Trace Elements Market Analysis

I,Analysis of non-ferrous metals

| Units | Week 4 of July | Week 5 of July | Week-on-week changes | Average price in July | As of August 1Average price | Month-on-month change | Current price as of August 5 | |

| Shanghai Metals Market # Zinc ingots | Yuan/ton |

22744 |

22430 |

↓314 |

22356 |

22230 |

↓126 |

22300 |

| Shanghai Metals Market # Electrolytic Copper | Yuan/ton |

79669 |

78856 |

↓813 |

79322 |

78330 |

↓992 |

78615 |

| Shanghai Metals AustraliaMn46% manganese ore | Yuan/ton |

40.3 |

40.33 |

↑0.3 |

39.91 |

40.55 |

↑0.64 |

40.55 |

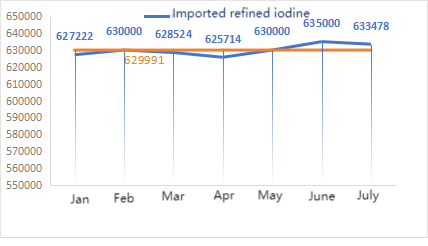

| The price of imported refined iodine by Business Society | Yuan/ton |

632000 |

63000 |

↓2000 |

633478 |

630000 |

↓3478 |

630000 |

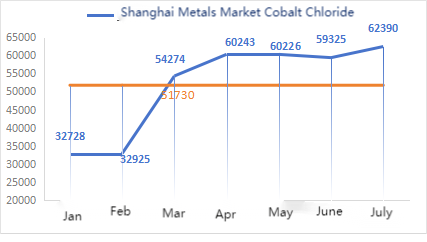

| Shanghai Metals Market Cobalt Chloride(co≥24.2%) | Yuan/ton |

62765 |

62915 |

↑150 |

62390 |

63075 |

↑685 |

63300 |

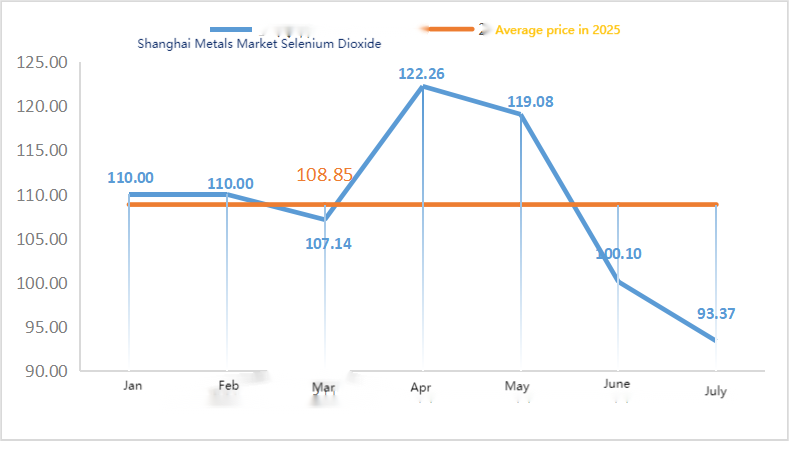

| Shanghai Metals Market Selenium Dioxide | Yuan/kilogram |

90.3 |

91.2 |

↑0.9 |

93.37 |

93.00 |

↓0.37 |

93 |

| Capacity utilization rate of titanium dioxide manufacturers | % |

75.61 |

73.52 |

↓2.09 |

75.16 |

73.52 |

↓1.64 |

Raw materials:

Zinc hypooxide: High raw material costs and strong purchasing intentions from downstream industries keep the transaction coefficient at a nearly three-month high. ② Changes in sulfuric acid prices across the country this week. The price of sulfuric acid has been raised. Soda ash prices rose in major regions this week. ③ Macroscopically, China and the US will continue to push for a 90-day extension of the 24% portion of the US reciprocal tariff, which has been suspended, and China’s countermeasures, which were originally due to expire on August 12. A meeting of the Political Bureau was held domestically, which lifted market sentiment to some extent. In terms of fundamentals, on the supply side, the supply of zinc concentrate at home and abroad remains loose. On the demand side, downstream industries maintain low operating rates, and the off-season characteristics of demand continue to weigh on zinc prices, with downstream essential purchases being dominant.

On Monday, the operating rate of water sulfate sample manufacturers was 83%, unchanged from the previous week. The capacity utilization rate was 68%, down 2% from the previous week. Some manufacturers’ production cuts led to a decline in the data. Market quotations remained stable this week. Manufacturers signed orders one after another in late July, and mainstream manufacturers scheduled orders until the end of August. Currently, the price of sulfuric acid is around 770 yuan per ton, up from last week. With relatively abundant orders and tight supply of raw materials and finished products, although zinc prices have slightly declined, factories are willing to hold zinc sulfate prices. Prices are expected to be adjusted around mid-August. The current market trading atmosphere is picking up. It is suggested that the demand side determine the purchasing plan in advance based on the delivery situation of the manufacturers.

Zinc prices are expected to operate within the range of 22,500 to 23,000 yuan per ton.

In terms of raw materials: ① Manganese ore prices are stable with a slight increase. Quotations for some mainstream ore types have risen slightly again by 0.25-0.5 yuan per tonne. However, the sentiment of futures price speculation has cooled, and silicon-manganese prices have slightly risen and then fallen. The overall cautious and wait-and-see atmosphere is relatively strong.

② The price of sulfuric acid has mainly risen.

This week, the operating rate of manganese sulfate sample factories was 85% and the capacity utilization rate was 63%, remaining unchanged from the previous week. The prices of raw materials such as sulfuric acid and pyrite rose. This week, quotations from major manufacturers rose compared to last week. The current peak season for aquaculture in the south provides some support for manganese sulfate demand, but the overall off-season boost for feed is limited. Market sentiment has warmed up against the backdrop of expected price increases in products.

Manganese sulfate prices have bottomed out and rebounded. Major manufacturers have maintenance plans in August and it is not ruled out that prices will rise further later. Demand is advised to purchase and stock up at the right time based on production conditions.

In terms of raw materials: Downstream demand for titanium dioxide remains sluggish. Some manufacturers have accumulated titanium dioxide inventories, resulting in low operating rates. The tight supply situation of ferrous sulfate in Qishui continues.

This week, samples of ferrous sulfate were operating at 75% and capacity utilization at 24%, remaining flat compared to the previous week. Quotations remained at post-holiday highs this week, with major manufacturers significantly cutting production and releasing information of price hikes. Producers’ orders are scheduled until early September. The tight supply situation of raw material Qishui ferrous has not improved. Coupled with the recent further increase in Qishui ferrous prices, under the background of cost support and relatively abundant orders, it is expected that the price of Qishui ferrous will remain firm at a high level in the later period. It is recommended that the demand side purchase and stock up at the right time in combination with inventory.

4)Copper sulfate/basic copper chloride

Raw materials: Macroscopically, the Fed’s interest rate remained unchanged and the dollar index gained more, suppressing copper prices.

In terms of fundamentals, the overall supply side has limited supplies and is in a tight situation. From the demand side, Stockholders have been affected by a further decline in end-of-month selling sentiment and continued premium quotations.

Etching solution: Some upstream raw material suppliers have deep processing of etching solution, further intensifying the raw material shortage, and the transaction coefficient remains high.

In terms of price, there is still uncertainty on the macro level. Coupled with weak supply and demand on the fundamentals, it is expected that the net price of copper will run around 78,000-79,000 yuan per ton this week.

Copper sulfate producers are operating at 100% this week, with a capacity utilization rate of 45%, remaining flat compared to the previous week. Quotations from major manufacturers remained stable this week compared to last week.

Copper mesh prices have been fluctuating at high levels recently, significantly affected by the international situation. It is recommended to pay attention to the fluctuations in copper mesh prices and make purchases at the right time.

In terms of raw materials: The raw material magnesite is stable.

The factory is operating normally and production is proceeding as usual. The delivery time is generally about 3 to 7 days. Prices have been stable from August to September. As winter approaches, there are policies in major factory areas that prohibit the use of kilns for magnesium oxide production. Moreover, the cost of using fuel coal increases in winter. Based on the above, it is expected that the price of magnesium oxide will rise from October to December. It is recommended that customers make purchases based on their needs.

Raw materials: The price of sulfuric acid in the north is currently rising in the short term.

Magnesium sulfate plants are operating at 100%, production and delivery are normal, and orders are scheduled until early September. The price of magnesium sulfate is expected to be stable with an upward trend in August. Customers are advised to purchase according to their production plans and inventory requirements.

Raw materials: The domestic iodine market is stable at present, the supply of imported refined iodine from Chile is stable, and the production of iodide manufacturers is stable.

This week, the production rate of calcium iodate sample manufacturers was 100%, the capacity utilization rate was 36%, the same as the previous week, and the quotations of mainstream manufacturers remained stable. The summer heat led to a decline in livestock feed, and manufacturers mostly purchased on demand. Aquatic feed manufacturers are in the peak demand season, driving up the demand for calcium iodate. This week’s demand is more stable than normal. Customers are advised to purchase according to their production plans and inventory requirements.

In terms of raw materials: On the supply side, the operating rate of domestic selenium dioxide enterprises has remained stable at around 70%, with no significant fluctuations in output. However, some enterprises are selling at low prices to clear their inventories, resulting in an increase in market supply. On the demand side, the purchasing enthusiasm of downstream industries such as photovoltaic and glass is not high, mostly driven by essential needs. Especially in the photovoltaic industry, due to temporary saturation, the growth of selenium dioxide demand is weak. It is difficult to provide effective support for the price of selenium dioxide. The price of selenium dioxide will be stable in the short term.

This week, sample manufacturers of sodium selenite were operating at 100%, capacity utilization at 36%, unchanged from the previous week, and quotations from mainstream manufacturers remained stable. The cost of raw materials is moderately supported, and it is expected that prices will not rise for the time being. It is recommended that the demand side purchase according to its own inventory.

Raw materials: On the supply side, given the upcoming “Golden September and Silver October” traditional auto market peak season and the new energy industry chain entering the stockpiling stage, nickel salts and cobalt salts are still expected to rise. Smelters’ quotations keep rising; On the demand side, downstream enterprises’ purchases are mainly for essential needs, and transactions are mainly in small quantities. It is expected that cobalt chloride prices will continue to rise in the future.

This week, the cobalt chloride sample factory’s operating rate was 100% and the capacity utilization rate was 44%, remaining flat compared with the previous week. Supported by raw material costs, cobalt chloride powder manufacturers’ quotations rose this week.

It is not ruled out that cobalt chloride prices will rise later. Customers are advised to stock up at the right time based on their inventory.

10)Cobalt salt/potassium chloride/potassium carbonate/calcium formate/iodide

1. Despite still being affected by Congo’s ban on gold and cobalt exports, there is little willingness to purchase and few bulk transactions. The trading atmosphere in the market is average, and the cobalt salt market is likely to be stable in the short term.

2. The market price of potassium chloride is stable with a tendency to be strong, while the demand side shows signs of seasonal recovery. The demand for fertilizer preparation in autumn is gradually released, and there are signs of supply falling short of demand . However, downstream compound fertilizer enterprises, affected by the sluggish urea market, remain cautious in their purchases. In summary, the prices of potassium chloride are in chaos and there is a shortage of supplies. It is expected that the potassium chloride market will remain stable with some fluctuations in the short term. The price of potassium carbonate remained stable compared with last week.

3. The price of calcium formate continued to rise this week. The price of raw formic acid rose as factories shut down for maintenance. Some calcium formate plants have stopped taking orders.

4. Iodide prices were stable and stronger this week compared to last week.

Media Contact:

Elaine Xu

SUSTAR Group

Email: elaine@sustarfeed.com

Mobile/WhatsApp: +86 18880477902

Post time: Aug-08-2025