Trace Elements Market Analysis

I,Analysis of non-ferrous metals

Week-on-week: Month-on-month:

| Units | Week 4 of August | Week 1 of September | Week-on-week changes | August average price | As of September 6

Average price |

Month-on-month change | Current price as of September 9 | |

| Shanghai Metals Market # Zinc ingots | Yuan/ton |

22130 |

22026 |

↓104 |

22250 |

22026 |

↓224 |

22190 |

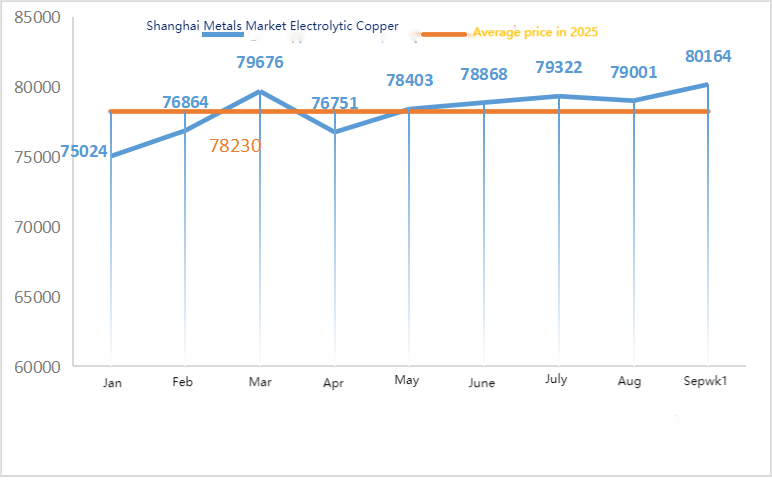

| Shanghai Metals Market # Electrolytic Copper | Yuan/ton |

79421 |

80164 |

↑743 |

79001 |

80164 |

↑1163 |

79890 |

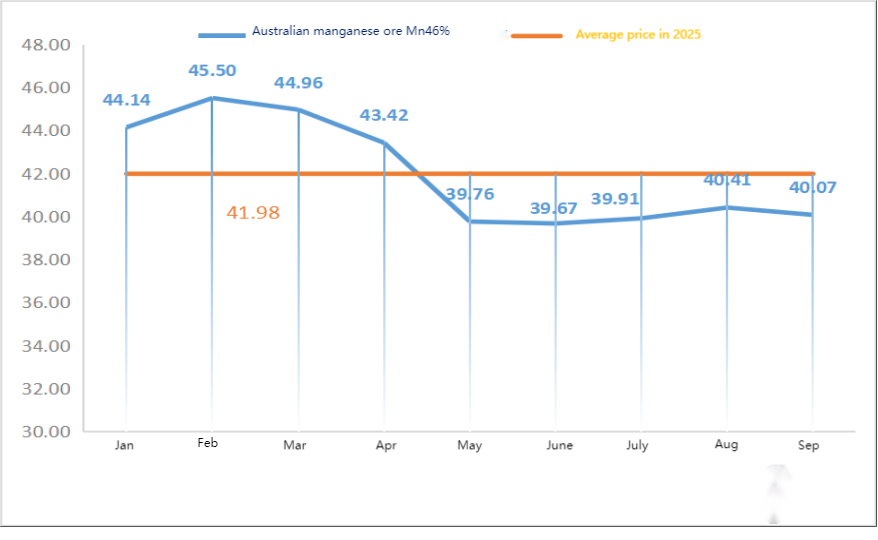

| Shanghai Metals Network Australia

Mn46% manganese ore |

Yuan/ton |

40.15 |

40.07 |

↓0.08 |

40.41 |

40.07 |

↓0.34 |

40.07 |

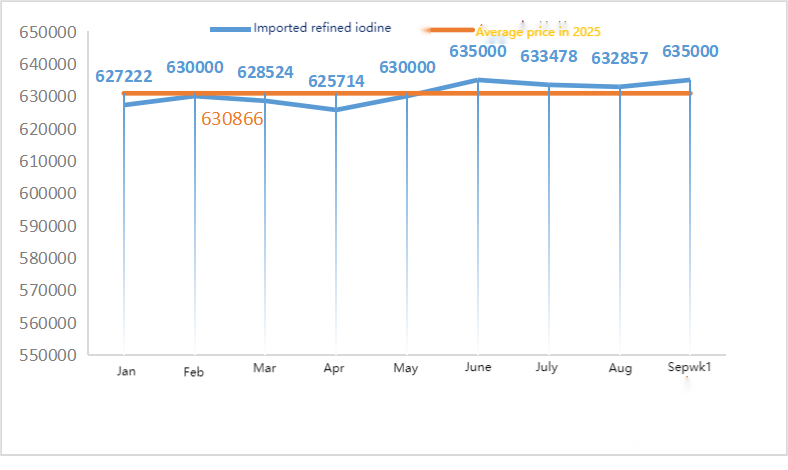

| Business Society imported refined iodine prices | Yuan/ton |

635000 |

635000 |

632857 |

635000 |

↑2143 |

635000 |

|

| Shanghai Metals Market Cobalt Chloride

(co≥24.2%) |

Yuan/ton |

64330 |

65300 |

↑970 |

63771 |

65300 |

↑1529 |

66100 |

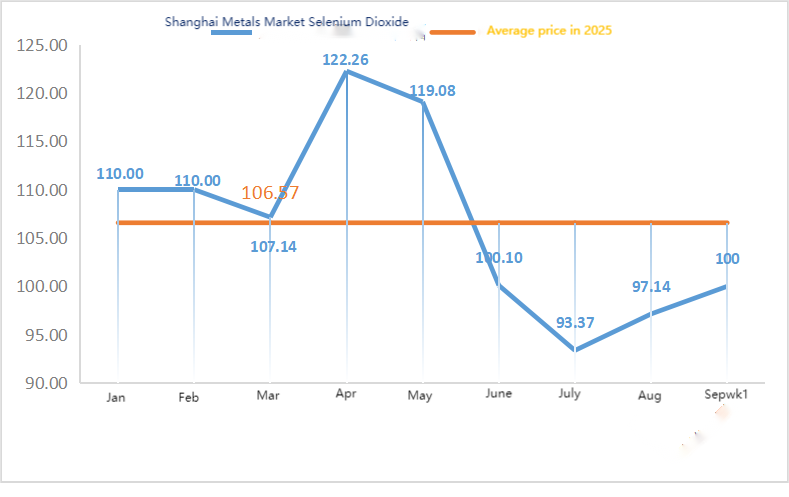

| Shanghai Metals Market Selenium Dioxide | Yuan/kilogram |

100 |

100 |

|

97.14 |

100 |

↑2.86 |

100 |

| Capacity utilization rate of titanium dioxide manufacturers | % |

76.6 |

77.34 |

↑0.74 |

74.95 |

77.34 |

↑2.39 |

|

① Raw materials: Zinc hypooxide: The transaction coefficient remains high. Overall macroeconomic sentiment in the market is warm, boosting zinc net prices and further increasing costs.

② Sulfuric acid prices remained stable at high levels across the country this week. Soda ash: Prices were stable this week. ③ Downstream buyers are only buying at low prices, with poor acceptance of high-priced zinc and a lack of consumer support. The bearish sentiment in the Shanghai zinc market remains heavy. There is little possibility of a sharp decline in zinc in the short to medium term.

Zinc prices are expected to run in the range of 22,000 to 22,500 yuan per ton next week.

On Monday, the operating rate of water zinc sulfate producers was 89%, up 6% from the previous week; Capacity utilization was 69%, up 1% from the previous week. Export demand rose to varying degrees. Zinc monohydrate is expected to rise slightly or remain stable at a high level amid firm raw material costs and recovering demand across industries.

Delivery tightness is expected to ease in the short term, but it will increase further as subsequent orders start to be delivered.

It is recommended that demanders purchase in advance based on their own inventories and stock up appropriately.

In terms of raw materials: ① The manganese ore market was generally stable and in a wait-and-see mode at the beginning of the week. Last Friday, the silicon-manganese market, driven by coking coal, followed the black series sector to stop falling and recover. Port inquiries became more active, traders’ quotations remained firm, and the willingness to sell at some low prices earlier decreased. The increase in foreign quotations and the start of a new round of factory restocking for the National Day holiday have raised expectations of a temporary improvement in the manganese ore market, making it more difficult for ports to purchase at low prices. However, the fundamentals of alloys have not improved significantly so far, and the high operating rate has exerted considerable negative pressure on the market. The manganese ore price lacks support, and the short-term upside and downside space is relatively narrow. Prices have remained stable for the time being.

② The price of sulfuric acid has remained stable at a high level.

This week, the operating rate of manganese sulfate producers was 81%, unchanged from the previous week; Capacity utilization was 52 percent, up 10 percent from the previous week. Mainstream manufacturers’ prices rose this week due to high raw material costs, leaving no room for negotiation.

Most factories have resumed production, orders are abundant, and delivery tensions have not improved significantly. The peak demand season in Australia and Central America is approaching, and order support remains. Some demand sides are depleting previous inventories, and shipments are slowing. Bulk deliveries are expected in late September.

Shipping customers are advised to take shipping time into account and stock up in advance.

In terms of raw materials: Downstream demand for titanium dioxide remains sluggish. Some manufacturers have accumulated titanium dioxide inventories, resulting in low operating rates. The tight supply situation of ferrous sulfate in Qishui continues.

This week, the operating rate of ferrous sulfate producers was 75%, the capacity utilization rate was 24%, unchanged from the previous week, and producers’ orders were scheduled until late October. Major manufacturers are expected to cut production, and quotations this week have risen compared to last week. The supply of by-product ferrous heptahydrate is tight, the cost of raw materials is strongly supported, manufacturers have tight delivery, and there is no room for negotiation for the time being. The price is firm at a high level and has upward momentum. It is suggested that the demand side purchase and stock up in combination with inventory.

4)Copper sulfate/basic copper chloride

In terms of raw materials: On a macro level, the dollar’s decline has led to a stronger purchasing power for dollar-priced metals, and negotiations between the US and Europe on a new round of sanctions against Russia have affected the global trade pattern. Market risk aversion has not subsided, and various signs indicate that the Fed’s interest rate cut is imminent. In terms of fundamentals, the supply from the mining sector remains tight, the Panama copper mine is about to enter the environmental audit stage, and the domestic consumption peak season of “golden September and Silver October” is expected to rebound. It is predicted that copper prices will remain at a high level with strong fluctuations in the short term. Reference range for the main operating range of Shanghai copper: 79,000-80,000 yuan per ton

Etching solution: Some upstream raw material manufacturers have accelerated capital turnover by deep processing etching solution into sponge copper or copper hydroxide. The proportion of sales to the copper sulfate industry has decreased, and the transaction coefficient has reached a new high. Copper net prices are likely to rise against the backdrop of warming macro sentiment, pushing up raw material costs again.

In terms of price, the main operating range of Shanghai copper is expected to fluctuate narrowly at 79,000-80,000 yuan per ton.

This week, the operating rate of copper sulfate producers was 100% and the capacity utilization rate was 45%, remaining flat compared with the previous week. Based on the recent raw material trend and raw material inventory analysis, the high copper network price, coupled with the difficulty in purchasing etching solution, is expected to increase the price of copper sulfate. Customers are advised to stock up at the recent low price based on their own inventory.

Raw materials: The raw material magnesite is stable.

The factory is operating normally and production is normal. The delivery time is generally around 3 to 7 days. Prices have been stable from August to September. As winter approaches, there are policies in major factory areas that prohibit the use of kilns for magnesium oxide production, and the cost of using fuel coal increases in winter. Combined with the above, it is expected that the price of magnesium oxide will rise from October to December. Customers are advised to purchase based on demand.

In terms of raw materials: Currently, the price of sulfuric acid in the north is on the rise in the short term.

At present, magnesium sulfate plants are operating at 100% and production and delivery are normal. As September approaches, the price of sulfuric acid is temporarily stable and further increases cannot be ruled out. Customers are advised to purchase according to their production plans and inventory requirements.

Raw materials: The domestic iodine market is stable at present, the supply of imported refined iodine from Chile is stable, and the production of iodide manufacturers is stable.

This week, the production rate of calcium iodate sample manufacturers was 100%, the capacity utilization rate was 36%, the same as the previous week, and the quotations of mainstream manufacturers remained stable.

Some manufacturers have plans to cut production, supply is tight, and prices are expected to rise slightly.

Customers are advised to purchase according to their production plans and inventory requirements.

In terms of raw materials: There were no significant changes on either side of supply and demand in the selenium dioxide market. Downstream demand remained sluggish. Holders had a strong willingness to hold prices, but actual transactions were limited.

This week, sample manufacturers of sodium selenite were operating at 100%, with capacity utilization at 36%, remaining flat compared to the previous week. Manufacturers’ quotations remained stable this week. Raw material prices are stable, supply and demand are balanced, and prices are expected to remain stable.

It is recommended that clients purchase as needed based on their own inventory.

In terms of raw materials: Upstream smelters tend to believe that supply will remain tight in the second half of the year, with a strong sentiment of reluctance to sell, driving quotations to continue to rise. Since August, the recovery of terminal demand has driven up purchases of cobalt oxide, and it is expected that cobalt chloride quotations will rise.

This week, cobalt chloride producers’ operating rate was 100% and capacity utilization rate was 44%, remaining flat compared with the previous week. Manufacturers’ quotations remained stable this week. The price of cobalt chloride raw materials is expected to rise slightly due to increased raw material prices and strengthened cost support. It is recommended that demand-side purchase and stockpiling plans be made seven days in advance in combination with inventory.

10)Cobalt salts/potassium chloride/potassium carbonate/calcium formate/iodide

1. Cobalt salts: Raw material costs: The Congolese (DRC) export ban continues, cobalt intermediate prices continue to rise, and cost pressures are passed downstream.

Inventory situation: The inventory of domestic cobalt salt plants is relatively low. Some enterprises have reduced production due to raw material shortages, further supporting prices. The cobalt salt market is expected to rise steadily in the short term, supported by raw material costs, but the speed of recovery on the demand side needs to be closely watched.

2. There was no significant change in the overall price of potassium chloride. The market showed a trend of both supply and demand being weak. The supply of market sources remained tight, but the demand support from downstream factories was limited. There were small fluctuations in some high-end prices, but the extent was not large. Prices remain stable at a high level. The price of potassium carbonate fluctuates with that of potassium chloride.

3. Calcium formate prices remained stable at high levels this week. The price of raw formic acid rose as factories shut down for maintenance. Some calcium formate plants have stopped taking orders.

4. Iodide prices remained stable this week compared to last week.

Post time: Sep-11-2025