Trace Elements Market Analysis

I,Analysis of non-ferrous metals

Week-on-week: Month-on-month:

| Units | Week 5 of September | Week 2 of October | Week-on-week changes | September average price | As of October 10

Average price |

Month-on-month change | Current price on October 14 | |

| Shanghai Metals Market # Zinc ingots | Yuan/ton |

21660 |

22150 |

↑490 |

21969 |

22000 |

↑210 |

22210 |

| Shanghai Metals Market # Electrolytic Copper | Yuan/ton |

82725 |

86210 |

↑3485 |

80664 |

80458 |

↓206 |

85990 |

| Shanghai Metals Australia

Mn46% manganese ore |

Yuan/ton |

40.35 |

40.35 |

|

40.32 |

40.35 |

|

40.35 |

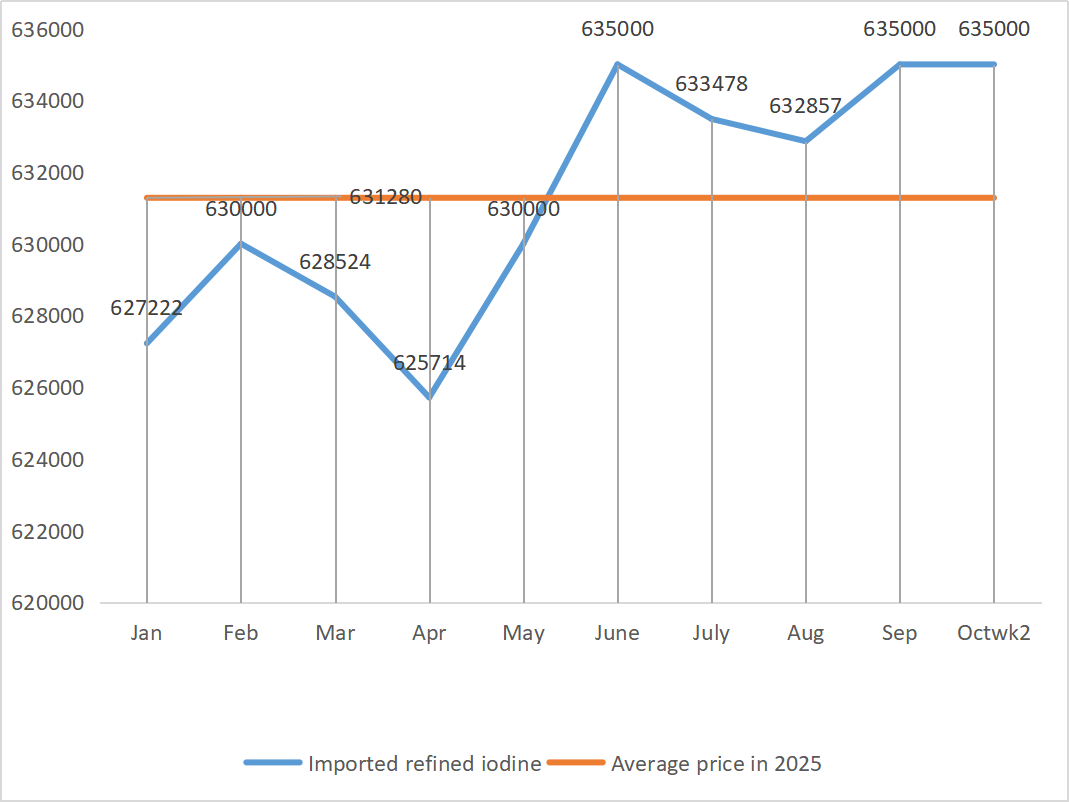

| Business Society imported refined iodine price | Yuan/ton |

635000 |

635000 |

635000 |

635000 |

|

635000 |

|

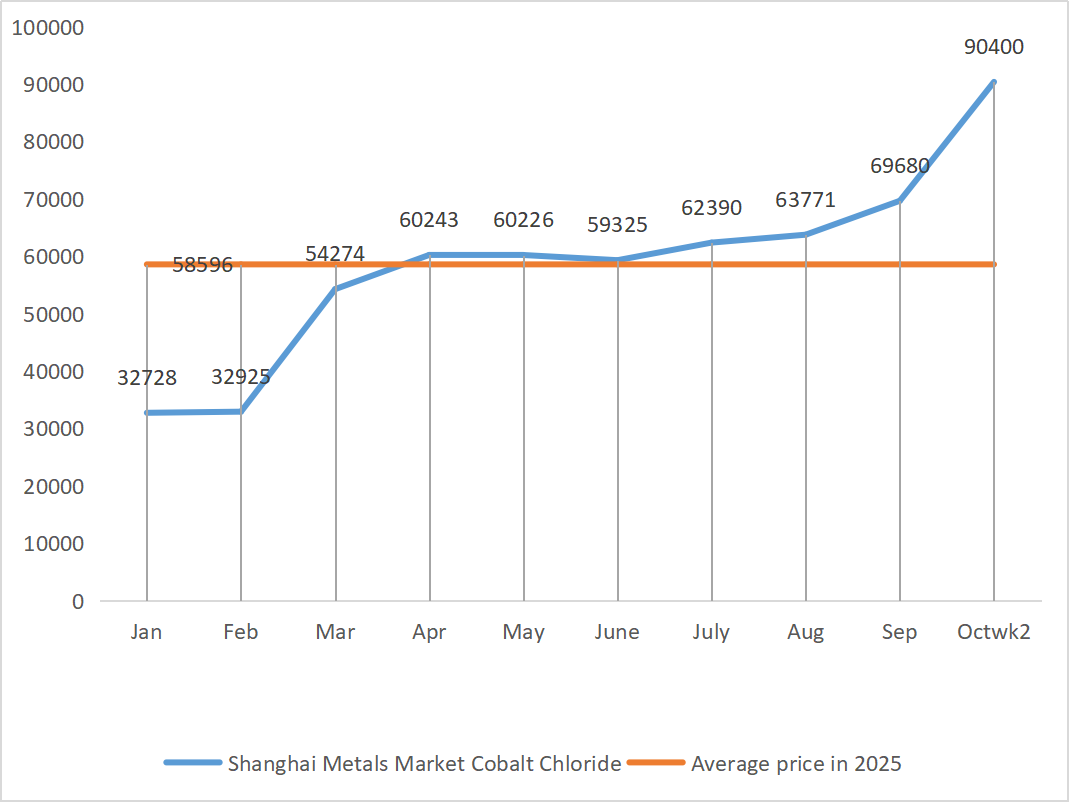

| Shanghai Metals Market Cobalt Chloride

(co≥24.2%) |

Yuan/ton |

80800 |

90400 |

↑9600 |

69680 |

68568 |

↓1112 |

97250 |

| Shanghai Metals Market Selenium Dioxide | Yuan/kilogram |

105 |

105 |

|

103.64 |

103.5 |

↓0.14 |

105 |

| Capacity utilization rate of titanium dioxide manufacturers | % |

77.35 |

78.28 |

↑0.93 |

76.82 |

76.82 |

|

1)Zinc sulfate

① Raw materials: Zinc hypooxide: After the maintenance of smelters in September, recovery is expected in October. Against the backdrop of strong supply and weak demand, zinc prices are under pressure above. However, due to strengthened expectations of Fed rate cuts, zinc prices are expected to rise slightly in the short term, raising the purchase cost of secondary zinc oxide.

② Sulfuric acid rose mainly in the southern region, while it remained stable in the northern region. Soda ash: Prices remained stable this week. Zinc prices are expected to operate in the range of 22,000 to 22,350 yuan per ton.

On Monday, the operating rate of water zinc sulfate producers was 78%, down 11% from the previous week, and the capacity utilization rate was 69%, slightly down 1% from the previous week. Major manufacturers have placed orders until late October. Zinc sulfate enterprises have normal upstream operating rates, but the order intake is significantly insufficient. In the context of firm raw material costs and the recovery of domestic demand in various industries, manufacturers maintain order scheduling and shipment; However, some manufacturers have a backlog of inventory, leaving a small room for negotiation and not ruling out the possibility of a slight price drop. Zinc sulfate is expected to remain stable around the weak in the short term. Customers are advised to shorten the inventory cycle.

2)Manganese sulfate

In terms of raw materials: ① The current spot price of manganese ore remains firm

② The price of sulfuric acid rose mainly in the southern region this week, while it remained stable in the northern region. It is expected that the price in the northern region will rise later due to the transmission of price increase sentiment in the southern region.

This week, the operating rate of manganese sulfate producers was 95% and the capacity utilization rate was 56%, remaining flat compared with the previous week. Major manufacturers’ orders are scheduled until early November. The operating rate of mainstream upstream enterprises is normal, prices are high and firm, manufacturers hover around the production cost line, prices are expected to remain stable. Based on the analysis of enterprise order volume and raw material factors, manganese sulfate is expected to remain firm in the short term. Customers are advised to increase inventory appropriately.

3)Ferrous sulfate

In terms of raw materials: Demand for titanium dioxide has improved slightly compared to the previous period, but overall demand remains sluggish. The operating rate of titanium dioxide manufacturers is low at 78.28%, and ferrous sulfate heptahydrate is a product in the production process of titanium dioxide. The current situation of manufacturers directly affects the market supply of ferrous sulfate heptahydrate. Lithium iron phosphate has a stable demand for ferrous sulfate heptahydrate, further reducing the supply of ferrous sulfate heptahydrate to the ferrous industry.

This week, the operating rate of ferrous sulfate producers is 75%, the capacity utilization rate is 24%, flat compared with the previous week. Producers have scheduled orders until November. Mainstream manufacturers have reduced production by 70%, and quotations remain stable at high levels this week. Although raw material heptahydrate is still in short supply, some manufacturers have overstocked finished ferrous sulfate, and it is not ruled out that prices will drop slightly in the short term. It is suggested that the demand side make purchasing plans in advance in light of inventory.

4)Copper sulfate/basic copper chloride

In terms of raw materials: The world’s second-largest copper mine, the Grasberg copper mine in Indonesia, has declared force majeure due to a mudslide accident and is expected to cut production by about 470,000 tons from the fourth quarter of 2025 to 2026. Copper mines in Chile and other places have also cut production, intensifying supply tightness. Copper prices have soared due to the impact of macro information. This drove up copper sulfate prices this week compared with pre-holiday prices

On the macro level, expectations of global monetary easing and optimistic domestic policy sentiment continue to support market risk appetite, providing bottom support for copper prices. On the other hand, bearish factors such as Trump’s tariff escalation remarks, weak demand after the National Day holiday, and the accumulation of social reserves have kept short sellers on the lookout. Overall, the season is still in full swing, with downstream operating rates showing a moderate recovery, but soaring prices are suppressing consumption. Despite tight supply, prices hitting record highs will trigger a wait-and-see attitude towards buying. In the short term, Trump’s remarks on tariff escalation have disrupted market sentiment. After the National Day holiday, demand is not strong, and the accumulation of Shanghai copper social reserves is significant. Copper futures are under pressure and volatile. But expectations of global monetary easing and optimism about domestic policy continue to boost market risk appetite. In the short term, copper prices will still be affected by a combination of factors such as trade war sentiment, supply and demand games, and inventory changes, showing a wide range of fluctuations. Copper price range for the week: 86,000-86,980 yuan per ton.

Etching solution: Some upstream raw material manufacturers have accelerated capital turnover by deep processing etching solution into sponge copper or copper hydroxide. The proportion of sales to the copper sulfate industry has decreased, and the transaction coefficient has reached a new high.

This week, the copper sulfate producers’ operating rate was 100% and the capacity utilization rate was 45%, remaining flat compared with the previous week. With a stable supply, manufacturers are cautious about taking orders due to concerns that copper prices will continue to rise in the future. On the demand side: As copper prices soared, the demand side was concerned that prices would continue to rise, and the situation of replenishing orders improved significantly. Customers are advised to stock up at an opportune time when the copper grid price drops in light of their own inventory.

5)Magnesium oxide

Raw materials: The raw material magnesite is stable.

Magnesium oxide prices were stable this week after last week, factories were operating normally and production was normal. The delivery time is generally around 3 to 7 days. The government has shut down backward production capacity. Kilns cannot be used to produce magnesium oxide, and the cost of using fuel coal increases in winter. The magnesia sand market is mainly stable, with downstream consumption of inventory as the main factor. It is expected that demand will gradually recover later, providing support for market prices. Customers are advised to purchase according to demand.

6)Magnesium sulfate

Raw materials: Currently, the price of sulfuric acid in the north is stable.

At present, the operating rate of magnesium sulfate plants is 100%, and production and delivery are normal. The price of sulfuric acid is stable at a high level. Coupled with the increase in the price of magnesium oxide, the possibility of further increase cannot be ruled out. Customers are advised to purchase according to their production plans and inventory requirements.

7)Calcium iodate

Raw materials: The domestic iodine market is stable at present, the supply of imported refined iodine from Chile is stable, and the production of iodide manufacturers is stable.

Calcium iodate producers were operating at 100% this week, unchanged from the previous week; Capacity utilization was 34%, down 2% from the previous week; Quotations from major manufacturers remained stable. The price of refined iodine rose slightly in the fourth quarter, the supply of calcium iodate was tight, and some iodide manufacturers were shut down or limited production. It is expected that the general tone of a steady and slight increase in iodide prices will remain unchanged. It is recommended to stock up appropriately.

8)Sodium selenite

In terms of raw materials: The current market price of crude selenium has stabilized, indicating that the competition for supply in the crude selenium market has become increasingly fierce recently, and market confidence is strong. It has also contributed to the further increase in the price of selenium dioxide. Currently, the entire supply chain is optimistic about the medium and long-term market price.

This week, sample manufacturers of sodium selenite were operating at 100%, with capacity utilization at 36%, remaining flat compared to the previous week. The supply of crude selenium and disselenium has been tight due to capital speculation recently. The price of selenium bidding in the middle of the year was higher than expected, boosting confidence in the selenium market. The selenium market was weak at first and then strong last week. The demand for sodium selenite was weak, but the quotations rose slightly this week. Prices are expected to be stable in the short term. It is recommended to supplement appropriately. It is recommended that clients purchase on demand based on their own inventory.

9)Cobalt chloride

In terms of raw materials: Due to the extension of the cobalt export ban by the Democratic Republic of the Congo to a supply-demand mismatch, the price of cobalt has risen by nearly 40% this year, and the price of pure cobalt chloride powder has increased compared to before the festival.

This week, cobalt chloride producers were operating at 100%, with a capacity utilization rate of 44%, remaining flat compared to the previous week. Due to the increase in raw material prices, the cost support for cobalt chloride raw materials has strengthened, and it is expected that prices will rise further in the future. It is recommended that the demand side make purchase and stockpiling plans in advance based on inventory conditions.

10)Cobalt salts/potassium chloride/potassium carbonate/calcium formate/iodide

1. Cobalt salts: Raw material costs: Congo (DRC) export ban continues, based on the current market, domestic cobalt raw materials are expected to perform strongly in the future. Strong foreign markets combined with a bullish sentiment on the supply side, cost support is solid. But downstream acceptance is limited, gains are likely to narrow, and the overall trend will be high volatility.

- The inventory of potassium chloride at ports has rebounded, and the supply of potassium chloride is gradually improving. The autumn rain continues and overall market transactions are slightly sluggish. It is uncertain whether it will affect the winter storage market. The urea market is in a position. It is recommended to pay attention to the market of other fertilizers. It is recommended to stock up appropriately. Potassium carbonate prices were stable this week.

3. Calcium formate prices continued to decline this week. Raw formic acid plants resume production and now increase factory production of formic acid, leading to an increase in formic acid capacity and an oversupply. In the long term, calcium formate prices are falling.

4 Iodide prices were stable this week compared to last week.

Post time: Oct-16-2025