Trace Elements Market Analysis

I,Analysis of non-ferrous metals

Week-on-week: Month-on-month:

| Units | Week 5 of October | Week 1 of November | Week-on-week changes | October average price | As of November 7

Average price |

Month-on-month change | Current price as of November 11 | |

| Shanghai Metals Market # Zinc ingots | Yuan/ton |

22190 |

22444 |

↑254 |

22044 |

22444 |

↑400 |

22660 |

| Shanghai Metals Market # Electrolytic Copper | Yuan/ton |

87904 |

86155 |

↓1749 |

86258 |

86155 |

↓103 |

86715 |

| Shanghai Metals Australia

Mn46% manganese ore |

Yuan/ton |

40.45 |

40.45 |

- |

40.49 |

40.45 |

↓0.04 |

40.55 |

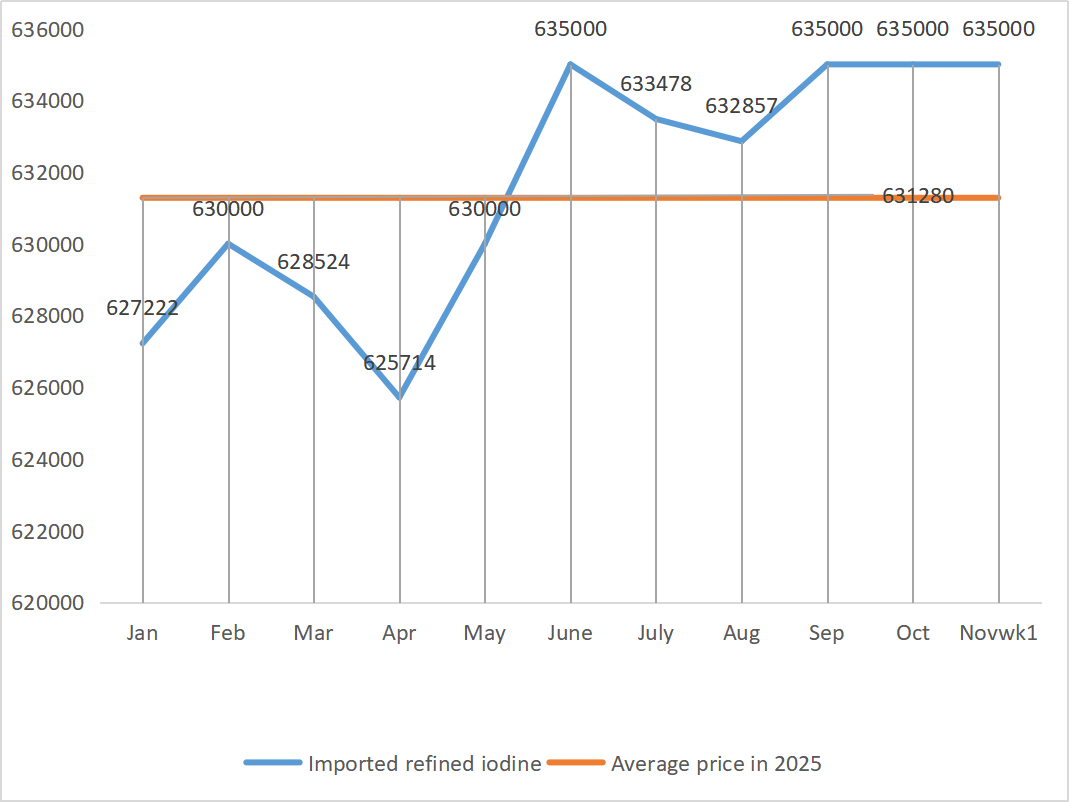

| The price of imported refined iodine by Business Society | Yuan/ton |

635000 |

635000 |

- |

635000 |

635000 |

|

635000 |

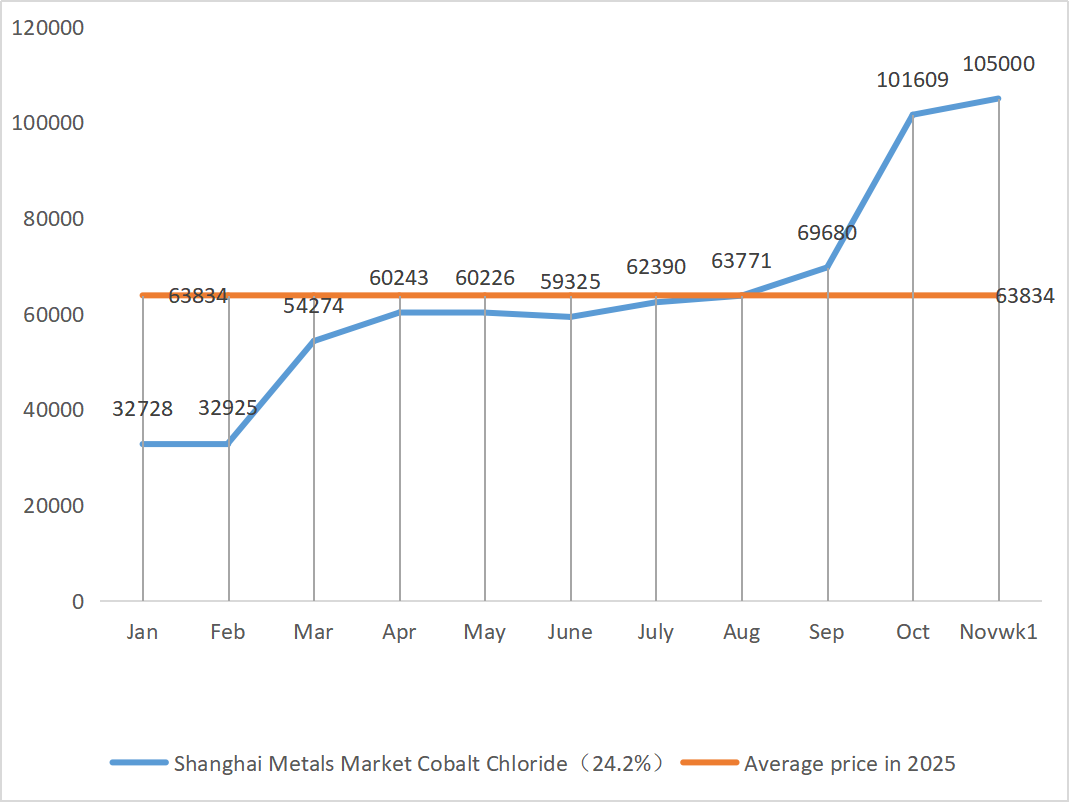

| Shanghai Metals Market Cobalt Chloride

(co≥24.2%) |

Yuan/ton |

105000 |

105000 |

- |

101609 |

105000 |

↑3391 |

105000 |

| Shanghai Metals Market Selenium Dioxide | Yuan/kilogram |

109 |

110 |

↑1 |

106.91 |

110 |

↑3.09 |

115 |

| Capacity utilization rate of titanium dioxide manufacturers | % |

77.13 |

77.02 |

↓0.11 |

77.68 |

77.02 |

↓0.66 |

1)Zinc sulfate

① Raw materials: Zinc hypooxide: The transaction coefficient keeps hitting new highs for the year.

Base zinc price: In terms of zinc prices, on a macro level, U.S. economic data eased recession concerns, expectations of Fed rate cuts rose, and a stronger dollar suppressed the performance of non-ferrous metals; Fundamentals: Low LME inventories combined with tight domestic supply support zinc prices. The operating space is 22,000-22,600 yuan per ton.

② Sulfuric acid prices remain high and stable across the country. Soda ash: Prices were stable this week.

On Monday, the operating rate of water zinc sulfate producers was 63%, down 16% from the previous week, and the capacity utilization rate was 66%, down 1% from the previous week. Major manufacturers’ orders are scheduled until early December. On the supply side: Affected by weak export demand, manufacturers’ inventories continue to rise. Under the pressure of high inventory and high costs, some manufacturers have chosen to suspend production, and given that raw material costs remain high, which supports prices, it is expected that prices will remain stable in the later period.

2)Manganese sulfate

In terms of raw materials: ① Manganese ore prices are stable with a slight and strong fluctuation, but downstream alloy prices are weakening and falling again, and the situation of supply and demand stalemate and game in the industrial chain remains unchanged.

② Sulfuric acid remained stable at a high level this week.

This week, the operating rate of manganese sulfate producers was 85% and the capacity utilization rate was 58%, remaining flat compared with the previous week. Major manufacturers are scheduled until late November. Manganese sulfate quotations were firm this week, mainly due to the continuous increase in the price of raw material sulfuric acid, which led to a slight increase in costs. Based on the analysis of enterprise order volume and raw material factors, manganese sulfate is expected to remain firm in the short term. Customers are advised to increase inventory appropriately.

3)Ferrous sulfate

In terms of raw materials: Demand for titanium dioxide remains sluggish, and the operating rate of titanium dioxide manufacturers is low. Ferrous sulfate heptahydrate is a product in the titanium dioxide production process. The current situation of manufacturers directly affects the market supply of ferrous sulfate heptahydrate. Lithium iron phosphate has a stable demand for ferrous sulfate heptahydrate, further reducing the supply of ferrous sulfate heptahydrate to the ferrous industry.

This week, the operating rate of ferrous sulfate manufacturers was 75%, and the capacity utilization rate was 24%, remaining unchanged compared to the previous week. The overall supply and demand relationship in the market remained stable this week, and the quotations of ferrous sulfate manufacturers remained stable. The supply structure is tight, but inventory pressure has emerged at some manufacturers, and there is a possibility that prices will decline in the future. It is suggested that the demand side purchase according to its own production situation and avoid buying at high prices.

4)Copper sulfate/basic copper chloride

Raw materials: Codelco, the state-owned copper company of Chile, saw its output fall 7 percent in September, which also provided support for copper prices, according to data from the Chilean Copper Industry commission (Cochilco). Output from the Glencore and Anglo American joint mine fell 26 percent, while output from BHP’s Escondida mine rose 17 percent. The prospect of a supply shortage for next year has supported copper prices, and supply disruptions at several mines are expected to affect copper concentrate production.

On a macro level, a weaker dollar index has been a key factor driving the copper price rebound. While U.S. stocks were mixed, easing tariff concerns lifted the outlook for metal demand, while the specter of the U.S. government shutdown persisted and the Fed’s generally hawkish stance on interest rate cuts at the end of the year further intensified market concerns over the current U.S. economy, and risk aversion persisted. China’s October CPI and PPI data were positive, boosting consumer confidence. Fundamentals: Indonesia’s mine reopening may increase supply, China’s copper imports declined in October, but the decline in Shanghai copper social reserves provided support. Although there are bearish signals in the short term, the macroeconomic outlook is positive and the fundamentals are solid. Copper prices are still expected to fluctuate at a high level in the short term. Copper price range this week: 86,000-86,920 yuan per ton.

Etching solution: Some upstream raw material manufacturers have accelerated capital turnover by deep processing etching solution into sponge copper or copper hydroxide. The proportion of sales to the copper sulfate industry has decreased, and the transaction coefficient has reached a new high.

Customers are advised to stock up at the right time when copper prices fall back to a relatively low level in light of their own inventories.

5)Magnesium sulfate/magnesium oxide

In terms of raw materials: Currently, sulfuric acid in the north is stable at a high level.

Due to the control of magnesite resources, quota restrictions and environmental rectification, many enterprises are producing based on sales. In September and October, many enterprises with an annual output of less than 100,000 tons were forced to suspend production for transformation due to the capacity replacement policy. There are no concentrated resumption actions in early November, and short-term productivity is unlikely to increase significantly. The price of sulfuric acid has risen, and the prices of magnesium sulfate and magnesium oxide are likely to increase slightly in the short term. It is recommended to stock up appropriately.

6)Calcium iodate

Raw materials: The domestic iodine market is stable at present, the supply of imported refined iodine from Chile is stable, and the production of iodide manufacturers is stable.

The price of refined iodine rose slightly in the fourth quarter, the supply of calcium iodate was tight, and some iodide manufacturers halted or limited production. It is expected that the general tone of a steady and slight increase in iodide prices will remain unchanged. It is recommended to stock up appropriately.

7)Sodium selenite

In terms of raw materials: The price of diselenium rose and then stabilized. Market insiders said that the selenium market price was stable with an upward trend, the trading activity was average, and the price was expected to remain strong in the later period. Sodium selenite producers say demand is weak, costs are rising, orders are increasing, and quotations are stable this week. Prices are expected to strengthen in the short term.

8)Cobalt chloride

This week, cobalt chloride producers were operating at 100%, with capacity utilization at 44%, remaining flat compared to the previous week. Manufacturers’ quotations remained stable this week, with major manufacturers scheduling orders until mid to late November. The tight supply situation in the market has eased slightly as upstream suppliers and traders have been stocking up recently. After prices stabilized, the pace of downstream purchasing slowed and the wait-and-see sentiment grew stronger. Despite the current high prices, the acceptance of downstream purchases remains at a relatively high level, reflecting that the current prices have some fundamental support. Due to the firm operation of raw materials, the cost support of cobalt chloride raw materials is strengthened, and it is expected that the price will remain stable at a high level in the later period.

9)Cobalt salts/potassium chloride/potassium carbonate/calcium formate/iodide

1. Cobalt salts: Raw material costs: The approval for the export of cobalt intermediates from the Democratic Republic of the Congo remains unapproved. The tight supply and demand situation in the cobalt market has not fundamentally changed in the short term, and there are no substantial negative factors at present. The sharp price fluctuations this week may be affected by capital behavior.

2. Potassium chloride: At present, the inventory of potassium chloride at northern ports is acceptable, with both new and old sources coexisting, increasing merchants’ awareness of selling and liquidating. However, supported by the guidance prices of major traders, the market as a whole is stabilizing and consolidating.

3 The price of calcium formate continued to decline this week. Raw formic acid plants resume production and now increase factory production of formic acid, leading to an increase in formic acid capacity and an oversupply. In the long term, calcium formate prices are falling.

4 Iodide prices were stable this week compared to last week.

Post time: Nov-12-2025