Trace Elements Market Analysis

I,Analysis of non-ferrous metals

| Units | Week 1 of July | Week 2 of July | Week-on-week changes | Average price in June | As of July 11Average price | Current price as of July 15th | Month-on-month change | |

| Shanghai Metals Market # Zinc Ingots | Yuan/ton |

22283 |

22190 |

↓ 93 |

22679 |

22283 |

22150 |

↓ 32 |

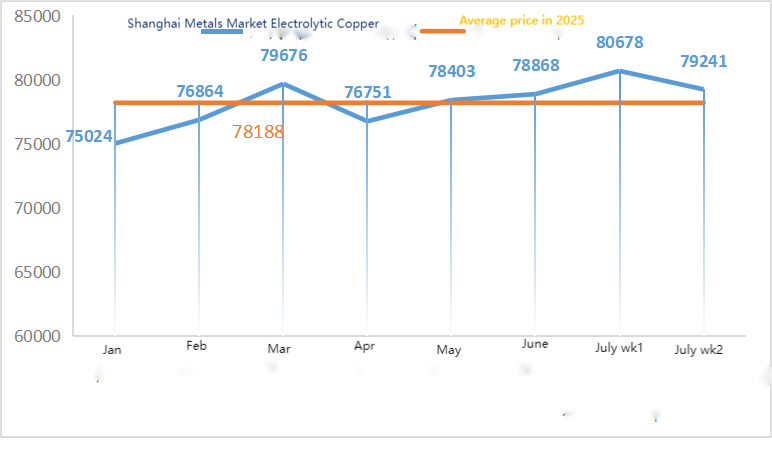

| Shanghai Metals Network # Electrolytic copper | Yuan/ton |

80678 |

79241 |

↓ 1437 |

78868 |

80678 |

78025 |

↑ 1011 |

| Shanghai Metals Network AustraliaMn46% manganese ore | Yuan/ton |

39.69 |

39.75 |

↑ 0.06 |

39.67 |

39.69 |

39.75 |

↓ 0.05 |

| Business Society imported refined iodine price | Yuan/ton |

635000 |

635000 |

635000 |

635000 |

635000 |

||

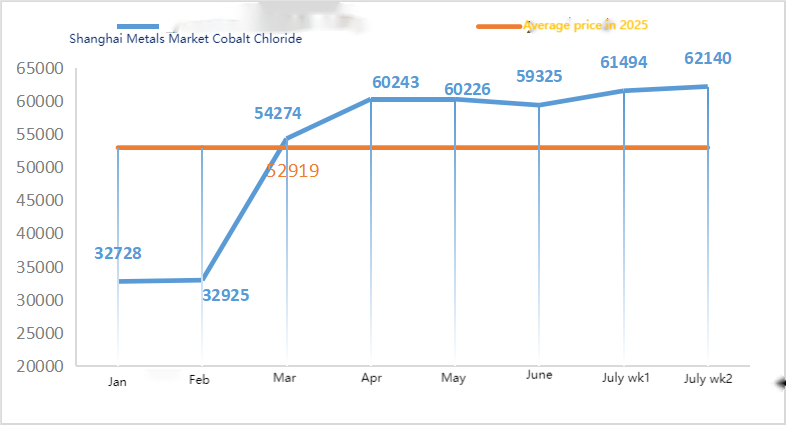

| Shanghai Metals Market Cobalt Chloride(co≥24.2%) | Yuan/ton |

61494 |

62140 |

↑ 646 |

59325 |

61494 |

62575 |

↑ 2528 |

| Shanghai Metals Market Selenium Dioxide | Yuan per kilogram |

97.5 |

95.5 |

↓ 2 |

100.10 |

97.50 |

95 |

↓ 3.71 |

| Capacity utilization rate of titanium dioxide manufacturers | % |

74.62 |

75.3 |

↑ 0.68 |

74.28 |

74.62 |

↓ 1.02 |

Raw materials:

① Zinc hypooxide: The operating rate of zinc hypooxide manufacturers dropped to the lowest level after the New Year, and the transaction coefficient remained at the highest level in nearly three months, indicating that the price of this raw material is temporarily stable. ② Sulfuric acid prices vary by region this week. Sulfuric acid prices rose in the northern part of the country, while they remained stable in the southern part. Soda ash prices remained stable this week. ③ At present, the supply of zinc ore in the market remains abundant. It is expected that the zinc net price will mainly operate weakly.

The operating range for next week is 21,300-22,000 yuan per ton.

On Monday, the operating rate of the water sulfate zinc sample factory was 89%, down 11% from the previous week. The capacity utilization rate was 70%, down 8% from the previous week. Some factories’ equipment maintenance drove the data change. Some factories are operating under production control as sales fall short of expectations, resulting in inventory. Quotations were steady this week. Major factories have seen an increase in orders, with many placing orders until late July and some until mid to early August. Some factories are expected to carry out maintenance by the end of July. At present, the price has hit a low point. Considering the decline in operating rates and demand, the price of zinc sulfate is expected to remain stable or operate weakly in the later period. It is predicted that the price of zinc sulfate will rise due to reasons such as high temperatures in August causing electricity charges, rising sulfuric acid prices and factory maintenance. It is recommended that customers purchase as needed.

In terms of raw materials: ① The imported manganese ore market is stable with a tendency to be firm. The situation of stalemate and game between supply and demand is obvious. On the one hand, the concentration of port sources has increased, supporting miners’ willingness to hold prices relatively strong; On the other hand, downstream manganese-based alloys have declined slightly again, and the situation of high quotations in the market has decreased, with factories mainly cutting prices for raw material purchases. ② Sulfuric acid prices varied from region to region this week. Sulfuric acid prices rose in the northern regions of the country, while they remained stable in the southern regions. Overall, it remained stable.

This week, the operating rate of sample manganese sulfate manufacturers was 73% and the capacity utilization rate was 66%, remaining flat compared with the previous week. Market prices hit the cost red line for manufacturers, and quotations from mainstream manufacturers bottomed out and rebounded this week. At present, major factories are scheduled until mid-August. Under the influence of the traditional off-season, demand is average. But driven by information about price hikes from manufacturers, the enthusiasm of traders to stock up has increased. Customers are advised to purchase and stock up at the right time based on production conditions.

In terms of raw materials: Downstream demand for titanium dioxide remains sluggish. Some manufacturers have accumulated titanium dioxide inventories, resulting in low operating rates. The tight supply situation of ferrous sulfate in Qishui continues.

This week, the operating rate of ferrous sulfate manufacturers was 75%, unchanged from the previous week; Capacity utilization was 24%, down 15% from the previous week. Due to the current tight supply of Qishui ferrous, some manufacturers have further reduced production, exacerbating the tight supply situation. Producers have scheduled orders until the end of August. The price of raw material ferrous heptahydrate has risen slightly. Against the backdrop of rising raw material costs and relatively abundant orders, it is expected that the price of ferrous monohydrate will remain firm in the later period. Customers are advised to purchase and stock up at the right time based on inventory.

4)Copper sulfate/basic copper chloride

Raw materials: On a macro level, Trump sent tariff letters to eight countries including Brazil (with a potential 50% tariff), and again on social media said he would impose a 50% tariff on imported copper; At the same time, the Fed’s June minutes showed that officials ruled out a rate cut in July due to differences in their views on the inflationary impact of tariffs, and policy uncertainty dampened risk appetite, collectively putting copper prices under pressure.

In terms of fundamentals, the decline in copper prices has spurred some downstream buyers to buy at low prices, and trading volumes have rebounded slightly. However, most downstream users, based on expectations of a bearish outlook for copper prices in the future, still adopt a cautious and wait-and-see overall purchasing strategy

In terms of etching solution: Some upstream raw material manufacturers are deep processing etching solution, the raw material shortage is further intensified, and the transaction coefficient remains high.

It is expected that the net price of copper will be around 77,000-78,000 yuan per ton next week.

Copper sulfate producers are operating at 100% this week, with a capacity utilization rate of 38%, remaining flat compared to the previous week. Due to the decline in copper net prices, the quotations for copper sulfate/basic copper chloride this week were lower than last week.

Copper prices have fluctuated significantly. Demand is advised to keep an eye on copper price changes and make purchases at the right time.

Raw materials: Currently, the price of sulfuric acid in the north has broken through 1,000 yuan per ton, and the price is expected to rise in the short term.

Magnesium sulfate plants are operating at 100% and production and delivery are normal,the current orders are scheduled until mid-August. 1) As the military parade is approaching, based on past experience, all hazardous chemicals, precursor chemicals and explosive chemicals involved in the north will increase in price at that time. 2) As summer approaches, most sulfuric acid plants will shut down for maintenance, which will drive up the price of sulfuric acid. It is predicted that the price of magnesium sulfate will not fall before September. The price of magnesium sulfate is expected to remain stable for a short period of time. Also, in August, pay attention to logistics in the north (Hebei/Tianjin, etc.). Logistics are subject to control due to the military parade. Vehicles need to be found in advance for shipment.

Raw materials: The domestic iodine market is stable at present, the supply of imported refined iodine from Chile is stable, and the production of iodide manufacturers is stable.

This week, the production rate of calcium iodate sample factories was 100%, the capacity utilization rate was 36%, the same as the previous week, and the price of imported iodine remained stable. Market quotations have reached the manufacturers’ cost line, and mainstream manufacturers have a strong willingness to hold prices, leaving no room for negotiation for the time being.

In terms of raw materials: Judging from the recent market transactions, on the one hand, the market shows the optimism of the industrial chain towards the medium and long-term market; on the other hand, the current selenium price is at a historical low, the risk of continuing to buy at the low price is very small, and the market buying sentiment is strong.

This week, sample manufacturers of sodium selenite were operating at 100%, capacity utilization was 36%, remaining flat compared to the previous week, and export orders from mainstream manufacturers increased. The manufacturer’s orders are relatively abundant, but the raw material cost support is average. It is expected that there will be no possibility of price increase in the later period. Customers are advised to purchase at an appropriate time based on their own inventory.

Raw materials: On the supply side, smelters remain in a wait-and-see mood, with fewer market transactions; On the demand side, downstream enterprises have relatively abundant inventory levels, and the market is actively inquiring but remains cautious about buying and selling.

This week, cobalt chloride sample factories were operating at 100%, with capacity utilization at 44%, remaining flat compared to the previous week. Quotations from major manufacturers remained stable this week. Cobalt chloride prices have remained stable recently, and customers are advised to purchase according to their inventory needs.

9)Cobalt salts/potassium chloride/potassium carbonate/calcium formate/iodide

1. Although still affected by the ban on cobalt and gold exports from Congo, the purchasing willingness is not high, and there are few large-scale transactions. The trading atmosphere in the market is average. In the short term, the market situation of cobalt salts is likely to remain stable.

2. Potassium chloride is in short supply and its price is rising. The domestic potash fertilizer market continued its upward trend. The price of potassium chloride kept climbing, and the price of potassium carbonate also rose slightly. However, due to cost pressure, the overall operating rate of the industry remained at a low level. The supply of goods in the market circulation is tight, while downstream factories have limited acceptance of high-priced goods. The purchasing pace has slowed down, and the market shows a situation of supply and demand competition. Overall, in the short term, the price of potassium chloride is likely to remain at a high level with fluctuations, which may also affect the price of potassium carbonate to rise slightly.

3. The price quote of calcium formate remained stable this week.

4. The price of iodide this week is stable compared with that of last week.

Media Contact:

Media Contact:

Elaine Xu

SUSTAR Group

Email: elaine@sustarfeed.com

Mobile/WhatsApp: +86 18880477902

Post time: Jul-18-2025