I,Analysis of non-ferrous metals

Week-on-week: Month-on-month:

| Units | Week 1 of August | Week 2 of August | Week-on-week changes | Average price in July | As of August 15Average price | Month-on-month change | Current price as of August 19 | |

| Shanghai Metals Market # Zinc ingots | Yuan/ton |

22286 |

22440 |

↑154 |

22356 |

22351 |

↓5 |

22200 |

| Shanghai Metals Market # Electrolytic Copper | Yuan/ton |

78483 |

79278 |

↑795 |

79322 |

78830 |

↓492 |

79100 |

| Shanghai Metals AustraliaMn46% manganese ore | Yuan/ton |

40.55 |

40.55 |

- |

39.91 |

40.55 |

↑0.64 |

40.35 |

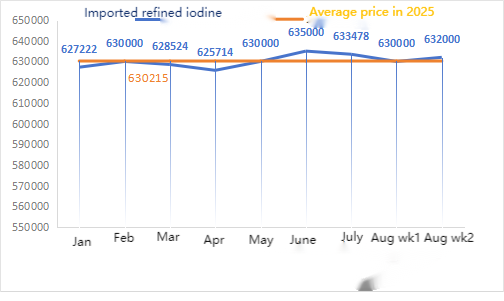

| The price of imported refined iodine by Business Society | Yuan/ton |

630000 |

632000 |

↑2000 |

633478 |

630909 |

↓2569 |

632000 |

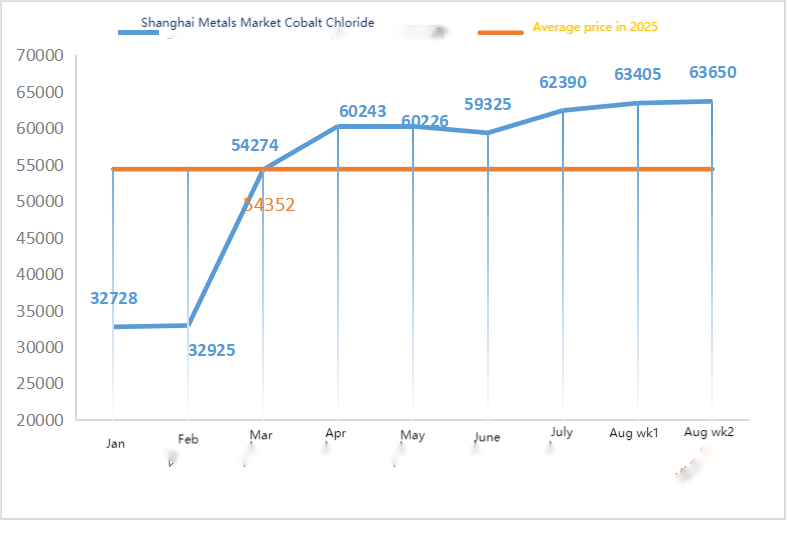

| Shanghai Metals Market Cobalt Chloride(co≥24.2%) | Yuan/ton |

63405 |

63650 |

↑245 |

62390 |

63486 |

↑1096 |

63700 |

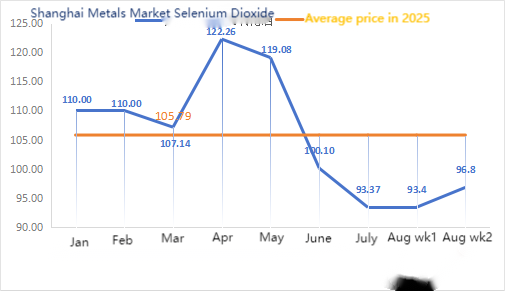

| Shanghai Metals Market Selenium Dioxide | Yuan/kilogram |

93.4 |

96.8 |

↑3.4 |

93.37 |

94.91 |

↑1.54 |

98 |

| Capacity utilization rate of titanium dioxide manufacturers | % |

74.22 |

74.7 |

↑0.48 |

75.16 |

74.15 |

↓1.01 |

In terms of raw materials: zinc hypooxide: With high raw material costs and strong purchasing intentions from downstream industries, manufacturers have a strong willingness to raise prices, and the high transaction coefficient is constantly being refreshed.

② Sulfuric acid prices remained stable across the country this week. Soda ash: Prices were stable this week. ③ Macroscopically, U.S. July CPI data became the focus of the market, hitting a new high since February. After the data was released, the market expected more than 90% probability of the Fed cutting interest rates in September, along with the continued suspension of the 24% additional tariffs and non-tariff measures against each other for 90 days starting August 12, easing concerns that trade frictions would drag down economic growth. The improved macro sentiment combined with the expectation of rate cuts pushed the nonferrous metals sector stronger as a whole.

In terms of fundamentals, the pattern of strong supply and weak demand remains unchanged, the off-season feature of demand continues, and downstream essential purchases are dominant.

On Monday, the operating rate of water zinc sulfate sample manufacturers was 83%, down 11% from the previous week. The capacity utilization rate was 71%, down 2% from the previous week. Quotations this week were the same as last week. Futures zinc ingot prices have declined, but raw material zinc oxide prices remain firm. The trading atmosphere has slowed this week. Later, with the start of the school season approaching, confidence in meat, egg and milk consumption has been boosted, and feed demand is expected to recover. Demand remained stable this week compared to the normal week. With firm raw material costs and signs of recovery in feed industry demand, prices will remain stable until the end of August and are expected to rise in September. It is suggested that the demand side determine the purchase plan in advance based on their own inventory situation.

Zinc prices are expected to run in the range of 22,200 to 22,300 yuan per ton.

① There are no obvious signs of fluctuation in the overall manganese ore market. There is a certain difference in ore prices between the north and south ports. Although it is difficult to find low-priced sources in the market, it is not easy to make high-priced deals either. The final pricing of large trend-setting steel mills’ tenders is still under negotiation, resulting in limited acceptance of high-priced raw materials by downstream factories.

② The price of sulfuric acid remained mainly stable.

This week, the operating rate of sample manufacturers of manganese sulfate was 86% and the capacity utilization rate was 61%, remaining flat compared with the previous week. Quotations from mainstream manufacturers this week were stable compared with last week. The cost of raw materials and the futures market provided a slight support. Manganese ore prices have stabilized recently, with demand increasing slightly compared to the normal week. Supported by raw material costs and demand, the price of manganese sulfate remained stable. Meanwhile, some major manufacturers have maintenance plans in the second half of the month. It is suggested that the demand side purchase and stock up at an appropriate time based on production conditions.

In terms of raw materials: Downstream demand for titanium dioxide remains sluggish. Some manufacturers have accumulated titanium dioxide inventories, resulting in low operating rates. The tight supply situation of ferrous sulfate in Qishui continues.

This week, the operating rate of sample ferrous sulfate manufacturers was 75%, and the capacity utilization rate was 24%, remaining flat compared with the previous week. Quotations this week were stable compared to last week. With cost support and relatively abundant orders, ferrous sulfate is firm, mainly due to the relative progress of raw material supply affected by the operating rate of the titanium dioxide industry. Recently, the shipment of heptahydrate ferrous sulfate has been good, which has led to an increase in costs for monohydrate ferrous sulfate producers. Currently, the overall operating rate of ferrous sulfate in China is not good, and enterprises have very little spot inventory, which brings favorable factors for the price increase of ferrous sulfate. At present, orders from mainstream factories are scheduled until mid-September, and prices are expected to rise in the short term. It is recommended that customers increase their inventories appropriately.

4)Copper sulfate/basic copper chloride

Raw materials: Macroscopically, after the release of U.S. July CPI data, improved macro sentiment combined with expectations of interest rate cuts pushed the non-ferrous metals sector stronger overall.

In terms of fundamentals, on the supply side, imported supplies are tight and the increase in domestic supplies will exceed the decrease in imported supplies, showing an overall upward trend in supply. On the consumer side, copper prices have risen above 79,000 yuan per ton again, and downstream purchasing sentiment has been suppressed.

In terms of etching solution: Some upstream raw material manufacturers are deep processing etching solution, the raw material shortage is further intensified, and the transaction coefficient remains high.

In terms of price, it is expected that the copper net price will fluctuate narrowly by 79,000 yuan per ton this week.

This week, copper sulfate producers’ operating rate is 100%, capacity utilization rate is 45%, flat compared with the previous week; This week, quotations from major manufacturers remained the same as last week.

Due to the recent high temperatures, copper sulfate/caustic copper producers have been relatively tight on raw materials recently, and demand is on par with the normal week. Based on the recent trend of raw materials and the operating conditions of manufacturers, copper sulfate is expected to remain at a high level with fluctuations in the short term. It is recommended that customers maintain normal inventories.

Raw materials: The raw material magnesite is stable.

The factory is operating normally and production is normal. The delivery time is generally around 3 to 7 days. Prices have been stable from August to September. As winter approaches, there are policies in major factory areas that prohibit the use of kilns for magnesium oxide production, and the cost of using fuel coal increases in winter. Combined with the above, it is expected that the price of magnesium oxide will rise from October to December. Customers are advised to purchase based on demand.

In terms of raw materials: Currently, the price of sulfuric acid in the north is on the rise in the short term.

Magnesium sulfate plants are operating at 100%, production and delivery are normal, and orders are scheduled until early September. The price of magnesium sulfate is expected to be stable with an upward trend in August. Customers are advised to purchase according to their production plans and inventory requirements.

Raw materials: The domestic iodine market is stable at present, the supply of imported refined iodine from Chile is stable, and the production of iodide manufacturers is stable.

This week, the production rate of calcium iodate sample manufacturers was 100%, the capacity utilization rate was 36%, the same as the previous week, and the quotations of mainstream manufacturers remained stable. Demand remained stable this week compared to the normal week. Customers are advised to purchase on demand based on production planning and inventory requirements.

In terms of raw materials: Crude selenium supply is tight, some manufacturers are reluctant to sell, and the shipment pace has slowed down. Weak demand in downstream industries such as electrolytic manganese and continued sluggish terminal consumption, with low enthusiasm for replenishment. Short-term prices are expected to remain stable.

This week, the production rate of sodium selenite sample manufacturers was 100% and the capacity utilization rate was 36%, remaining flat compared with the previous week. Prices remained stable this week compared with last week. Raw material prices have remained relatively stable. Demand is advised to make purchases at appropriate times based on their own inventories.

Raw materials: On the supply side, upstream smelters have recently accelerated the pace of raw material procurement, and manufacturers are bullish on the long-term outlook for the future, with a relatively calm shipment mentality. On the demand side, downstream purchasing sentiment has reversed recently. Prices are expected to rise further in the short term.

This week, cobalt chloride sample factories were operating at 100% and capacity utilization at 44%, remaining flat compared to the previous week. Manufacturers’ quotations remained stable this week. The high temperatures persisted, and the demand from leading ruminant producers remained relatively stable, mainly for essential purchases. As the weather gradually cools down after the Start of autumn, the inquiry situation has improved, and it is expected that demand will rise in the future.

It is not ruled out that cobalt chloride raw material prices will rise further. Customers are advised to purchase at the right time based on inventory.

10)Cobalt salt/potassium chloride/potassium carbonate/calcium formate/iodide

1 Cobalt salt prices are affected by the ban on cobalt exports in the Democratic Republic of the Congo, with tight supply of raw materials and obvious cost support. In the short term, cobalt salt prices are likely to remain volatile and upward, but attention should be paid to the actual purchasing situation downstream and the pace of demand recovery. It is recommended to keep a close eye on the dynamics of raw material supply and changes in terminal demand.

2. The domestic market price of potassium chloride remained generally stable. Production and operating rates declined slightly

Demand: Overall weak downstream demand for potassium chloride. The market price of potassium chloride is expected to remain stable in the near future. The price of potassium carbonate is affected by the price of raw material potassium chloride, and it is expected to decline.

3. The price of calcium formate remained stable at a high level this week. The price of raw formic acid rose as factories shut down for maintenance. Some calcium formate plants have stopped taking orders.

4. Iodide prices were stable and stronger this week compared to last week.

Media Contact:

Elaine Xu

SUSTAR Group

Email: elaine@sustarfeed.com

Mobile/WhatsApp: +86 18880477902

Post time: Aug-20-2025