Trace Elements Market Analysis

I,Analysis of non-ferrous metals

Week-on-week: Month-on-month:

| Units | Week 1 of January | Week 2 of January | Week-on-week changes | December average price | The average price up to 9 days in January | Month-on-month changes | Current price on January 14 | |

| Shanghai Metals Market # Zinc ingots | Yuan/ton |

23283 |

24092 |

↑809 |

23070 |

24092 |

↑1022 |

24570 |

| Shanghai Metals Network # Electrolytic copper | Yuan/ton |

99060 |

102002 |

↑2942 |

93236 |

102002 |

↑8766 |

103915 |

| Shanghai Metals Australia

Mn46% manganese ore |

Yuan/ton |

41.85 |

41.85 |

- |

41.58 |

41.97 |

↑0.39 |

41.85 |

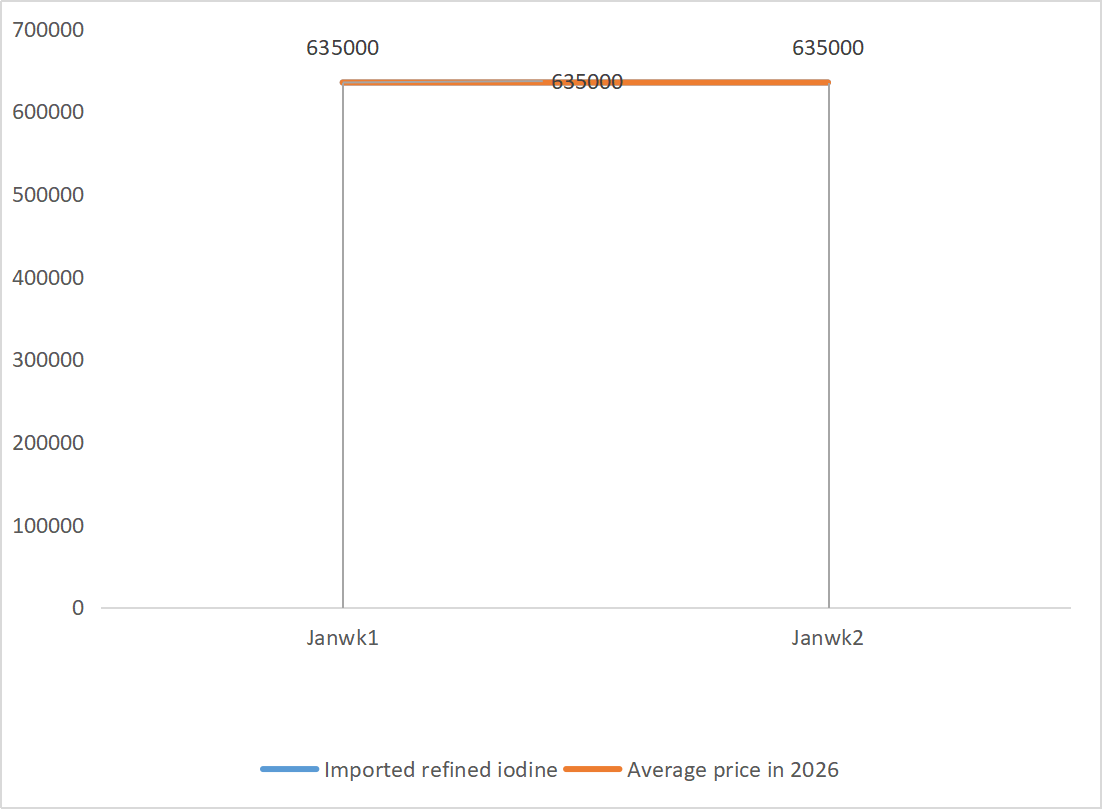

| The price of imported refined iodine by Business Society | Yuan/ton |

635000 |

635000 |

- |

635000 |

635000 |

- |

635000 |

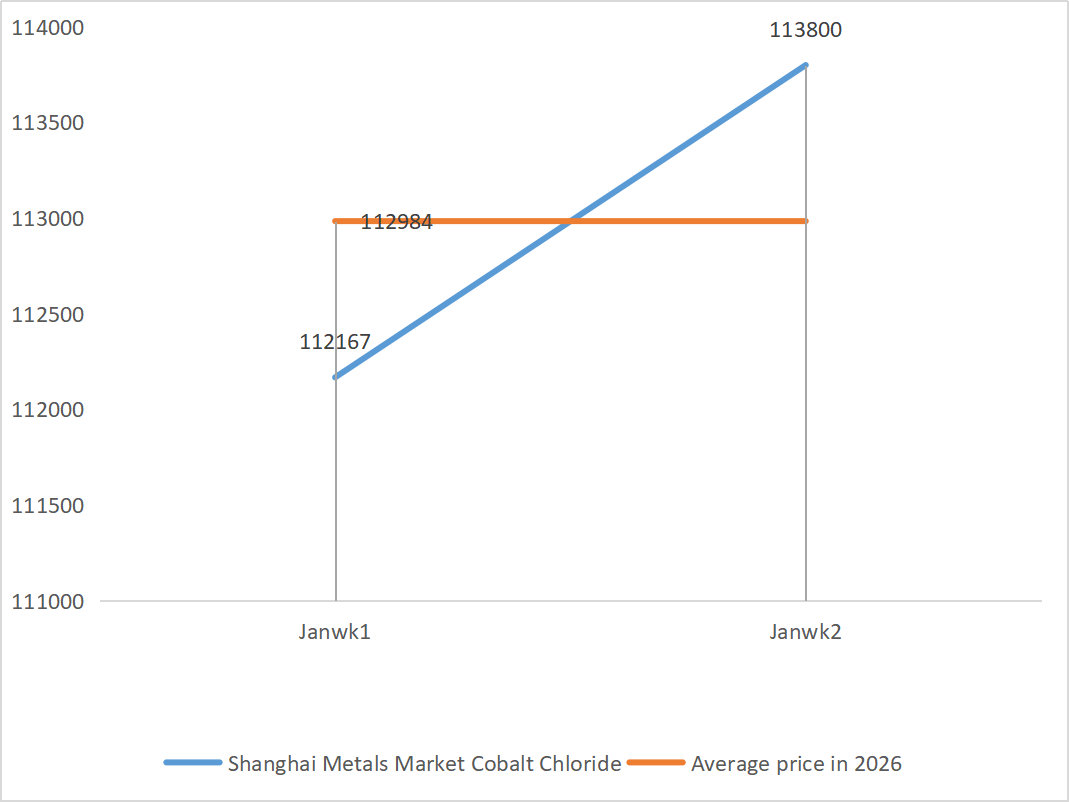

| Shanghai Metals Market Cobalt Chloride

(co≥24.2%) |

Yuan/ton |

112167 |

113800 |

↑1633 |

109135 |

113800 |

↑4665 |

115250 |

| Shanghai Metals Market Selenium Dioxide | Yuan/kilogram |

117.5 |

112.5 |

↓5 |

112.9 |

112.9 |

↓0.4 |

127.5 |

| Capacity utilization rate of titanium dioxide manufacturers | % |

76.67 |

77.85 |

↑1.18 |

74.69 |

77.85 |

↑3.16 |

|

1)Zinc sulfate

① Raw materials: Zinc hypooxide: The supply shortage situation has eased somewhat, but manufacturers’ quotations remain relatively firm, and the cost side of enterprises continues to be under pressure.

Zinc network price background: There is a lack of favorable macro support for the time being. The latest U.S. unemployment rate for December was 4.4%, lower than market expectations of 4.5%, further reducing the likelihood of the Fed cutting rates in January.

In terms of fundamentals, smelter profits have been restored as prices of by-products such as sulfuric acid and minor metals remain high, and zinc smelting output is expected to increase to 569,400 tons in January. At the same time, the window for zinc ingot exports has closed, while downstream consumption remains weak. Both macroeconomics and fundamentals have struggled to provide effective support for zinc prices. The average price of zinc is expected to fall back to around 23,800 yuan per ton next week.

② Sulfuric acid: Market prices are stable this week.

This week, the supply side continued the upward trend: the factory operating rate reached 79%, up 5 percentage points from the previous week; Capacity utilization reached 69%, up 4 percentage points from the previous week. The demand side remains strong, with major manufacturers’ orders scheduled until early February. Backed by high costs of core raw materials and abundant pending orders, the current market price of zinc sulfate remains firm. To avoid tight delivery before the Spring Festival, customers are advised to purchase and stock up in advance at an appropriate time.

2)Manganese sulfate

① The supply of manganese ore is tight and the price is firm

② Sulfuric acid prices remain high and stable.

This week, the operating rate of manganese sulfate producers was 71%, down 4% from the previous week; Capacity utilization was 51%, down 2% from the previous week. Major manufacturers’ orders are scheduled until the first ten days of February. Cost and demand form the core support for the current price, and the direction of sulfuric acid prices is a key variable. If the upward trend continues, it will directly push up manganese sulfate prices through cost transmission. Based on the analysis of enterprise order volume and raw material factors, manganese sulfate is expected to remain firm in the short term. Customers are advised to purchase as needed.

3)Ferrous sulfate

In terms of raw materials: As a by-product of titanium dioxide, the supply of ferrous sulfate is directly constrained by the main industry. At present, the titanium dioxide industry is facing high inventories and off-season sales, and some manufacturers have shut down as a result, leading to a simultaneous reduction in the output of its by-product ferrous sulfate. Meanwhile, stable demand from the lithium iron phosphate industry continues to divert some raw materials, further intensifying the tight supply situation of feed-grade ferrous sulfate products.

This week, manufacturers’ operating rate was 80%, up 60% from the previous week; Capacity utilization remained at 23 per cent, up 15 per cent from the previous week, but it was still low. Most of the major manufacturers have shut down, and the tight supply situation in the market persists.

Supported by the slow recovery of production capacity and tight supply of raw materials, ferrous sulfate prices are expected to remain high and firm in the medium to short term. Buy and stock up at the right time based on your own inventory situation.

4)Copper sulfate/basic copper chloride

Boosted by the continued decline in LME copper inventories and the soaring Japanese copper premium to a new high, the surge in copper prices driven by artificial intelligence and the energy transition, global mining bets heating up the market, the inventory data of the Shanghai Futures Exchange shows that inventories continue to accumulate and increase, reflecting the weak reality problem in the domestic market. The industry is currently in the off-season, and demand has dropped before the traditional Spring Festival, but dominated by macro positive factors, copper prices have responded limited to this. Overall, the improvement in macro expectations, the reshaping of supply and demand patterns, and changes in industry demand will continue to support the strong performance of non-ferrous metal prices.

In terms of raw materials: Upstream manufacturers are processing more etching solutions into intermediate products such as sponge copper to accelerate capital turnover, resulting in a narrower proportion of direct raw materials flowing into copper sulfate production. This structural tension persists, keeping the raw material purchase coefficient high and providing a rigid cost support for copper sulfate prices.

Copper prices are expected to continue to fluctuate at high levels. Overall, it is expected that copper prices will fluctuate in the range of 101,000 to 103,000 yuan per ton next week.

Customers are advised to stock up at the right time when copper prices fall back to a relatively low level in light of their own inventories, and pay attention to the problem of inventory accumulation suppressing the upward trend.

5)Magnesium sulfate/magnesium oxide

In terms of raw materials: Currently, sulfuric acid in the north is stable at a high level.

Magnesium oxide and magnesium sulfate prices have risen. The impact of magnesite resource control, quota restrictions and environmental rectification has led to many enterprises producing based on sales. Light-burned magnesium oxide enterprises shut down on Friday due to capacity replacement policies and the increase in sulfuric acid prices, and the prices of magnesium sulfate and magnesium oxide rose in the short term. It is recommended to stock up appropriately.

6)Calcium iodate

In the fourth quarter, with the Fed cutting interest rates and the appreciation of the yuan, the exchange rate of the US dollar against the yuan continued to fall. As of the first ten days of January, the average exchange rate was down 2% compared with November, and the cost of imported refined iodine decreased. This week, the price of imported refined iodine dropped by 12,000-13,000 yuan per ton compared with last week. Despite the decline in raw material costs, the price of calcium iodate is expected to remain stable in the short term, supported by peak season demand and orders.

7)Sodium selenite

In terms of raw materials: The prices of non-ferrous metals continue to rise. The overall market for crude selenium and selenium dioxide is shrinking in volume but stable in price. Pre-holiday stockpiling is cautious. The support from high-end demand is stronger than that in traditional fields. Capital speculation leads to a shortage of raw materials due to the upstream non-shipment of crude selenium and selenium dioxide. The inventory of manufacturers is low and the price is raised. Buy on demand.

8)Cobalt chloride

The price center of cobalt sulfate in the city continued to rise, but the overall transaction volume was slightly sluggish. On the supply side, smelters are short of raw materials and quotations continue to rise. The trading atmosphere in the cobalt chloride market is more active than before the holiday. Leading companies’ continued purchases may provide further upward momentum for cobalt chloride prices. Keep an eye on market changes and stock up appropriately.

9)Cobalt salts/potassium chloride/potassium carbonate/calcium formate/iodide

- Cobalt salts: The cobalt salts market has remained firm overall, supported by tight raw material supply, rising costs and strong downstream demand. In the short term, price fluctuations will be limited due to the year-end liquidity and demand rhythm, but in the medium to long term, with the growth of new energy demand and the continuation of supply constraints, cobalt salt prices still have upside potential.

2. Potassium chloride: Potassium prices are firm, but demand is not strong and there are few transactions. The import volume is large and the stock at the port has not increased significantly recently. The recent price firmness is related to the inspection of state reserves. The goods may be released after New Year’s Day. Purchase according to demand in the near future.

3. The stalemate in supply and demand in the formic acid market remains unchanged, and there is significant pressure to digest inventory. Downstream demand is unlikely to show substantial improvement in the short term. In the short term, prices will still be mainly fluctuating and weak, and the demand for calcium formate is average. It is recommended to pay attention to the formic acid market and purchase as needed

4. Iodide prices remained stable this week compared to last week.

Post time: Jan-14-2026