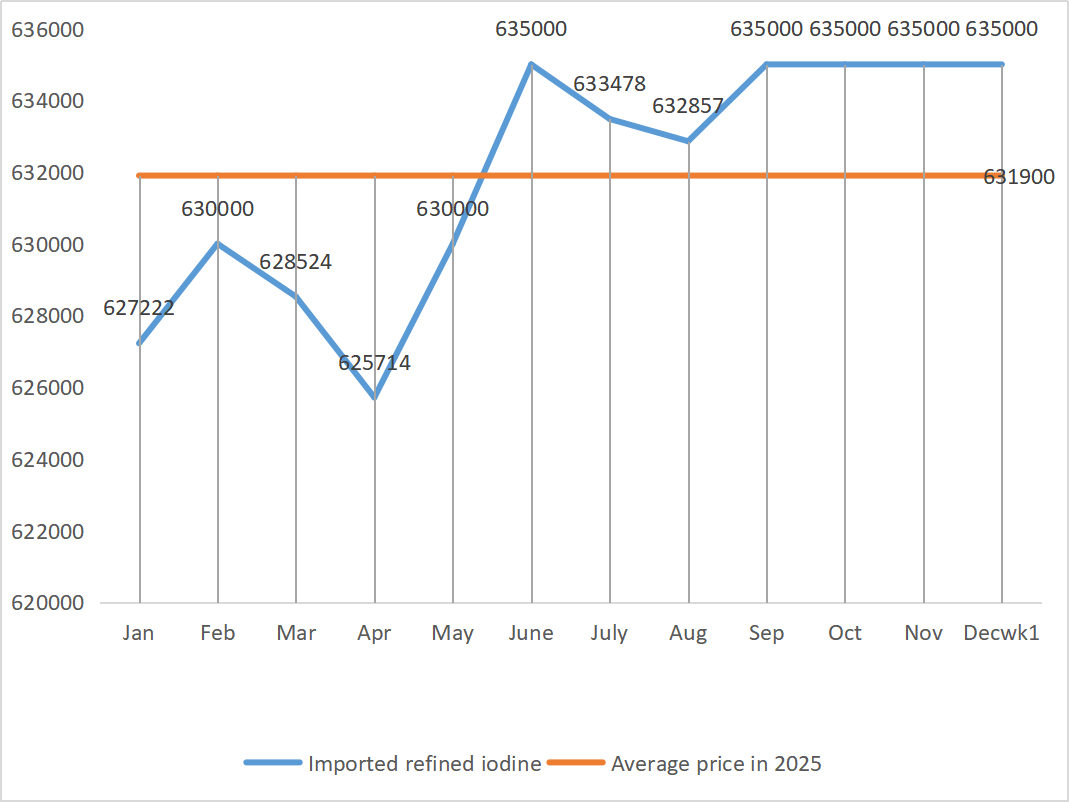

| The price of imported refined iodine by Business Society | Yuan/ton |

635000 |

635000 |

- |

635000 |

635000 |

635000 |

|

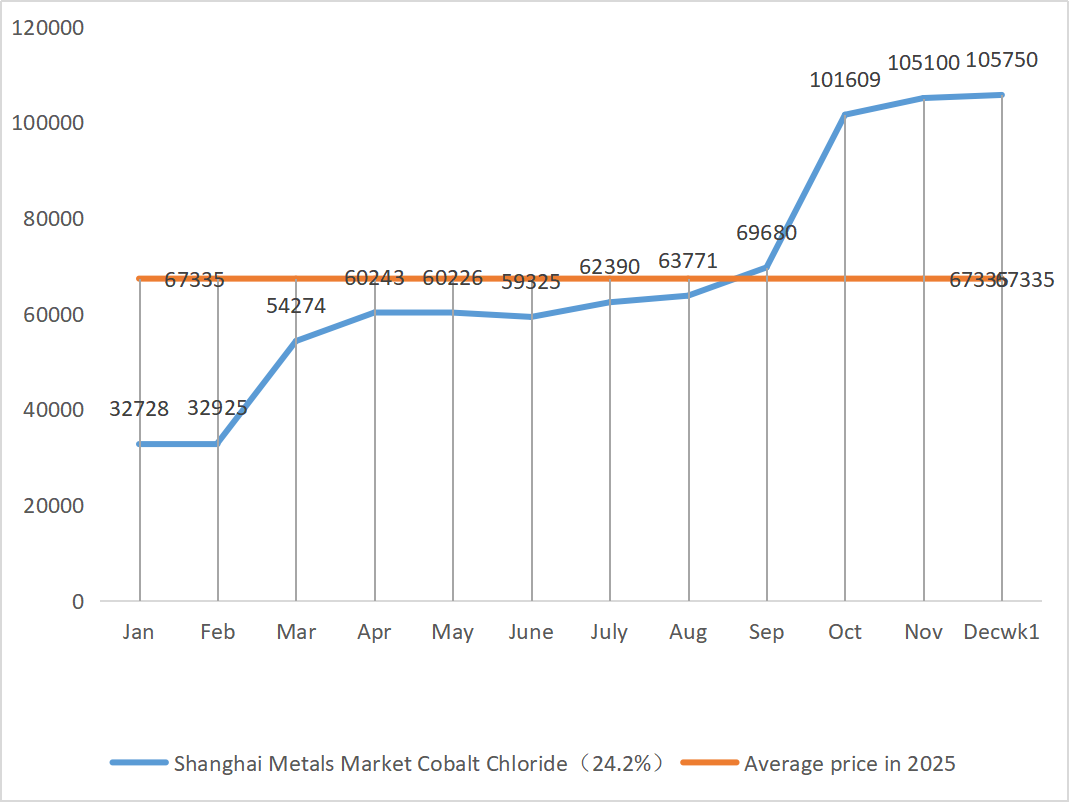

| Shanghai Metals Market Cobalt Chloride(co≥24.2%) | Yuan/ton |

104500 |

105750 |

↑350 |

105100 |

105750 |

↑650 |

105750 |

| Shanghai Metals Market Selenium Dioxide | Yuan per kilogram |

115 |

114 |

↓1 |

113.5 |

114 |

↑0.5 |

107.5 |

| Capacity utilization rate of titanium dioxide manufacturers | % |

74.8 |

74.46 |

↓0.34 |

75.97 |

74.46 |

↓1.51 |

1)Zinc sulfate

① Raw materials: Zinc hypooxide: The transaction coefficient keeps hitting new highs for the year.

On the macro level, the US ADP data fell short of expectations, and market expectations of a Fed rate cut strengthened, which was favorable for zinc prices on the macro level. Coupled with low processing fees for zinc concentrate, there is significant support from the supply side, and zinc prices are running strongly, with the main contract price of Shanghai zinc hitting a new high since August this year. The net price of zinc is expected to be around 22,300 yuan per ton next week.

② Due to the continuous increase in sulfur prices, the prices of sulfuric acid are mainly rising in various regions. Soda ash: Prices remained stable this week.

The operating rate of water zinc sulfate producers on Monday was 74%, unchanged from the previous week; Capacity utilization was 61 percent, down 3 percent from the previous week.

In the short term, high raw material costs provide a rigid support for zinc sulfate prices, and the market remains stable at a high level. In the medium to long term, with the acceleration of export shipments and the resumption of inquiries, there is still room for a slight increase in prices.

2)Manganese sulfate

In terms of raw materials: ① Manganese ore prices are stable with a slight increase. The supply of Australian blocks, Gabon blocks, etc. at northern ports is tight, and the quotations of major miners are generally slightly higher.

② Sulfuric acid prices remain stable at a high level and are expected to strengthen.

This week, due to the sharp increase in sulfur prices, the production cost of manganese sulfate has continued to rise. On the demand side: there is an overall moderate recovery trend, and short-term prices are expected to be stronger. Cost-driven, if the price of sulfuric acid continues to rise, the price of manganese sulfate is expected to follow suit and strengthen. Customers are advised to purchase on demand.

3)Ferrous sulfate

Raw materials: As a by-product of titanium dioxide, its supply is constrained by the low operating rate of titanium dioxide in the main industry. Meanwhile, the stable demand from the lithium iron phosphate industry has squeezed the share flowing to the feed industry, resulting in a long-term tight supply of feed-grade ferrous sulfate.

This week, the operating rate of ferrous sulfate producers dropped sharply to 20%, a 60% decrease from the previous week; Capacity utilization was only 7 percent, down 19 percent from the previous week. Orders from major manufacturers have been scheduled until February, and shipping is tight. With strong support from raw material costs and the suspension of quotations in some regions, ferrous sulfate prices are expected to maintain an upward trend in the medium to short term. It is suggested that the demand side purchase according to its own production situation and avoid buying at high prices. For customers with stable demand, it is recommended to negotiate forward orders in advance.

4)Copper sulfate/basic copper chloride

In terms of fundamentals, the expansion of global copper mines has been slow, and production has been disrupted in many places, leading to an intensification of raw material shortages. The market predicts that there may be a supply gap of 450,000 tons of refined copper worldwide in 2026. To attract necessary investment, copper prices need to remain at a high level for a relatively long period of time (such as an annual average price exceeding 12,000 US dollars per ton). The demand growth in emerging fields such as new energy (photovoltaic, electric vehicles, energy storage), artificial intelligence, and power grid investment on the demand side is clear. It is expected to increase the proportion of copper consumption and constitute a long-term positive factor. Domestic spot and terminal consumption are currently performing weakly. The downstream’s acceptance of high copper prices and their willingness to purchase are relatively low, which imposes a realistic constraint on prices.

At the macro level, negative and positive factors are intertwined. Expectations of the Federal Reserve cutting interest rates have strengthened the US dollar, making copper priced in US dollars more expensive for non-US buyers and suppressing the upward momentum of LME copper. China has announced that it will expand domestic demand and adopt more proactive macro policies in 2026, boosting the demand outlook for industrial metals. Meanwhile, the US tariff policy: The US’s import tariff exemption policy for refined copper remains in place, and the review results (possibly imposing taxes) will not be announced until June next year. This has spurred merchants to ship copper to the United States in advance to avoid potential risks, leading to a continuous premium for COMEX copper futures and providing support for a “stockpiling wave”.

Overall, China’s policy expectations and the United States’ “hoarding” behavior have jointly formed the bottom support for copper prices, keeping them resilient at a high level. However, the strength of the US dollar and the sluggish short-term consumption at home have limited the room for price increases. As a result, the copper price is caught in a dilemma. It is expected to fluctuate narrowly within the range of 91,850 to 93,350 yuan per ton amid the game of China’s policy efforts, the US stockpiling and the sluggish domestic consumption.

Customers are advised to take advantage of their inventories to stock up when copper prices fall back to a relatively low level, so as to ensure supply while controlling costs.

5)Magnesium sulfate/magnesium oxide

In terms of raw materials: Currently, sulfuric acid in the north is stable at a high level.

Magnesium oxide and magnesium sulfate prices have risen. The impact of magnesite resource control, quota restrictions and environmental rectification has led to many enterprises producing based on sales. Light-burned magnesia enterprises have been forced to suspend production for transformation due to capacity replacement policies, and short-term productivity is unlikely to increase significantly. With the increase in sulfuric acid prices, the prices of magnesium sulfate and magnesium oxide may rise slightly in the short term. It is recommended to stock up appropriately.

6)Calcium iodate

Raw materials: The price of refined iodine rose slightly in the fourth quarter. The supply of calcium iodate is tight. Some iodide manufacturers have suspended production or limited production. The supply of iodide is expected to remain stable and slightly upward in the long term. It is recommended to stock up appropriately.

7)Sodium selenite

In terms of raw materials: The price of diselenium rose and then stabilized. Market insiders said that the selenium market price was stable with an upward trend, the trading activity was average, and the price was expected to remain strong in the later period. Sodium selenite producers say demand is weak, costs are rising, orders are increasing, and quotations are slightly lowered this week. Buy on demand.

8)Cobalt chloride

The shortage of raw materials has turned from expectation to reality, with producers maintaining strong quotations supported by high costs. Although some downstream sectors have started to lay out for the first quarter of next year and purchasing enthusiasm has increased, the market as a whole remains cautious and wait-and-see at the current price level. Close attention should be paid to policy trends in major production areas such as the Democratic Republic of the Congo, as any supply disruption could quickly push up costs. Cobalt chloride prices are expected to remain stable against the backdrop of stable supply and demand and cost support. There is a risk of rapid price increases if policies in the Democratic Republic of the Congo further affect raw material supply. Conversely, if high prices continue to suppress demand, a phased pullback cannot be ruled out.

Stock up according to demand.

9)Cobalt salt/potassium chloride/potassium carbonate/calcium formate/iodide

1. Cobalt salts: Raw material costs: The price of cobalt sulfate rose slightly on Monday and the market center shifted upward. Raw material costs on the supply side are strongly supported, and smelters are resolute in holding prices: Quotations for MHP and recycled materials were raised to 90,000-91,000 yuan per ton, while those for intermediate products remained around 95,000 yuan. The current price divergence between upstream and downstream still exists, but buyers’ acceptance of the current price is gradually increasing. When downstream completes phase digestion and initiates a new round of centralized purchasing, cobalt salt quotations are expected to rise again.

2. Potassium chloride: Overall stability, local fluctuations: Recently, the potassium chloride market has been mainly stabilizing and consolidating. There are signs of a rebound in the prices of some products that have declined significantly earlier, but there are still certain difficulties in implementing high prices. In the long term, the possibility of a significant price increase is low

3. Calcium formate prices were stable this week. Calcium formate prices are expected to rise in the short term as raw formic acid plants are shut down for maintenance in December until the end of the month due to raw material shortages.

4 Iodide prices were stable this week compared with last week.

Post time: Dec-12-2025