Trace Elements Market Analysis

I,Analysis of non-ferrous metals

Week-on-week: Month-on-month:

| Units | Week 1 of October | Week 2 of October | Week-on-week changes | September average price | October up to 18

Average price |

Month-on-month change | Current price on October 21 | |

| Shanghai Metals Market # Zinc ingots | Yuan/ton |

22150 |

21968 |

↓182 |

21969 |

22020 |

↑51 |

21940 |

| Shanghai Metals Market # Electrolytic Copper | Yuan/ton |

86210 |

85244 |

↓966 |

80664 |

85520 |

↑4856 |

85730 |

| Shanghai Metals Australia

Mn46% manganese ore |

Yuan/ton |

40.35 |

40.51 |

↑0.16 |

40.32 |

40.46 |

↑0.14 |

40.55 |

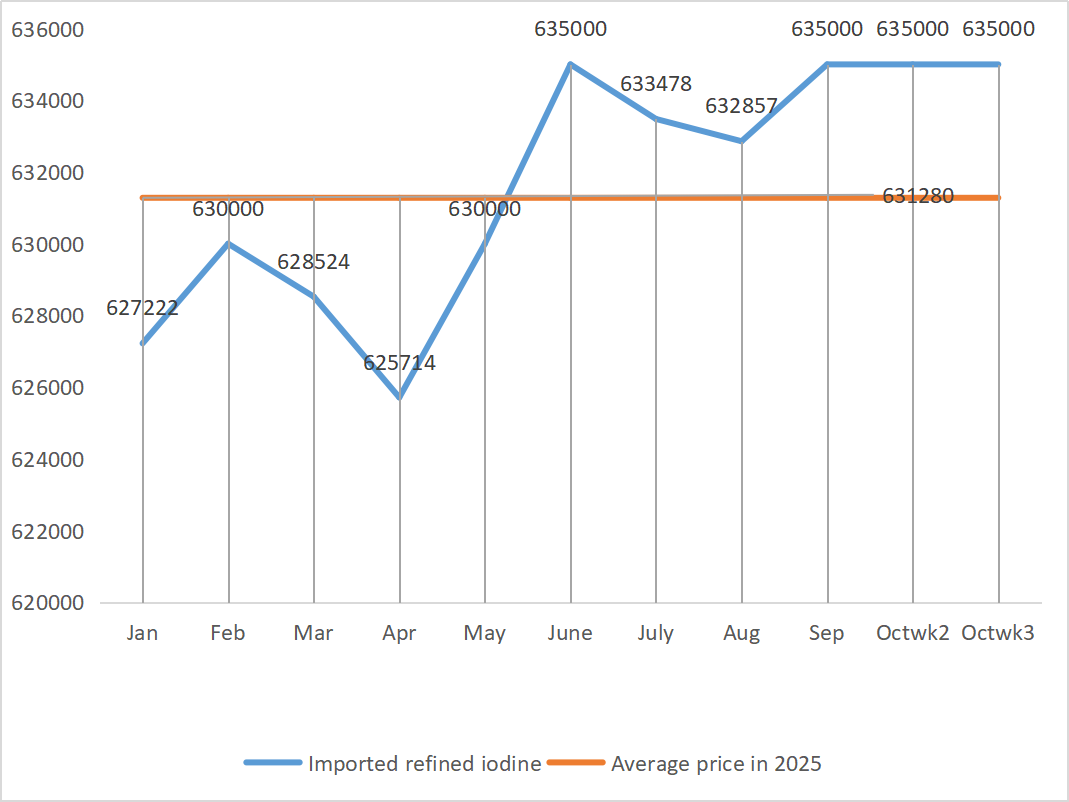

| The price of imported refined iodine by Business Society | Yuan/ton |

635000 |

635000 |

635000 |

635000 |

|

635000 |

|

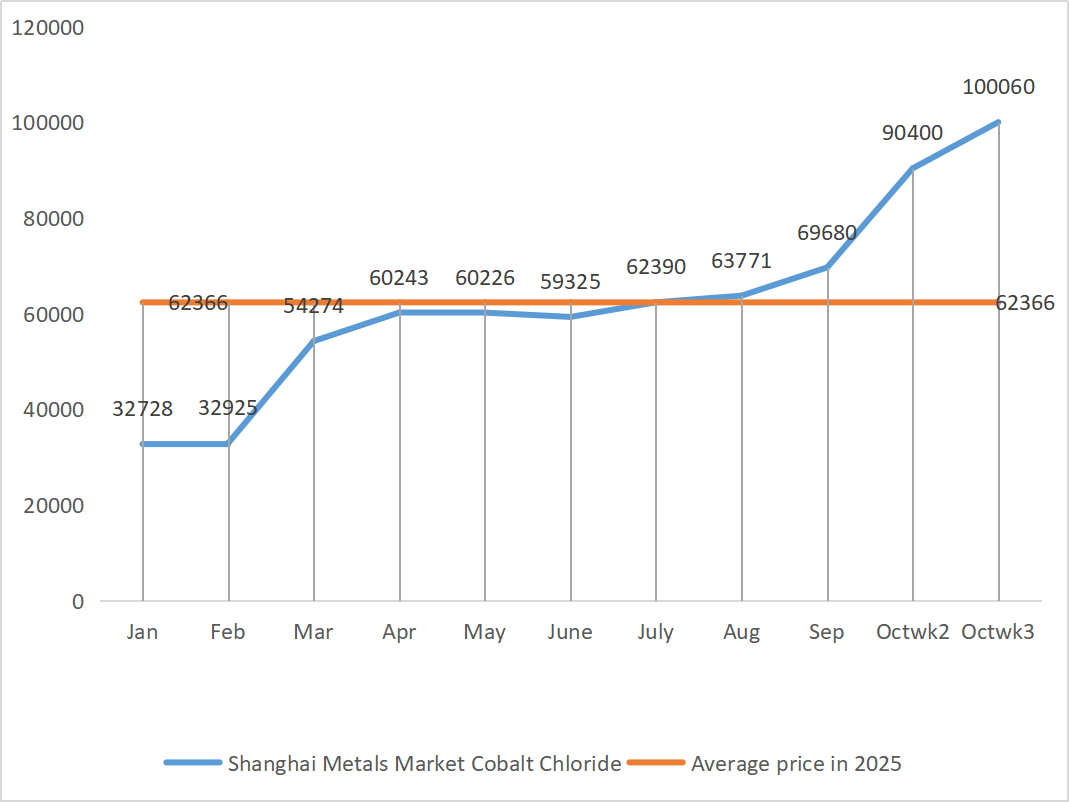

| Shanghai Metals Market Cobalt Chloride

(co≥24.2%) |

Yuan/ton |

90400 |

100060 |

↑9660 |

69680 |

97300 |

↑27620 |

104000 |

| Shanghai Metals Market Selenium Dioxide | Yuan/kilogram |

105 |

105 |

|

103.64 |

105 |

↑1.36 |

107 |

| Capacity utilization rate of titanium dioxide manufacturers | % |

78.28 |

77.85 |

↓0.43 |

76.82 |

78.06 |

↑1.24 |

1)Zinc sulfate

① Raw materials: Zinc hypooxide: The transaction coefficient keeps hitting new highs for the year.

Base zinc price for pricing: Against the backdrop of strong supply and weak demand, with strengthened expectations of Fed rate cuts, it is expected that zinc prices will rise slightly in the short term, raising the purchase cost of secondary zinc oxide.

② Sulfuric acid prices are mainly rising in various regions. Soda ash: Prices remained stable this week. Zinc prices are expected to run in the range of 21,900-22,000 yuan per ton.

On Monday, the operating rate of water zinc sulfate producers was 78%, down 11% from the previous week, and the capacity utilization rate was 69%, slightly down 1% from the previous week. Major manufacturers have placed orders until late October. This week, the order continuity of manufacturers was decent, remaining at around one month. Due to the slower pace of export shipments, some manufacturers have accumulated inventory, and in order to recover funds and relieve inventory pressure, quotations have slightly declined; In the context of firm raw material costs, it is expected that there will be no significant drop in the later period. Customers are advised to purchase on demand.

2)Manganese sulfate

In terms of raw materials: ① The current spot price of manganese ore remains firm

② The price of sulfuric acid rose in various places this week

This week, the operating rate of manganese sulfate producers was 95% and the capacity utilization rate was 56%, remaining flat compared with the previous week. Major manufacturers’ orders are scheduled until early November. The operating rate of mainstream upstream enterprises is normal, prices are high and firm, manufacturers hover around the production cost line, prices are expected to remain stable. Delivery tensions have eased and supply and demand are relatively stable. Based on the analysis of enterprise order volume and raw material factors, manganese sulfate will remain at a high and firm price in the short term, with manufacturers hovering around the production cost line. It is expected that the price will remain stable and customers are advised to increase inventory appropriately.

3)Ferrous sulfate

In terms of raw materials: The demand for titanium dioxide has slightly improved compared to the previous period, but the overall demand remains sluggish. The operating rate of titanium dioxide manufacturers is 78.28%, which is at a low level. Ferrous sulfate heptahydrate is a product in the production process of titanium dioxide. The current situation of manufacturers directly affects the market supply of ferrous sulfate heptahydrate. Lithium iron phosphate has a stable demand for ferrous sulfate heptahydrate, further reducing the supply of ferrous sulfate heptahydrate to the ferrous industry.

This week, the operating rate of ferrous sulfate producers is 75%, the capacity utilization rate is 24%, flat compared with the previous week. Producers have scheduled orders until November. Mainstream manufacturers have reduced production by 70%, and quotations remain stable at high levels this week. Before the holiday, there was a relatively abundant supply of goods on the demand side, but the recovery of purchasing enthusiasm after the holiday was less than expected; Prices fluctuated slightly as some manufacturers increased their shipments, to some extent suppressing demand-side stockpiling. Although the raw material ferrous heptahydrate is still in short supply, some manufacturers have overstocked inventories of finished ferrous sulfate, and it is not ruled out that prices will drop slightly in the short term.

It is suggested that the demand side make purchasing plans in advance in light of inventory.

4)Copper sulfate/basic copper chloride

Raw materials: Copper prices fell this week as market information about copper mine shutdowns in Indonesia was digested.

On the macro level, concerns over US credit dampened market risk sentiment, and the copper market fluctuated weakly for the second week. The domestic conference is approaching, and the market has optimistic expectations. Trump said on Friday that he would meet with the Chinese president in two weeks and pointed out that his 100% tariff proposal would be hard to sustain, a move that partially eased trade concerns between China and the United States while boosting expectations for metal demand. The current market’s concerns over the copper shortage seem to have eased, the current high copper prices have suppressed downstream buying demand, and the accumulation of inventories has put pressure. However, the supply of copper raw materials at the industrial end remains tight, the reduction of overseas mines has tightened expectations for future supply, and the optimistic expectations for the peak demand season, copper prices are likely to remain in a “more likely to rise than fall” pattern in the short term. Copper price range for the week: 85,560-85,900 yuan per ton.

Etching solution: Tight and the purchasing coefficient remains high for a long time. Some upstream raw material manufacturers have accelerated capital turnover by deep processing etching solution into sponge copper or copper hydroxide, and the proportion of sales to the copper sulfate industry has decreased, with the transaction coefficient reaching a new high.

This week, the copper sulfate producers’ operating rate was 100% and the capacity utilization rate was 45%, remaining flat compared with the previous week. The Fed’s rate cuts are likely to increase further, and copper prices are expected to remain supported by favorable macroeconomic conditions.

Customers are advised to take advantage of their inventories to stock up when the copper grid price drops.

5)Magnesium sulfate/magnesium oxide

Raw materials: The price of sulfuric acid is rising in the north at present.

At present, factory production and delivery are normal. The magnesia sand market is mainly stable. Downstream consumption of inventory is the main factor. Demand is expected to gradually recover in the later period, which will support the market price. The market price of light-burned magnesia powder is stable. There may be changes in subsequent kiln upgrades. In the short term, the price of magnesium sulfate may rise slightly. It is recommended to stock up appropriately.

6)Calcium iodate

Raw materials: The domestic iodine market is stable at present, the supply of imported refined iodine from Chile is stable, and the production of iodide manufacturers is stable.

Calcium iodate producers were operating at 100% this week, unchanged from the previous week; Capacity utilization was 34%, down 2% from the previous week; Quotations from major manufacturers remained stable. Tight supply does not rule out the possibility of a slight price increase. It is recommended to stock up appropriately.

7)Sodium selenite

In terms of raw materials: Recently, there has been capital speculation on crude selenium and diselenium, resulting in a tight supply. During the mid-year selenium bidding, the prices were higher than expected, which has somewhat boosted confidence in the selenium market. Last week, the selenium market was weak at first and then strengthened. The demand for sodium selenite was weak, but the quotations rose slightly this week. Prices are expected to be stable in the short term. It is recommended to supplement appropriately

This week, sample manufacturers of sodium selenite were operating at 100%, with capacity utilization at 36%, remaining flat compared to the previous week. Prices have been stable recently, but a slight increase is not ruled out. It is recommended that clients purchase as needed based on their own inventory.

8)Cobalt chloride

In terms of raw materials: There was a period of panic in the market after the release of the export ban in the Democratic Republic of the Congo on September 22, but the panic has gradually subsided after nearly a month of digestion. Downstream enterprises have become more cautious in their purchasing behavior, affected by weaker expectations for demand at the end of the year and next year. But given that upstream prices still have upward momentum, cobalt chloride prices are expected to continue to rise next week.

This week, cobalt chloride producers’ operating rate was 100% and capacity utilization rate was 44%, remaining flat compared with the previous week. Due to rising raw material prices, the cost support for cobalt chloride raw materials has strengthened, and it is expected that prices will rise further in the future.

It is recommended that the demand side make purchase and stockpiling plans in advance based on inventory conditions.

9)Cobalt salts/potassium chloride/potassium carbonate/calcium formate/iodide

1. Cobalt salts: Raw material costs: The extension of the Congo (DRC) cobalt export ban until the end of 2025 has led to continued tightness in domestic cobalt raw material supply. If the ban is lifted earlier or there is a significant increase in supply (such as a substantial increase in cobalt production in Indonesia), it could ease supply pressure and push prices back. But for now, the probability of the ban being lifted is low and the tight supply situation is unlikely to reverse in the short term. Prices are expected to be strong in the short term, and stock up appropriately based on demand.

- The inventory of potassium chloride at ports has risen somewhat, there are rumors of a halt in the import of potassium through border trade, potassium chloride has risen slightly, but there is still a gap to watch the continuous arrival volume. Watch winter storage demand, or start in November, and watch the urea market. It is recommended to stock up appropriately.

3. Calcium formate prices continued to decline this week. Raw formic acid plants resume production and now increase factory production of formic acid, leading to an increase in formic acid capacity and an oversupply. In the long term, calcium formate prices are falling.

4 Iodide prices were stable this week compared to last week.

Post time: Oct-22-2025