Trace Elements Market Analysis

I,Analysis of non-ferrous metals

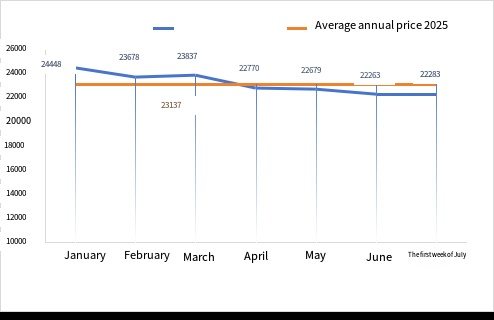

| Units | Week 4 of June | Week 1 of July | Week-on-week changes | Average price in June | The average price for July up to the 5th day | Month-on-month changes | |

| Shanghai Metals Market # Zinc Ingots | Yuan/ton |

22156 |

22283 |

↑127 |

22679 |

22283 |

↑ 20 |

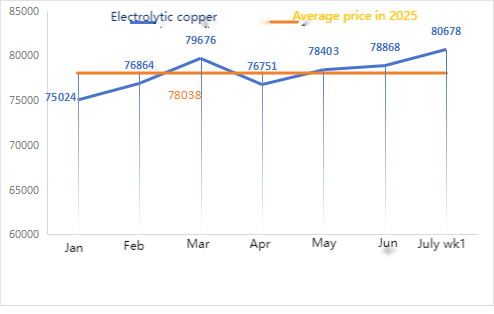

| Shanghai Metals Network # Electrolytic copper | Yuan/ton |

78877 |

80678 |

↑1801 |

78868 |

80678 |

↑ 1810 |

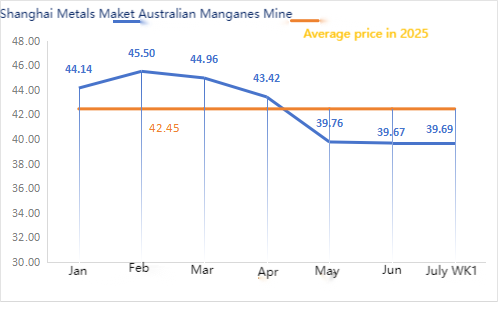

| Shanghai Youse Network Australia Mn46% manganese ore |

Yuan/ton |

39.5 |

39.69 |

↓0.08 |

39.67 |

39.69 |

↓ 0.02 |

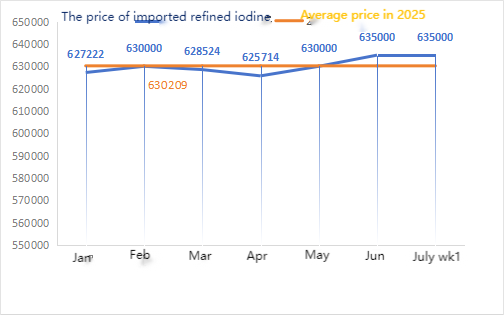

| Business Society imported refined iodine prices | Yuan/ton |

635000 |

635000 |

635000 |

635000 |

||

| Shanghai Metals Market cobalt chloride(co≥24.2%) | Yuan/ton |

60185 |

61494 |

↑ 1309 |

59325 |

61494 |

↑ 2169 |

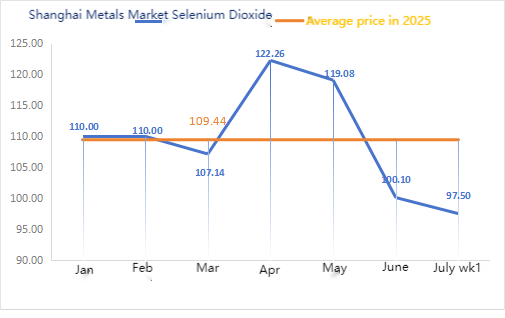

| Shanghai Metals Market Selenium Dioxide | Yuan/kilogram |

94 |

97.5 |

↑3.5 |

100.10 |

97.50 |

↓2.6 |

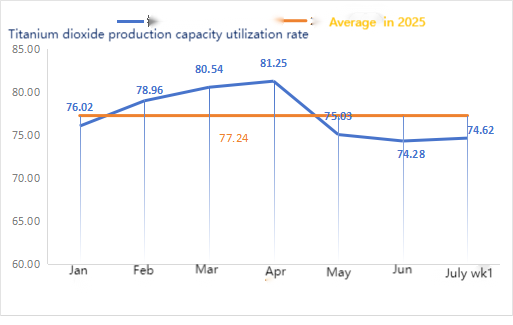

| Capacity utilization rate of titanium dioxide manufacturers | % |

73.69 |

74.62 |

↑ 0.93 |

74.28 |

74.62 |

↓ 1.34 |

Weekly change: Month-on-month change:

Raw materials:

① Zinc hypooxide: The operating rate of zinc hypooxide manufacturers dropped to the lowest level after the New Year, and the transaction coefficient remained at the highest level in nearly three months, indicating that the price of this raw material is temporarily stable. ② Sulfuric acid prices vary by region this week. Sulfuric acid prices rose in the northern part of the country, while they remained stable in the southern part. Soda ash prices continued to decline this week. ③ Zinc prices are expected to remain high and volatile in the short term.

On Monday, the operating rate of water zinc sulfate plants was 100%, up 6% from the previous week, and the capacity utilization rate was 78%, up 2% from the previous week. Some factories completed maintenance, which led to some recovery in the data. Quotations remain stable. The upstream and downstream purchasing enthusiasm is not high and the demand is not large. Given normal operating rates and low demand, the price of zinc sulfate is expected to remain weak in the short term. It is predicted that the price will reach a low point in mid to late July, followed by a rebound in August. It is recommended that customers purchase as needed.

In terms of raw materials: ① Prices remained stable and firm, with some mineral types still showing signs of rising. This was mainly driven by macro news, which pushed up downstream silicon manganese futures prices, boosting market confidence and sentiment. However, there were few actual high-price transactions, and downstream factories’ purchases were mostly cautious and based on demand. ② Sulfuric acid prices varied from region to region this week. Sulfuric acid prices rose in the northern regions of the country, while they remained stable in the southern regions. Overall, it remained stable.

This week, the operating rate of manganese sulfate sample factories was 73% and the capacity utilization rate was 66%, remaining flat compared with the previous week. Orders for major factories have risen, and against the backdrop of firm raw material costs, there is a strong desire for factories to raise prices. Some major factories have now increased their prices. Customers are advised to prepare their stock plans 20 days in advance based on production conditions.

In terms of raw materials: Downstream demand for titanium dioxide remains sluggish. Some manufacturers have accumulated titanium dioxide inventories, resulting in persistently low operating rates. The tight supply situation of ferrous sulfate in Qishui continues.

This week, the operating rate of ferrous sulfate manufacturers was 75%, and the capacity utilization rate was 39%, with no change compared to the previous week. This week, major manufacturers are not quoting prices but are willing to sell at high prices, while other manufacturers’ quotations remain at the highest level in nearly two months. At present, the domestic operating rate of ferrous sulfate is low, enterprises have very little spot inventory, titanium dioxide factories have too much inventory accumulation leading to overstocking, causing factories to cut production and suspend operations. Producers have scheduled orders until mid to late August, and the tight supply situation of ferrous sulfate heptahydrate has not improved. Coupled with the recent high price of ferrous sulfate heptahydrate, supported by raw material costs and relatively abundant orders, it is expected that the price shortage of ferrous sulfate monohydrate will continue to rise in the later period. Customers are advised to purchase and stock up at the right time based on inventory.

4)Copper sulfate/basic cuprous chloride

Raw materials: On the macro side, U.S. ADP employment was 95,000 less than expected, and the weak labor market still showed no improvement. Traders increased their bets that the Federal Reserve would cut interest rates at least twice before the end of this year, which was bullish for copper prices.

In terms of fundamentals, from the supply side, intraday Stockholders have a strong willingness to sell, and there are behaviors of buying at low prices in the market, forming a regional tight supply pattern. From the demand side, copper prices are in a high range, suppressing downstream demand, and overall downstream purchasing sentiment is low.

In terms of etching solution: Some upstream raw material manufacturers are engaged in deep processing of etching solution, further intensifying the shortage of raw materials. The transaction coefficient remains at a high level

Copper sulfate/basic copper chloride producers were operating at 100% this week, unchanged from the previous week; Capacity utilization was 38%, down 2% from the previous week, with producers operating normally recently.

Copper sulfate/basic copper chloride prices remain at the highest level in nearly two months. It is not ruled out that prices will rise further. Based on the recent stable trend of raw materials and the operation of manufacturers, copper sulfate will remain at a high level in the short term. Customers are advised to pay attention to inventory and purchase at the right time.

In terms of raw materials: Currently, the price of sulfuric acid in the north is 970 yuan per ton, and it is expected to exceed 1,000 yuan per ton in July. The price is valid in the short term.

Magnesium sulfate plants are operating at 100% and production and delivery are normal. 1) As the military parade is approaching, based on past experience, all hazardous chemicals, precursor chemicals and explosive chemicals involved in the north will increase in price at that time. 2) As summer approaches, most sulfuric acid plants will shut down for maintenance, which will drive up the price of sulfuric acid. It is predicted that the price of magnesium sulfate will not fall before September. The price of magnesium sulfate is expected to remain stable for a short period of time. Also, in August, pay attention to logistics in the north (Hebei/Tianjin, etc.). Logistics are subject to control due to the military parade. Vehicles need to be found in advance for shipment.

Raw materials: The domestic iodine market is stable at present, the supply of imported refined iodine from Chile is stable, and the production of iodide manufacturers is stable.

This week, the production rate of calcium iodate sample manufacturers was 100%, the capacity utilization rate was 36%, the same as the previous week, and the quotations of mainstream manufacturers remained unchanged. Customers are advised to make purchases based on production and inventory requirements

Raw materials: The price of crude selenium has dropped significantly due to collective suppression by supply chain enterprises; After the market adjusted itself and manufacturers began to replenish raw material inventories, crude selenium demand rebounded, pushing crude selenium prices slightly back. Sodium selenite raw material prices remained weak this week.

This week, sample manufacturers of sodium selenite were operating at 100%, with capacity utilization at 36%, remaining flat compared to the previous week. Quotations from mainstream manufacturers declined slightly by 3 to 5 percent compared to last week. Due to the decline in raw material prices and the sluggishness in demand, sodium selenite prices are showing a weak trend. Customers are advised to purchase according to their own inventory.

Raw materials: On the supply side, smelters remain in a wait-and-see mood, with fewer market transactions; On the demand side, downstream enterprises have relatively abundant inventory levels and the market is actively inquiring about prices, but transactions remain cautious.

This week, the cobalt chloride sample factories were operating at 100%, and the capacity utilization rate was 44%, remaining flat compared with the previous week. The prices of major manufacturers rose slightly this week as market information spread that the export ban in the Democratic Republic of the Congo was extended for three months. It is not ruled out that there will be further increases later. Customers are advised to stock up at the right time based on their inventory.

9)Cobalt salts/potassium chloride/calcium formate

The price of upstream battery-grade cobalt salts has been suspended. The ban on exports from the Democratic Republic of the Congo has been extended for three months. Cobalt prices may continue to rise, with quotations rising this week compared to last week.

2 Potassium chloride prices have risen compared to last week. Canadian potassium is out of stock at the port and may be replaced with Russian white powder potassium later. The increase in potassium chloride prices is ongoing and may continue to rise in the future. It is recommended to purchase appropriate stock according to demand.

3. Formic acid prices continue to fall, exports are restricted and demand is not met. This week, quotations for calcium formate have decreased compared to the previous two weeks, and prices are at a relatively low level.

Media Contact:

Media Contact:

Elaine Xu

SUSTAR Group

Email: elaine@sustarfeed.com

Mobile/WhatsApp: +86 18880477902

Post time: Jul-09-2025