Trace Elements Market Analysis

I,Analysis of non-ferrous metals

Week-on-week: Month-on-month:

| Units | Week 1 of September | Week 2 of September | Week-on-week changes | August average price | As of September 13Average price | Month-on-month change | Current price as of September 16 | |

| Shanghai Metals Market # Zinc ingots | Yuan/ton |

22026 |

22096 |

↑70 |

22250 |

22061 |

↓189 |

22230 |

| Shanghai Metals Market # Electrolytic Copper | Yuan/ton |

80164 |

80087 |

↓77 |

79001 |

80126 |

↑1125 |

81120 |

| Shanghai Metals Network AustraliaMn46% manganese ore | Yuan/ton |

40.07 |

39.99 |

↓0.08 |

40.41 |

40.03 |

↓0.38 |

40.65 |

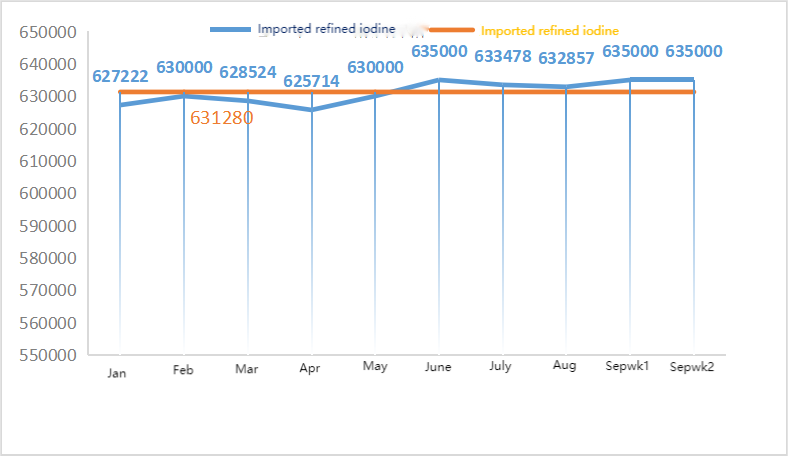

| Business Society imported refined iodine prices | Yuan/ton |

635000 |

635000 |

632857 |

635000 |

↑2143 |

635000 |

|

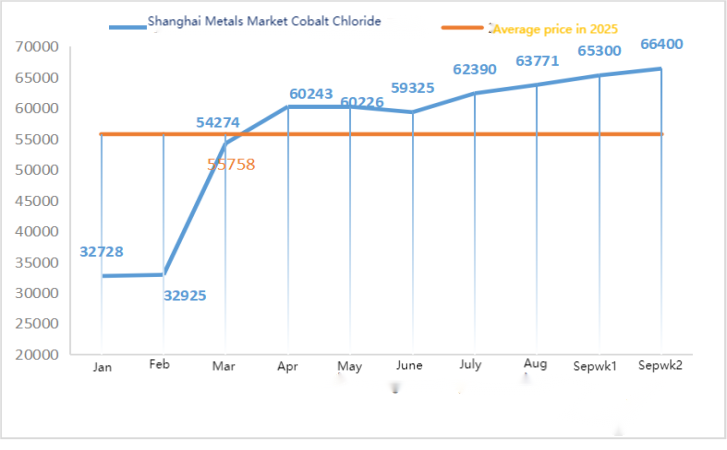

| Shanghai Metals Market Cobalt Chloride(co≥24.2%) | Yuan/ton |

65300 |

66400 |

↑1100 |

63771 |

65850 |

↑2079 |

69000 |

| Shanghai Metals Market Selenium Dioxide | Yuan/kilogram |

100 |

104 |

↑4 |

97.14 |

102 |

↑4.86 |

105 |

| Capacity utilization rate of titanium dioxide manufacturers | % |

77.34 |

76.08 |

↓1.26 |

74.95 |

76.7 |

↑1.76 |

① Raw materials: Zinc hypooxide: The transaction coefficient remains high. Overall macroeconomic sentiment in the market is warm, boosting zinc net prices and further increasing costs.

② Sulfuric acid prices remained stable at high levels across the country this week. Soda ash: Prices were stable this week. ③ The demand side is relatively stable. There is a tendency for zinc supply and demand balance to be in excess, and there is little possibility of a significant decline in zinc in the short – to medium term. Zinc prices are expected to run in the range of 22,000 to 22,500 yuan per ton next week.

On Monday, the operating rate of water zinc sulfate producers was 89% and the capacity utilization rate was 69%, remaining flat compared with the previous week. Major manufacturers’ orders are scheduled until mid-October. Demand is picking up. Australia is in the peak demand season. Central America has increased demand with the arrival of the rainy season. Delivery is tight. Demand is gradually recovering and raw material costs are firm. Prices are expected to remain at a high level.

Customers are advised to stock up appropriately in advance based on their own inventory.

In terms of raw materials: ① Manganese ore prices remained stable with strong fluctuations. As the holiday approached, factories began to prepare ore and pick up goods one after another. The inquiry atmosphere at ports was active. Product quotations were firm and the transaction pace was gradually following.

② Sulfuric acid prices remained stable at a high level.

This week, the operating rate of manganese sulfate manufacturers was 76%, a 5% decrease compared to the previous week. Capacity utilization was 49%, down 3% from the previous week. Mainstream manufacturers’ prices remain high this week due to high raw material costs, and there is no room for negotiation. On the supply side: Delivery tensions have increased further, and orders are currently scheduled until mid-October.

Sea shipping customers are advised to fully consider shipping time and prepare goods in advance.

In terms of raw materials: Tight procurement, major titanium dioxide producers in Hubei region have been shut down due to production accidents, further intensifying the tight supply situation of ferrous sulfate heptahydrate. The downstream demand for titanium dioxide remains sluggish. Some manufacturers have accumulated titanium dioxide inventories, resulting in low operating rates and tight supply of ferrous heptahydrate. Coupled with the high demand for ferrous heptahydrate in the lithium iron phosphate industry, the shortage of raw materials has further intensified.

This week, the operating rate of ferrous sulfate producers was 75%, and the capacity utilization rate was 24%, remaining flat compared with the previous week. Mainstream manufacturers are expected to cut production, and quotations this week rose compared with last week. The supply of by-product heptahydrate ferrous sulfate is tight, with strong support from raw material costs and tight delivery by manufacturers. Considering the recent inventory levels of enterprises and upstream operating rates, ferrous sulfate is expected to rise in the short term.

4)Copper sulfate/basic copper chloride

Raw materials: Copper prices are expected to rise strongly this week as a major copper mine in Indonesia remains shut down, raising concerns about supply. Expectations of a 2.5 percent increase in the LME policy this week have boosted confidence across the industrial metals sector and improved the demand outlook. A prolonged shutdown at the world’s second-largest copper mine could tighten the market. Meanwhile, expectations of a U.S. easing of monetary policy have boosted confidence across the industrial metals sector and improved the demand outlook. Positive for copper prices, which are expected to remain high, strong and volatile in the short term. Reference range for the main operating range of Shanghai copper: 81,050-81,090 yuan/ton.

From a macro perspective: Strong expectations of the Federal Reserve cutting interest rates have led to a simultaneous rise in copper prices both domestically and internationally. The Federal Reserve’s interest rate cut in September is a certainty, and the market has priced in the expectation of three rate cuts within the year. The warm macro wind has driven the copper price center to rise slowly. In terms of fundamentals, there are minor disturbances at the mining end, and the contradiction between supply and demand of domestic electrolytic copper has been magnified. As the delivery approaches, there is still a gap between the number of warehouse receipts required to match the positions of the current month’s Shanghai copper contract and the existing futures warehouse receipts, which has pushed up the price of the current month’s contract. By the close of trading, the Shanghai copper futures contract 2509 closed at 81,390 yuan per ton. The LME copper price broke through the $10,134 per ton mark and then reached a high of $10,100 per ton, hitting a intraday high of $10,126 per ton.

Etching solution: Some upstream raw material manufacturers have accelerated capital flow by deep processing etching solution into sponge copper or copper hydroxide. The proportion of sales to the copper sulfate industry has decreased, and the transaction coefficient has reached a new high. Copper net prices are likely to rise against the backdrop of warming macro sentiment, pushing up raw material costs again.

Copper sulfate/caustic copper producers were operating at 100% this week, with a capacity utilization rate of 45%, remaining flat compared to the previous week. Demand: Steady and slightly recovering, copper net prices rising, driving up copper sulfate prices. Customers are advised to stock up based on their own inventories.

Raw materials: The raw material magnesite is stable.

The factory is operating normally and production is normal. The delivery time is generally around 3 to 7 days. The government has shut down backward production capacity. Kilns cannot be used to produce magnesium oxide, and the cost of using fuel coal increases in winter. Combined with the concentrated season of bidding and purchasing for magnesium oxide, all these factors led to an increase in magnesium oxide prices this month. Customers are advised to purchase according to their needs.

6)Magnesium sulfate

Raw materials: The price of sulfuric acid in the north is currently rising in the short term.

Magnesium sulfate plants are operating at 100% and production and delivery are normal. As September approaches, the price of sulfuric acid is stable at a high level and further increases cannot be ruled out. Customers are advised to purchase according to their production plans and inventory requirements.

In terms of raw materials: Currently, the domestic iodine market is operating stably. The arrival volume of imported refined iodine from Chile is stable, and the production of iodide manufacturers is stable.

This week, the production rate of calcium iodate sample manufacturers was 100%, the capacity utilization rate was 36%, the same as the previous week, and the quotations of mainstream manufacturers remained stable. Supply and demand are balanced and prices are stable. Customers are advised to purchase on demand based on production planning and inventory requirements.

In terms of raw materials: There were no significant changes on either side of supply and demand in the selenium dioxide market. Downstream demand remained sluggish. Holders had a strong willingness to hold prices, but actual transactions were limited.

This week, sample manufacturers of sodium selenite were operating at 100%, with capacity utilization at 36%, remaining flat compared to the previous week. Manufacturers’ quotations remained stable this week. Raw material prices are stable, supply and demand are balanced, and prices are expected to remain stable.

It is recommended that clients purchase as needed based on their own inventory.

In terms of raw materials: The market is pessimistic about the continuation of the cobalt raw material export policy in the Democratic Republic of the Congo in September, which has prompted midstream enterprises to actively stock up, and the purchasing sentiment has significantly increased. At the same time, some upstream suppliers are purchasing cobalt chloride and locking in supplies at higher prices, further boosting market prices

This week, cobalt chloride producers were operating at 100%, with a capacity utilization rate of 44%, remaining flat compared to the previous week. Manufacturers’ quotations remained stable this week. The price of cobalt chloride raw materials is expected to rise slightly due to increased raw material prices and strengthened cost support. It is recommended that demand-side purchase and stockpiling plans be made seven days in advance in combination with inventory.

10)Cobalt salts/potassium chloride/potassium carbonate/calcium formate/iodide

1. Cobalt salts: Raw material costs: The Congolese (DRC) export ban continues, cobalt intermediate prices continue to rise, and cost pressures are passed downstream.

The cobalt salt market was positive this week, with quotations maintaining an upward trend and supply being tight, mainly driven by supply and demand. Trading of cobalt salts and oxides is expected to increase further next week. Focus on the new round of export policy in the Democratic Republic of the Congo in September. At present, cobalt intermediates have just touched $14 per pound, and some industry insiders are worried that the price has not reached the expected level previously mentioned by the Congolese side, while the slow pace of quota negotiations will intensify market concerns over further delays.

2. There was no significant change in the overall price of potassium chloride. The market showed a trend of both supply and demand being weak. The supply of market sources remained tight, but the demand support from downstream factories was limited. There were small fluctuations in some high-end prices, but the extent was not large. Prices remain stable at a high level. The price of potassium carbonate fluctuates with that of potassium chloride.

3. The price of calcium formate was lowered this week. Raw formic acid plants resume production and now increase factory production of formic acid, leading to an increase in formic acid capacity and an oversupply. In the long term, calcium formate prices are falling.

4 Iodide prices were stable this week compared to last week.

Post time: Sep-18-2025