Trace Elements Market Analysis

I,Analysis of non-ferrous metals

| Units | Week 3 of June | Week 4 of June | Week-on-week changes | May average price | Average price as of June 27 | Month-on-month changes | |

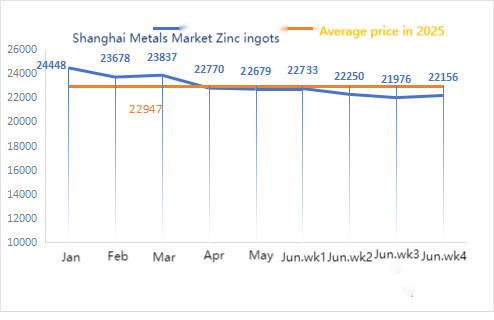

| Shanghai Metals Market # Zinc Ingots | Yuan/ton |

21976 |

22156 |

↑180 |

22679 |

22255 |

↓424 |

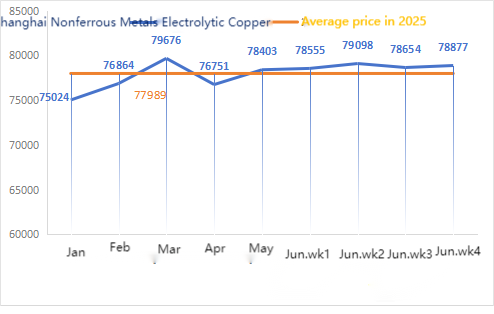

| Shanghai Metals Network#Electrolytic copper | Yuan/ton |

78654 |

78877 |

↑223 |

78403 |

78809 |

↑ 406 |

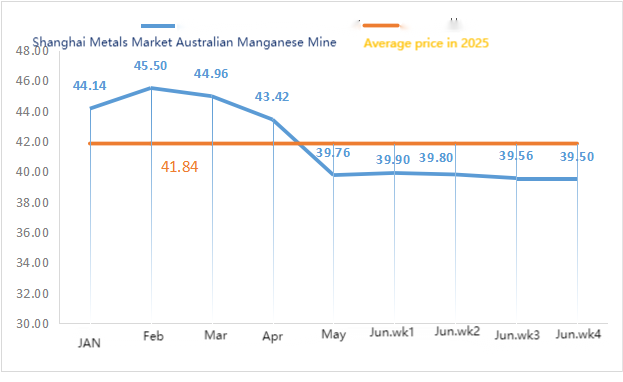

| Shanghai Youse Network Australia Mn46% Manganese Mine | Yuan/ton |

39.56 |

39.5 |

↓0.06 |

39.76 |

39.68 |

↓ 0.08 |

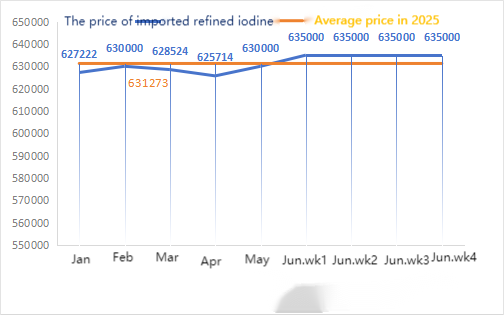

| Business Society imported refined iodine prices | Yuan/ton |

635000 |

635000 |

630000 |

635000 |

↑ 5000 |

|

| Cobalt chloride (co≥24.2%) | Yuan/ton |

58525 |

60185 |

↑1660 |

60226 |

59213 |

↓ 1013 |

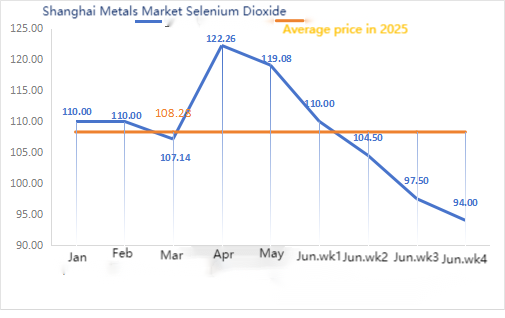

| Shanghai Metals Market Selenium Dioxide | Yuan/kilogram |

97.5 |

94 |

↓3.5 |

119.06 |

101.05 |

↓18.03 |

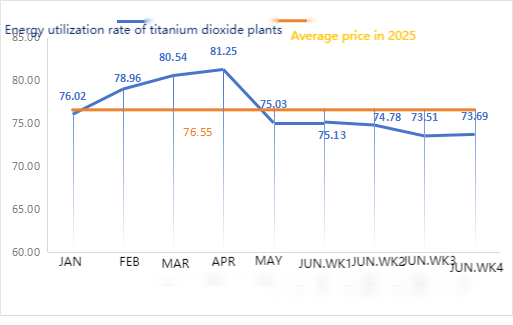

| Capacity utilization rate of titanium dioxidemanufacturers | % |

73.51 |

73.69 |

↑0.18 |

75.03 |

73.69 |

↓ 1.34 |

Weekly change: Month-on-month change:

Raw materials:

① Zinc hypooxide: The operating rate of zinc hypooxide manufacturers dropped to the lowest level after the New Year, and the transaction coefficient remained at the highest level in nearly three months, indicating that the price of this raw material is temporarily stable ② Sulfuric acid prices remained stable this week, while soda ash prices continued to decline this week. ③ Zinc prices are expected to remain high and volatile in the short term.

This week, the operating rate of active zinc oxide plants was 91%, up 18% from the previous week, and the capacity utilization rate was 56%, up 8% from the previous week. Some factories have resumed operations due to weakened environmental factors and production and delivery have returned to normal. Due to the off-season demand and stable raw material prices, there is an oversupply, and zinc sulfate prices are expected to remain stable or continue to decline in July. Prices are expected to be weak, and customers are advised to purchase according to their needs.

Raw materials: ① Manganese ore prices rose slightly, but factories’ acceptance of high-priced raw materials was poor, and overall price fluctuations were limited in the short term. ② Sulfuric acid prices are mainly stable.

This week, the operating rate of manganese sulfate plants was 73% and the capacity utilization rate was 66%, remaining flat compared with the previous week. Operating rates are normal and quotations from major manufacturers remain stable. Prices began to decline slowly, and recently they are close to the lowest level in a year, stimulating a recovery in purchasing. Under the influence of the traditional off-season, overall demand is at a low level (the essential demand in the fertilizer market has passed, there has been no significant increase in foreign trade orders, and the enthusiasm of domestic terminal customers to replenish inventories is not high), and the price of manganese sulfate is stable in the short term. It is suggested that clients purchase at an appropriate time based on their inventory situation.

In terms of raw materials: Downstream demand for titanium dioxide remains sluggish. Some manufacturers have accumulated titanium dioxide inventories, resulting in persistently low operating rates. The tight supply situation of ferrous sulfate in Qishui continues.

The price of ferrous sulfate remained firm this week. Currently, the overall operating rate of ferrous sulfate in China is not good, enterprises have very little spot inventory, some titanium dioxide plants still maintain production cuts and shutdowns, and the market operation has declined. The price of ferrous sulfate heptahydrate rose, and the raw material side supported the price increase of ferrous sulfate monohydrate. Considering the impact of raw materials and operating rate, ferrous sulfate is expected to rise in the short term. It is suggested that clients purchase and stock up at the right time based on inventory. In addition, due to the shortage of raw materials and production cuts at major factories, the delivery of ferrous sulfate in July is expected to be extended, with new orders expected to be delivered in one month.

4)Copper sulfate/ Tribasic Copper Chloride

In terms of raw materials: On a macro level, Trump announced that he believed the war between Iran and Israel was over, that the US would hold talks with Iran next week, that he did not think a nuclear deal was necessary, and that the market generally expected the Federal Reserve to resume its ring-cutting cycle soon, the dollar index fell, supporting copper prices.

In terms of fundamentals, most enterprises are gradually completing their inventory clearance plans. Currently, the available supply of goods in the market is limited, and the prices of some scarce supplies will rise.

Etching solution: Some upstream raw material manufacturers are deep processing etching solution, further intensifying the raw material shortage, maintaining a high transaction coefficient.

This week, copper sulfate producers’ operating rate was 100% and capacity utilization rate was 40%, remaining flat compared with the previous week. The recent increase in agricultural demand and export orders has led to tight supply, coupled with fluctuations in copper futures. In light of the above raw materials and supply situation, copper sulfate/ Tribasic Copper Chloride quotations will remain firm. Customers are advised to make purchase plans in advance to ensure safety stock.

In terms of raw materials: Currently, the price of sulfuric acid in the north is 970 yuan per ton, and it is expected to exceed 1,000 yuan per ton in July. The price is valid in the short term.

As sulfuric acid is the main reaction material for magnesium sulfate, the price increase affects the cost rise. In addition to the upcoming military parade, based on past experience, all hazardous chemicals, precursor chemicals and explosive chemicals involved in the north will increase in price at that time. Magnesium sulfate prices are not expected to fall back before August. Also, in August, pay attention to the northern logistics (Hebei/Tianjin, etc.), which are subject to control due to the military parade logistics and need to find vehicles in advance for shipment.

Raw materials: The domestic iodine market is stable at present, the supply of imported refined iodine from Chile is stable, and the production of iodide manufacturers is stable.

This week, the production rate of calcium iodate sample manufacturers was 100%, the capacity utilization rate was 36%, the same as the previous week, and the quotations of mainstream manufacturers remained unchanged. Feed industry: Demand shows a differentiated pattern of “strong aquaculture, weak livestock and poultry”, and the demand situation is the same as the normal week of this month. Customers are advised to purchase as needed based on production and inventory requirements

In terms of raw materials: There have been many tenders for selenium products from copper smelters in the market recently, resulting in an increase in supply. Driven by the decline in crude selenium prices at the raw material end, the price of sodium selenite raw materials remained weak this week.

This week, sample manufacturers of sodium selenite were operating at 100%, with capacity utilization at 36%, remaining flat compared to the previous week. Quotations from mainstream manufacturers stopped falling and stabilized. Due to the previous price decline, feed manufacturers’ purchasing intentions were weak, and weekly demand was flat compared to the normal week. Sodium selenite prices have been weak. It is recommended that demanders purchase according to their own inventories.

Raw materials: On the supply side, smelters have chosen to suspend quotations and shipments to observe market sentiment; On the demand side, downstream enterprises have relatively abundant inventory levels and the market is actively inquiring and watching price trends. On the price side, upstream smelters have suspended quotations but are generally bullish on prices

This week, the cobalt chloride sample factory was operating at 100% and the capacity utilization rate was 44%, remaining flat compared with the previous week. The prices of major manufacturers rose slightly this week as market information spread that the export ban in the Democratic Republic of the Congo was extended for three months. There is a possibility of further price increases in the future. Customers are advised to stock up at the right time based on their inventory

9)Cobalt salt/potassium chloride

1.The price of upstream battery-grade cobalt salts has been suspended. The ban on exports from the Democratic Republic of the Congo has been extended for three months. Cobalt prices may continue to rise.

2. Potassium chloride prices soared last week.

Positive: Less imported potassium, low operating rate of potassium sulfate, rising urea prices, major traders holding back sales, unstable situation in the Middle East.

Bearish: Weak demand during the off-season, large contract prices are low. Due to the scarcity of potassium chloride itself, the above has a positive impact on the upward trend of potassium chloride.

Although the upward trend is strong, high-priced orders are not satisfactory. In the future, pay attention to trading volume and domestic potassium prices, and purchase appropriate stockpiling according to demand.

Media Contact:

Elaine Xu

SUSTAR Group

Email: elaine@sustarfeed.com

Mobile/WhatsApp: +86 18880477902

About SUSTAR Group:

Founded over 35 years ago, SUSTAR Group drives progress in animal nutrition through cutting-edge mineral solutions and premixes. As China’s top trace mineral producer, it combines scale, innovation, and stringent quality control to serve 100+ leading feed companies worldwide. Learn more at [www.sustarfeed.com].

Post time: Jul-01-2025